Filling Form W 9 Avoid These 6 Mistakes

Filling Form W 9 Avoid These 6 Mistakes Youtube Six common mistakes happen while filling form w 9 .these mistakes can cost you avoidable delays in refund and penalties ! so , make sure that when you are su. Not signing the form w 9. another common mistake that might seem trivial yet has grave consequences is neglecting to sign the w 9 form. the irs requires a signature to validate the information on the form. an unsigned form is considered incomplete and can cause delays or potential legal issues. 6.

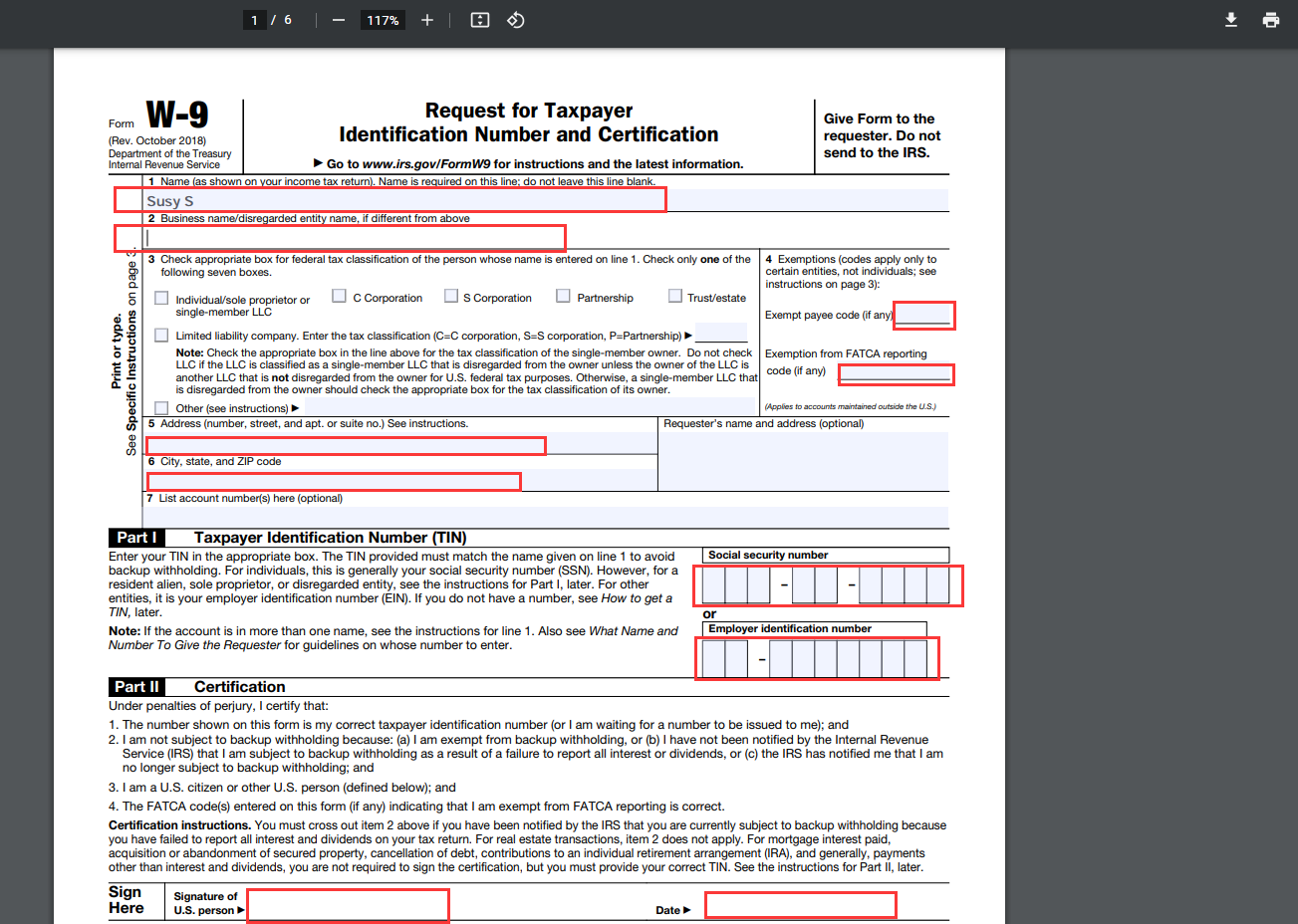

W9 Form With Filling Tips Wps Pdf Blog The first section of form w 9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you. line 1: enter your name as it appears on your income tax return. line 2: enter your business name or disregarded entity name if it is different from the name that you. Check the correct box on the tax classification section area. if you’re unsure about the business entity structure, consult with your tax advisor. add the business owner’s name to the form. occasionally the person authorized to sign the w 9 form is someone other than the owner. do not use your personal name and social security number on the. Every year, independent contractors, freelancers, and others whose income isn’t automatically taxed and who earn $600 or more must fill out a w 9 form. this form is key to ensuring your earnings are reported accurately to the irs. this form facilitates transparent communication between freelancers and their clients regarding tax obligations. Avoiding these common mistakes can save time and prevent difficulties while filling out your w 9 form. the critical takeaway is to double check all information on your w 9 before submitting it.

All About W 9 Form What It Is What It Is Used For And How To Fill It Out Every year, independent contractors, freelancers, and others whose income isn’t automatically taxed and who earn $600 or more must fill out a w 9 form. this form is key to ensuring your earnings are reported accurately to the irs. this form facilitates transparent communication between freelancers and their clients regarding tax obligations. Avoiding these common mistakes can save time and prevent difficulties while filling out your w 9 form. the critical takeaway is to double check all information on your w 9 before submitting it. All form w 9 revisions. about publication 515, withholding of tax on nonresident aliens and foreign entities. about publication 519, u.s. tax guide for aliens. publication 1281, backup withholding for missing and incorrect name tin(s) pdf. publication 5027, identity theft information for taxpayers pdf. video: how to complete form w 9. other. Common mistakes to avoid when filling out a w 9 form when filling out a w 9 form, it is important to be aware of common mistakes that people make. avoiding these mistakes can help ensure that your form is completed accurately and that you do not encounter any issues with payment or tax reporting.

How To Fill Out Form W 9 For A Nonprofit The Charity Cfo All form w 9 revisions. about publication 515, withholding of tax on nonresident aliens and foreign entities. about publication 519, u.s. tax guide for aliens. publication 1281, backup withholding for missing and incorrect name tin(s) pdf. publication 5027, identity theft information for taxpayers pdf. video: how to complete form w 9. other. Common mistakes to avoid when filling out a w 9 form when filling out a w 9 form, it is important to be aware of common mistakes that people make. avoiding these mistakes can help ensure that your form is completed accurately and that you do not encounter any issues with payment or tax reporting.

How To Fill Out A W 9 Form Complete The Request Correctly Gop Convention

Comments are closed.