Federal Reserve Consumer Credit

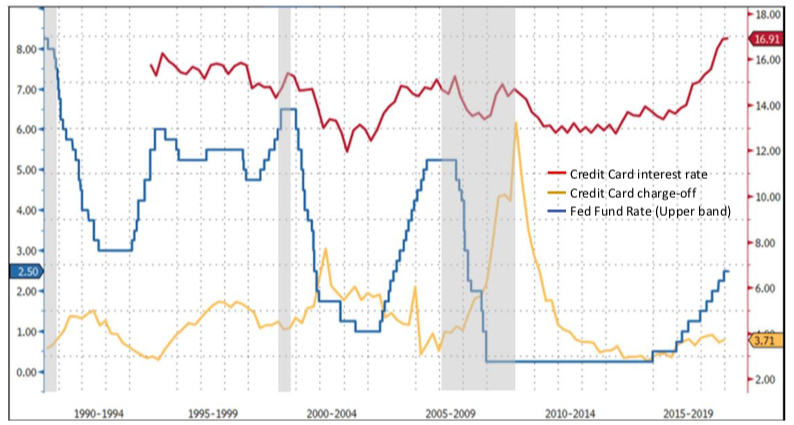

Fed Funds Vs Consumer Credit вђ Uncharted Territory вђ The Econonaut The federal reserve board collects quarterly data on interest rates for 48 month new car loans (item 7802) and 24 month personal credit card plans (item 7808) through the quarterly report of interest rates on selected direct consumer installment loans (fr 2835). banks are asked to report the "most common rate" for each type of loan that is, the. December 2021. in 2021, consumer credit increased 5.9 percent, with revolving and nonrevolving credit increasing 6.6 percent and 5.7 percent, respectively. during the fourth quarter, consumer credit increased at a seasonally adjusted annual rate of 6.6 percent, while in december it increased at a seasonally adjusted annual rate of 5.1 percent.

Federal Reserve Board Consumer Credit G 19 Consumer credit g.19. the board of governors of the federal reserve system and the federal reserve bank of st. louis's federal reserve economic data (fred) program are working together to expand options for finding, accessing, and visualizing data from the board's data download program (ddp) in fred. Household debt and credit (based on new york fed consumer credit panel) the latest quarterly report on household debt and credit shows that total household debt rose by $109 billion to reach $17.80 trillion, with mortgage balances posting a modest $77 billion increase to hit $12.52 trillion. balances on auto loans were up $10 billion to reach. G.19 consumer credit. consumer credit outstanding, seasonally adjusted. billions of dollars except as noted. graph and download economic data for total consumer credit owned and securitized (totalsl) from jan 1943 to jun 2024 about securitized, owned, consumer credit, loans, consumer, and usa. Category: banking > consumer credit, 151 economic data series, fred: download, graph, and track economic data. federal reserve bank of st. louis, one federal.

A Patient Federal Reserve And Us Consumer Credit Outlook Assured G.19 consumer credit. consumer credit outstanding, seasonally adjusted. billions of dollars except as noted. graph and download economic data for total consumer credit owned and securitized (totalsl) from jan 1943 to jun 2024 about securitized, owned, consumer credit, loans, consumer, and usa. Category: banking > consumer credit, 151 economic data series, fred: download, graph, and track economic data. federal reserve bank of st. louis, one federal. Total household debt rose by $109 billion to reach $17.80 trillion, according to the latest quarterly report on household debt and credit. mortgage balances were up $77 billion to reach $12.52 trillion, while auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion. In the fifteen years since that effort came to fruition, the new york fed consumer credit panel (ccp) has provided many valuable insights into household behavior and its implications for the macro economy and financial stability. the ccp was one of the first data sets drawn from credit bureau data, one of the earliest features of the center for.

Bankruptcy In America Inman Total household debt rose by $109 billion to reach $17.80 trillion, according to the latest quarterly report on household debt and credit. mortgage balances were up $77 billion to reach $12.52 trillion, while auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion. In the fifteen years since that effort came to fruition, the new york fed consumer credit panel (ccp) has provided many valuable insights into household behavior and its implications for the macro economy and financial stability. the ccp was one of the first data sets drawn from credit bureau data, one of the earliest features of the center for.

Comments are closed.