Financial Statements Analysis

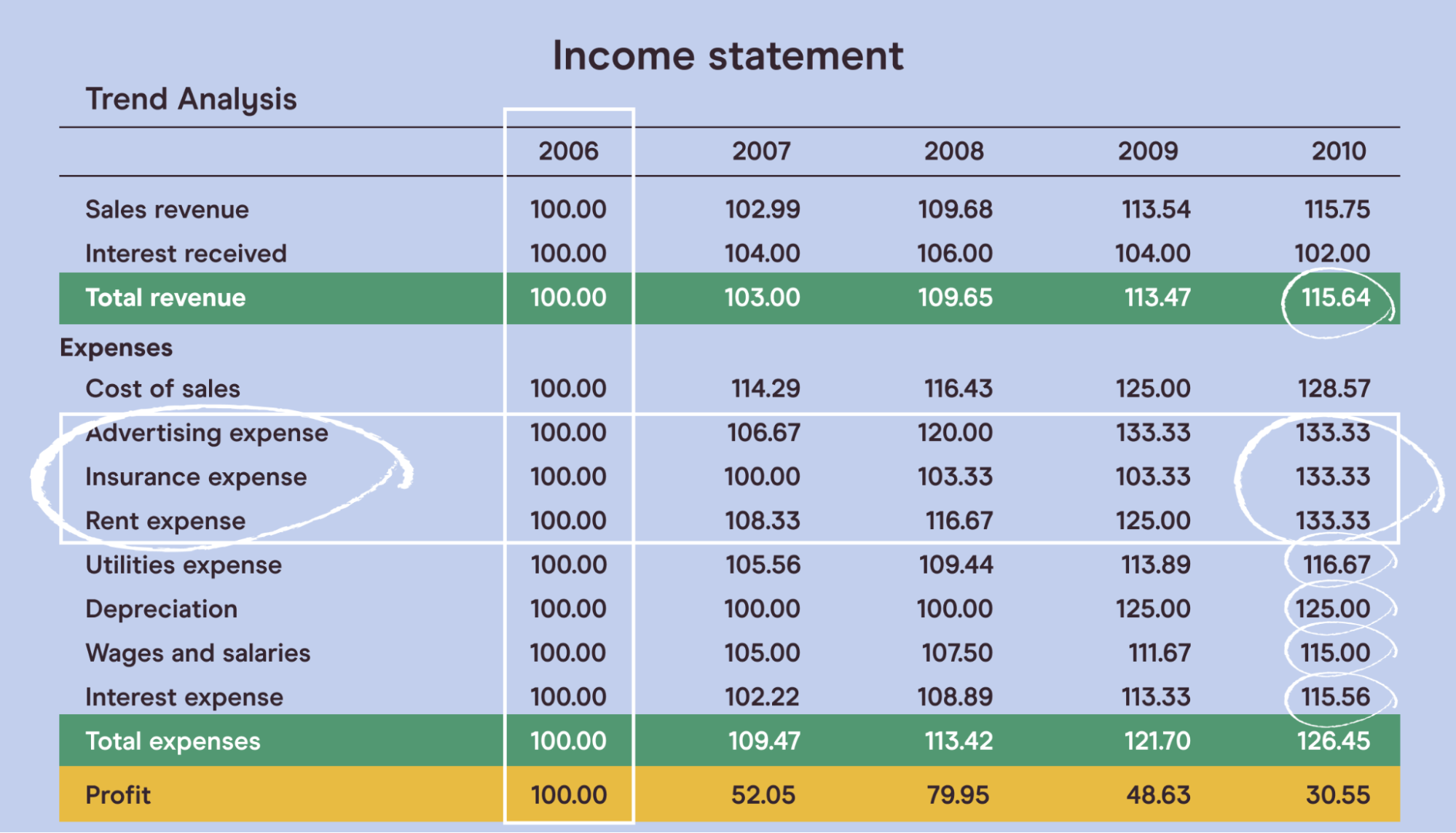

How To Read Financial Statements A Step By Step Guide Pareto Labs Learn how to analyze a company’s financial statements for decision making purposes using horizontal, vertical, and ratio analysis. find out the key metrics and techniques for each statement type: balance sheet, income statement, and cash flow statement. Learn how to evaluate a company's financial health and performance by reviewing its income statement, balance sheet, and cash flow statement. this guide covers various metrics and methods for profitability, liquidity, solvency, and efficiency analysis.

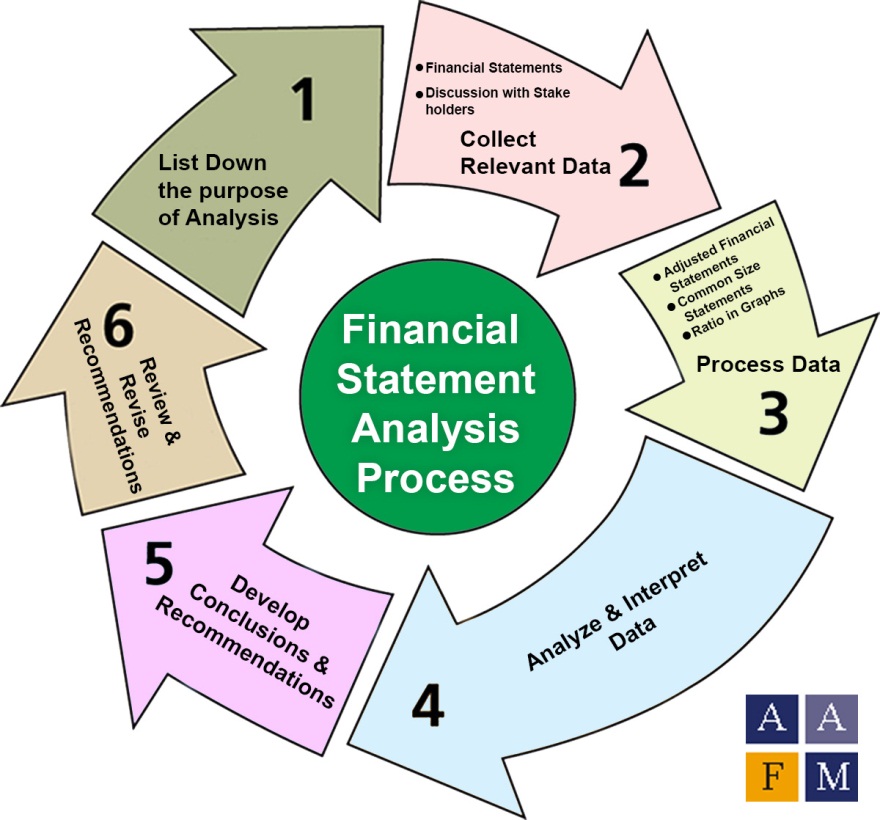

What Is The Easiest Way To Learn How To Analyse Financial Statements Learn how to analyze financial statements to evaluate a company's performance, strategies, and risks. find out the tools and techniques used for fundamental, dupont, horizontal, and vertical analysis. Learn how to read and understand balance sheets, income statements, cash flow statements, and annual reports to assess a company's financial health and performance. this guide covers the key components, terms, and insights of each financial statement with examples and tips. Learn the basics of balance sheet, income statement, and cash flow statement, and how to use financial ratios to measure your business performance. see examples, formulas, and tips for interpreting your financial data. Learn the basics of financial statement analysis, the process of examining a company’s performance and financial position using its financial reports and other sources. this reading covers the roles of financial reporting, the primary financial statements, the notes and supplementary information, the audit and internal control, and the analysis framework.

Financial Statement Analysis Fsa Ratios Process Tools Uses Users Learn the basics of balance sheet, income statement, and cash flow statement, and how to use financial ratios to measure your business performance. see examples, formulas, and tips for interpreting your financial data. Learn the basics of financial statement analysis, the process of examining a company’s performance and financial position using its financial reports and other sources. this reading covers the roles of financial reporting, the primary financial statements, the notes and supplementary information, the audit and internal control, and the analysis framework. Learn how to analyze a company's financial position, performance, and growth potential using balance sheet, income statement, and cash flow statement. see real world examples, key items to look for, and financial ratios to calculate. Learn how to read and analyze financial statements, such as balance sheet, income statement, and cash flow statement. find definitions, examples, and faqs on key terms and concepts related to financial statements.

Financial Analysis Example For Complete Beginners Fourweekmba Learn how to analyze a company's financial position, performance, and growth potential using balance sheet, income statement, and cash flow statement. see real world examples, key items to look for, and financial ratios to calculate. Learn how to read and analyze financial statements, such as balance sheet, income statement, and cash flow statement. find definitions, examples, and faqs on key terms and concepts related to financial statements.

:max_bytes(150000):strip_icc()/Financial-Statement-Analysis-FINAL-224d7e8f12f246c8b29d1b99330a7b8e.jpg)

юааfinancialюаб Statement юааanalysisюаб How Itтащs Done By Statement Type

Comments are closed.