Federal Tax Revenue Brackets For 2023 And 2024

Federal Tax Revenue Brackets For 2023 And 2024 You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with.

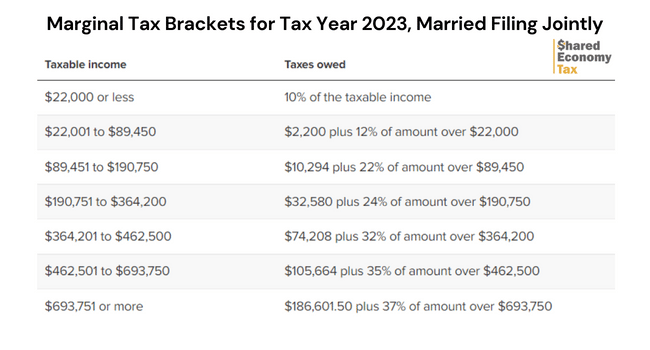

Listed Here Are The Federal Tax Brackets For 2023 Vs 2022 Finapress The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: 10%, 12%, 22%, 24%, 32%, 35% and 37%. your filing. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. your bracket depends on your taxable income and filing status. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; and for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023. marginal rates: for tax year 2024, the top tax rate. The income limits for every 2023 tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). there are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with taxable.

2024 Tax Brackets Taxed Right For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; and for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023. marginal rates: for tax year 2024, the top tax rate. The income limits for every 2023 tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). there are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with taxable. The tax inflation adjustments for 2024 rose by 5.4% from 2023 (which is slightly lower than the 7.1% increase the 2023 tax year had over the 2022 rates). in 2024, the top tax rate of 37% applies. For example, for the 2024 tax year, the 22% tax bracket range for single filers is $47,150 to $100,525, while the same rate applies to head of household filers with taxable income from $63,100 to.

Irs Tax Brackets 2024 Federal Income Tax Tables Inflation Adjustment The tax inflation adjustments for 2024 rose by 5.4% from 2023 (which is slightly lower than the 7.1% increase the 2023 tax year had over the 2022 rates). in 2024, the top tax rate of 37% applies. For example, for the 2024 tax year, the 22% tax bracket range for single filers is $47,150 to $100,525, while the same rate applies to head of household filers with taxable income from $63,100 to.

New Irs Tax Brackets For 2023 Explained By Pros Shared Economy Tax

Comments are closed.