Federal Vs Private Student Loans What S The Difference Penfed

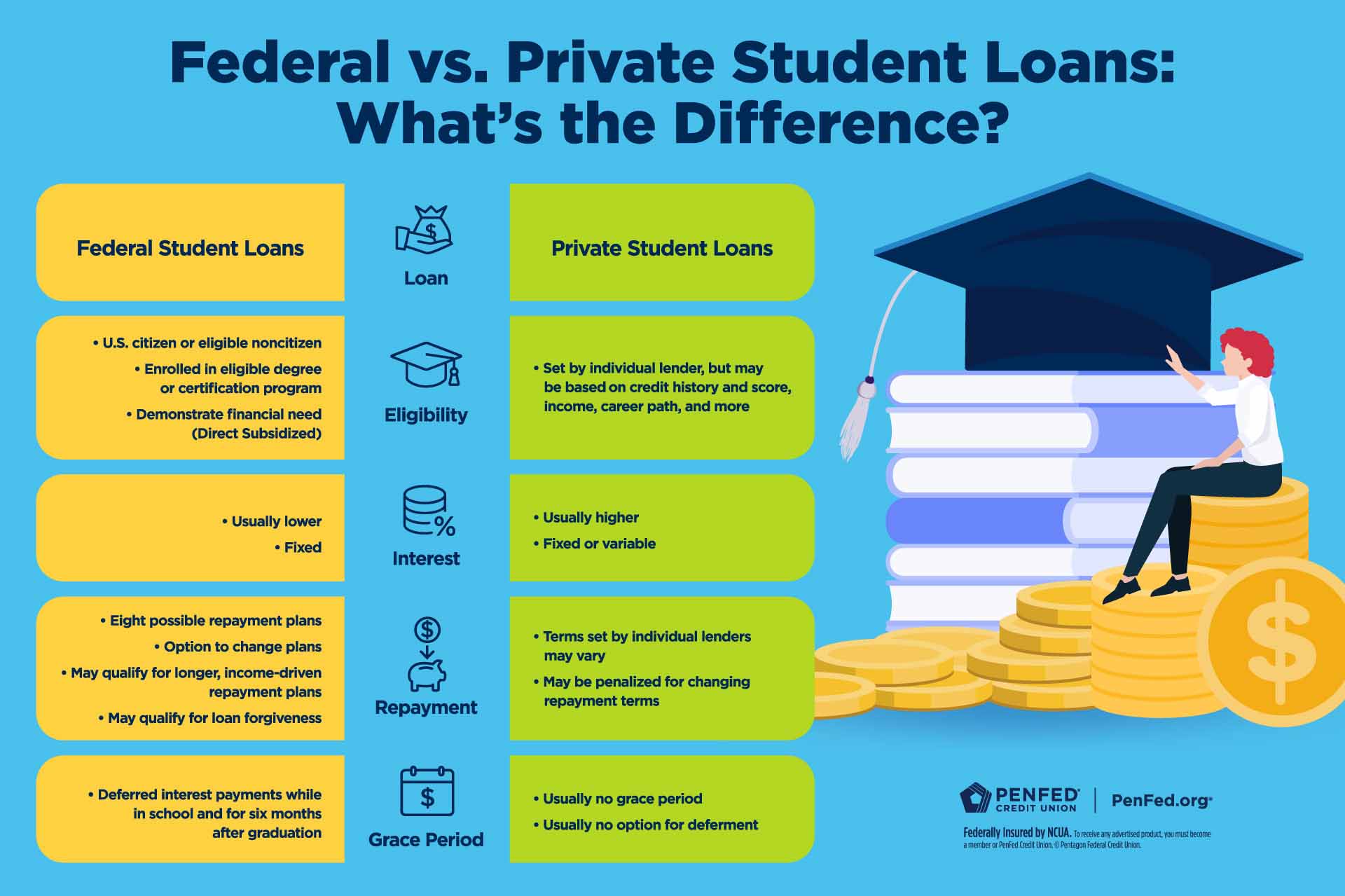

Federal Vs Private Student Loans What S The Difference Penfed In addition to offering lower interest rates, federal student loans come with fixed interest rates. this means that even if interest rates rise, your student loan's interest rate will remain the same. with private lenders, your interest rate can be fixed or variable depending on the terms you negotiate. if you have a variable interest rate and. 1. refinancing is only offered by private lenders. this means you’ll be changing your federal loans to private loans. by doing so, you’ll lose federal student loan benefits offered by the u.s. department of education including access to: income driven repayment (idr) plans.

Explain The Main Differences Between Federal And Private Student Lo For the 2022 23 school year, rates on federal subsidized and unsubsidized student loans for undergraduates is 4.99%. by contrast, fixed rates on private loans for undergraduates start at 2.99% on. The basic eligibility criteria for federal student loans is that you: complete the fafsa. the office of federal student aid evaluates eligibility for student loans using the free application for federal student aid (fafsa). the application gathers financial data about your family to determine how much and what kind of aid you qualify for. Federal student loans are made available by the u.s. department of education, while private lenders (e.g., banks, credit unions, and some state affiliated organizations) offer private student loans. The interest rates on some private student loans are lower than rates on federal loans for those who qualify. you'll typically need excellent credit to get the best rates, though. if you wind up.

юааfederalюаб юааvsюаб юааprivateюаб юааstudentюаб юааloansюаб юааwhatтащsюаб юааthe Differenceюаб J Federal student loans are made available by the u.s. department of education, while private lenders (e.g., banks, credit unions, and some state affiliated organizations) offer private student loans. The interest rates on some private student loans are lower than rates on federal loans for those who qualify. you'll typically need excellent credit to get the best rates, though. if you wind up. Higher loan amounts than with federal student loans. faster application and approval process. lower interest rate if you have great credit and a low dti ratio or a co signer. usually no. It’s important to choose between federal vs. private student loans, as each has different interest rates, repayment terms, hardship options and fees. in most cases, federal student loans are.

Comments are closed.