Ford Vs Gm Stock Analysis Who Emerges Victorious 2024

Ford Vs Gm Stock вђ Which One Is A Better Bet Fundamental Data And In this video, we delve into a comprehensive stock analysis comparing two giants of the automotive industry: ford and general motors (gm).with the year 2024. General motors(gm0.55%)and ford(f0.76%)are both trading for rather low valuations, and both are in the early stages of figuring out their electric vehicle strategies. in this video, i sit down for.

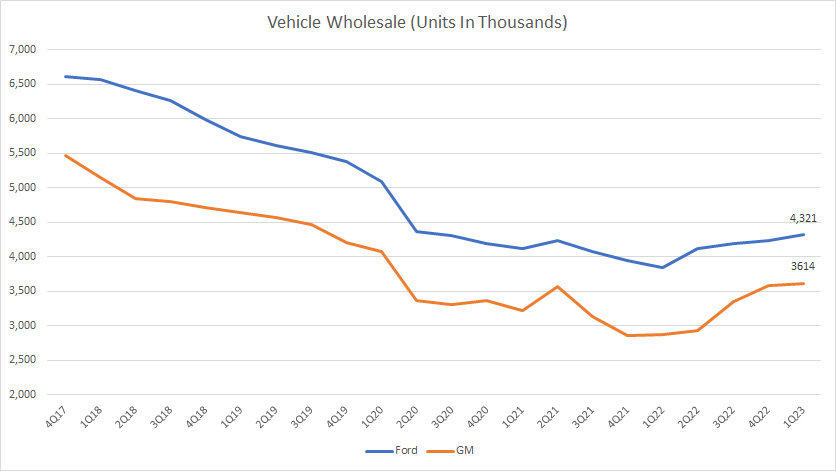

Ford Vs General Motors Stock Which Is The Better Buy Seeking Alpha Gm as of may 6, 2024. stock price: $45.47. market cap: $51.92 billion. year to date: 26.13%. past year: 35.2%. past month: 2.64%. cfra research has a hold rating as of may 4 on the stock, citing. The automotive domestic industry is in the top 36% of over 250 zacks industries and two stocks investors may consider buying out of the group are general motors (gm) and ford motor company (f). Ford is off to a strong start. fueled by strong demand for its pickup trucks and crossover suvs, ford motor (nyse: f) reported u.s. auto sales rose 6.8% during the first quarter.as a result, ford. Ford and general motors both had a strong 2021. 2022 could be even better, depending on inflation and other macro factors. stock analysis collapse menu. stock ideas 80k in 2024, and 160k.

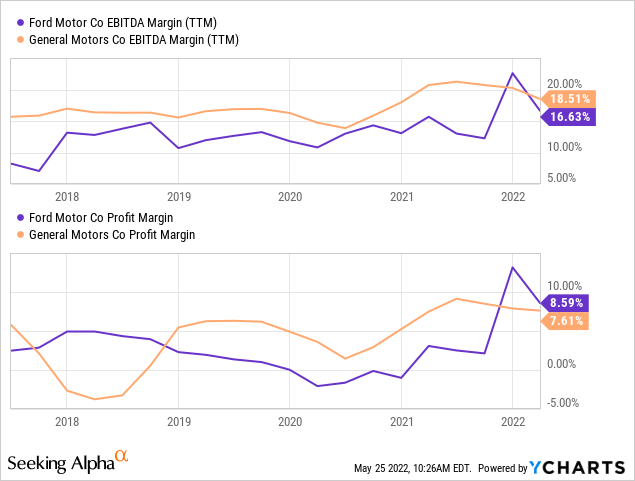

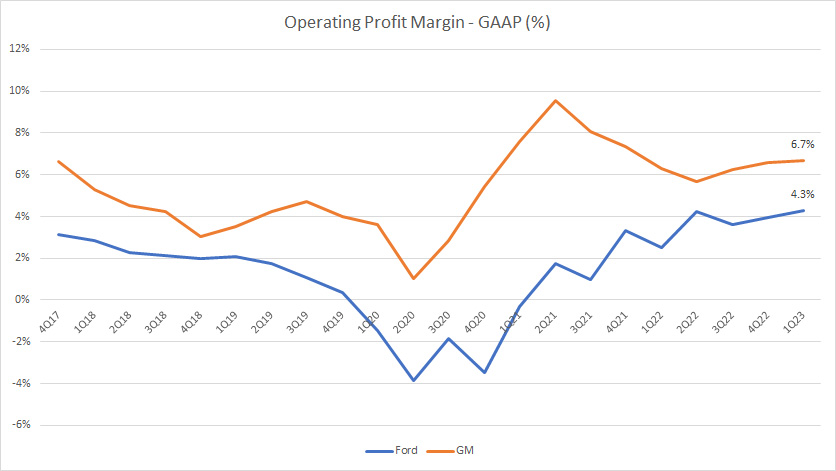

Ford Vs Gm Stock вђ Which One Is A Better Bet Fundamental Data And Ford is off to a strong start. fueled by strong demand for its pickup trucks and crossover suvs, ford motor (nyse: f) reported u.s. auto sales rose 6.8% during the first quarter.as a result, ford. Ford and general motors both had a strong 2021. 2022 could be even better, depending on inflation and other macro factors. stock analysis collapse menu. stock ideas 80k in 2024, and 160k. In terms of profitability, gm is also ahead of ford: gm's ebit margin of 7.66% (compared to 4.85% for ford) as well as its roe of 14.06% (compared to ford's 4.69%) are significantly above its. While the past 12 month stock performance of general motors is 23.68%, ford’s is 2.19%. general motors' p e [fwd] ratio is currently 6.46 while ford’s is 19.56. at this moment in time, the.

Comments are closed.