Federal Tax Withheld Tax Rate 2021 Federal Withholding Tables 2021

Withholding Tax Charts For 2021 Federal Withholding Tables 20 And 1040 sr and to pay any related tax due un til may 17, 2021. this does not affect the due dates for estimated tax payments for 2021. the first estimated tax payment is due april 15, 2021. any payment made with a timely exten sion request after april 15, 2021, and on or before may 17, 2021, that you later have available as a refund on your 2020. The tax withholding estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. we don't save or record the information you enter in the estimator. for details on how to protect yourself from scams, see tax scams consumer alerts. check your w 4 tax withholding with the irs tax.

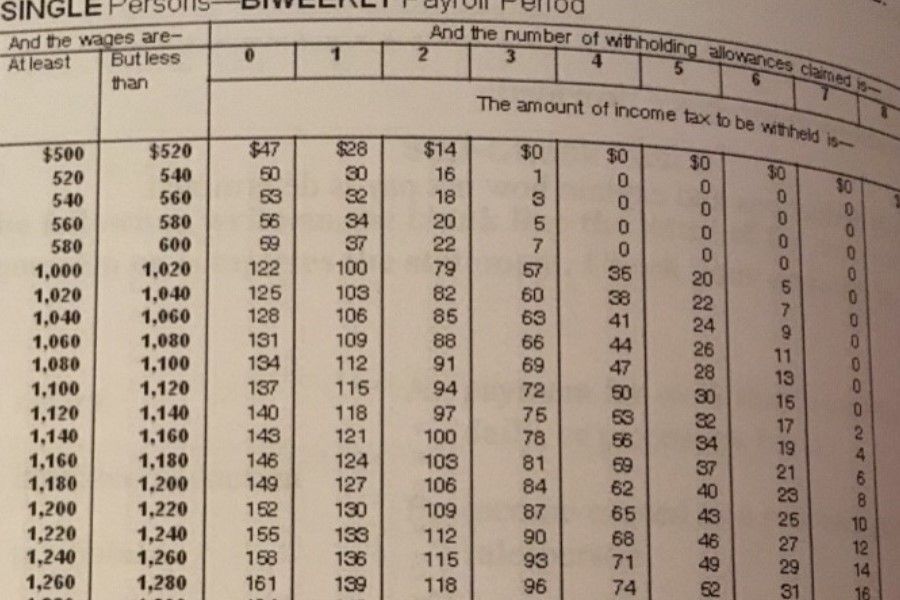

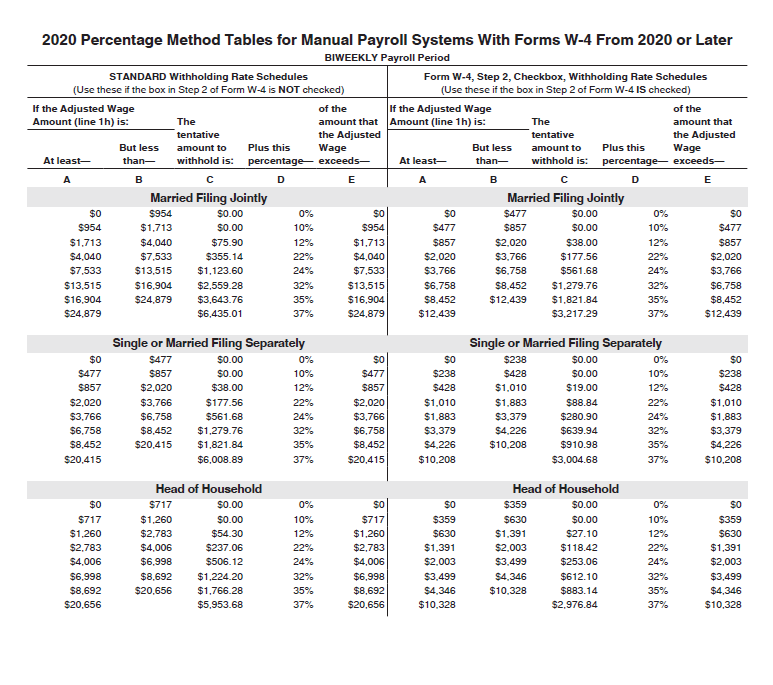

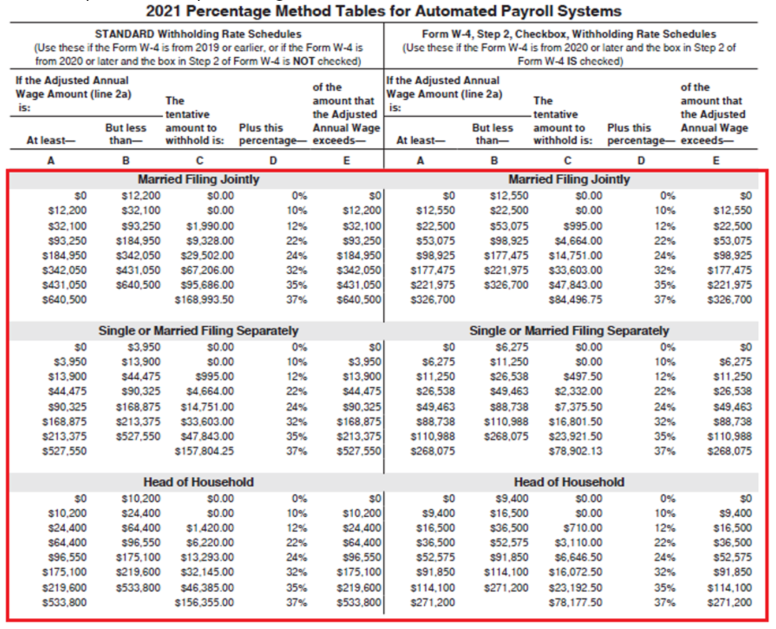

Bi Weekly Federal Income Tax Withholding 2021 Federal Withholdingођ 2021 federal income tax brackets and rates. in 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). the top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and higher for married couples. Rate withholding applies or if the 22% optional flat rate withholding is used to figure federal income tax withhold ing. for more information about withholding on supple mental wages, see section 7 of pub. 15. although this publication may be used to figure federal income tax withholding on periodic payments of pensions. Sep 15, 2021 –3rd installment deadline to pay 2021 estimated taxes due oct15, 2021 –last day to file federal income tax return if 6 month extension was requested by april 15, 2021. last day to recharacterize an eligible traditional ira or roth ira contribution from 2020 if extension was filed or tax return was filed by april 15, 2021 (and. We won't keep you in suspense. here are the 2021 u.s. federal income tax brackets. first, the tax brackets for single filers: marginal tax rate (tax bracket) taxable income range. 10%. $0 $9,950.

Federal Tax Withheld Tax Rate 2021 Federal Withholding Tables 2021 Sep 15, 2021 –3rd installment deadline to pay 2021 estimated taxes due oct15, 2021 –last day to file federal income tax return if 6 month extension was requested by april 15, 2021. last day to recharacterize an eligible traditional ira or roth ira contribution from 2020 if extension was filed or tax return was filed by april 15, 2021 (and. We won't keep you in suspense. here are the 2021 u.s. federal income tax brackets. first, the tax brackets for single filers: marginal tax rate (tax bracket) taxable income range. 10%. $0 $9,950. The 2021 instructions for federal income withholding were released by the irs. an optional application may be used to bridge calculations between older and newer forms w 4. the finalized version of publication 15 t, federal income tax withholding methods, was released dec. 9 by the internal revenue service. The federal tax brackets are broken down into seven (7) taxable income groups, based on your filing status. the tax rates for 2021 are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. it’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate.

2021 Us Federal Income Tax Tables Federal Withholding Tablesо The 2021 instructions for federal income withholding were released by the irs. an optional application may be used to bridge calculations between older and newer forms w 4. the finalized version of publication 15 t, federal income tax withholding methods, was released dec. 9 by the internal revenue service. The federal tax brackets are broken down into seven (7) taxable income groups, based on your filing status. the tax rates for 2021 are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. it’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate.

Federal Tax Withholding Tables 2021 Pdf Federal Withholdingођ

Comments are closed.