Federal Solar Tax Incentives 101 Renvu Youtube

Federal Solar Tax Incentives 101 Renvu Youtube For a more detailed overview and instructions on tax forms for solar: renvu i would like to know what types of rebates or tax incentives are a. Welcome to the official renvu channel! ☀️ renvu is a solar and energy storage equipment distributor, stocking the market's leading brands at competitive prices. we carry solar modules.

Federal Solar Tax Credit 101 Youtube The federal investment tax credit (itc) for solar energy is perhaps the best biggest incentive to go solar right now. quite simply, you get a 30% tax credit. The installation of the system must be complete during the tax year. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. in august 2022, congress passed an extension of the itc, raising it to 30% for the installation of which was between 2022 2032. (systems installed on or before december 31, 2019 were also eligible. The u.s. department of energy (doe) solar energy technologies office (seto) developed three resources to help americans navigate changes to the federal solar investment tax credit (itc), which was expanded in 2022 through the passage of the inflation reduction act (ira). these resources—for homeowners, businesses, and manufacturers—provide. For example, if you installed solar panels on your home in 2024 and paid $10,000, you could claim 30% or $3,000. so, if you owe $2,000 in taxes, you can apply $2,000 of your solar tax credit to.

Solar Tax Incentives Available To You Video The u.s. department of energy (doe) solar energy technologies office (seto) developed three resources to help americans navigate changes to the federal solar investment tax credit (itc), which was expanded in 2022 through the passage of the inflation reduction act (ira). these resources—for homeowners, businesses, and manufacturers—provide. For example, if you installed solar panels on your home in 2024 and paid $10,000, you could claim 30% or $3,000. so, if you owe $2,000 in taxes, you can apply $2,000 of your solar tax credit to. The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. the credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. you may be able to take the credit if you. Solar tax credit 2024. the solar panel tax credit allows filers to take a tax credit equal to up to 30% of eligible costs. there is no income limit to qualify, and you can claim the credit each.

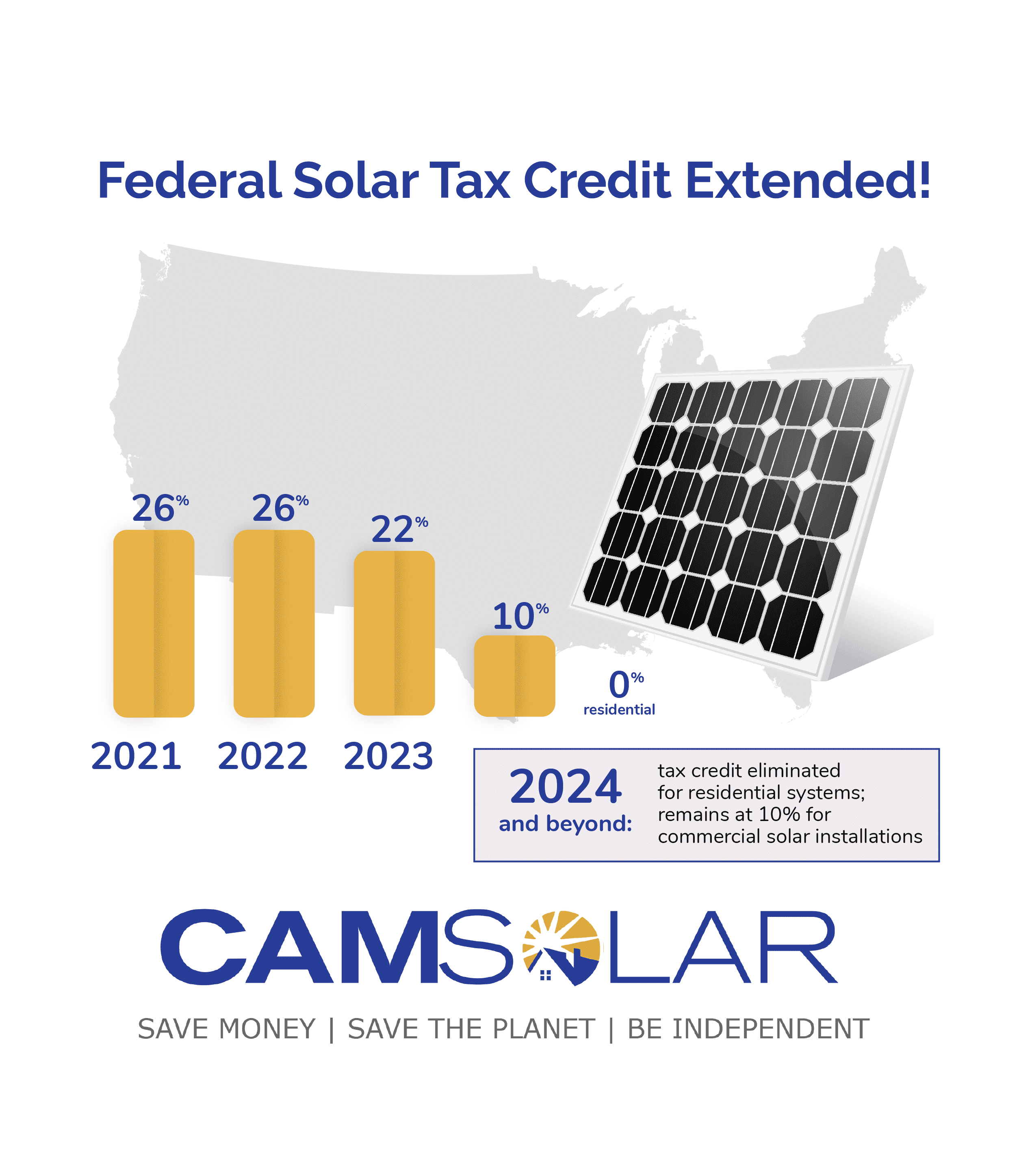

Federal Solar Incentives Cam Solar The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. the credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. you may be able to take the credit if you. Solar tax credit 2024. the solar panel tax credit allows filers to take a tax credit equal to up to 30% of eligible costs. there is no income limit to qualify, and you can claim the credit each.

Comments are closed.