Form 4868 Application For Extension Definition

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition Form 4868: application for automatic extension of time to file u.s. individual income tax return is an internal revenue service (irs) form for individuals who wish to extend the amount of time. Form 4868 is used by individuals to apply for six (6) more months to file form 1040, 1040nr, or 1040nr ez. a u.s. citizen or resident files this form to request an automatic extension of time to file a u.s. individual income tax return.

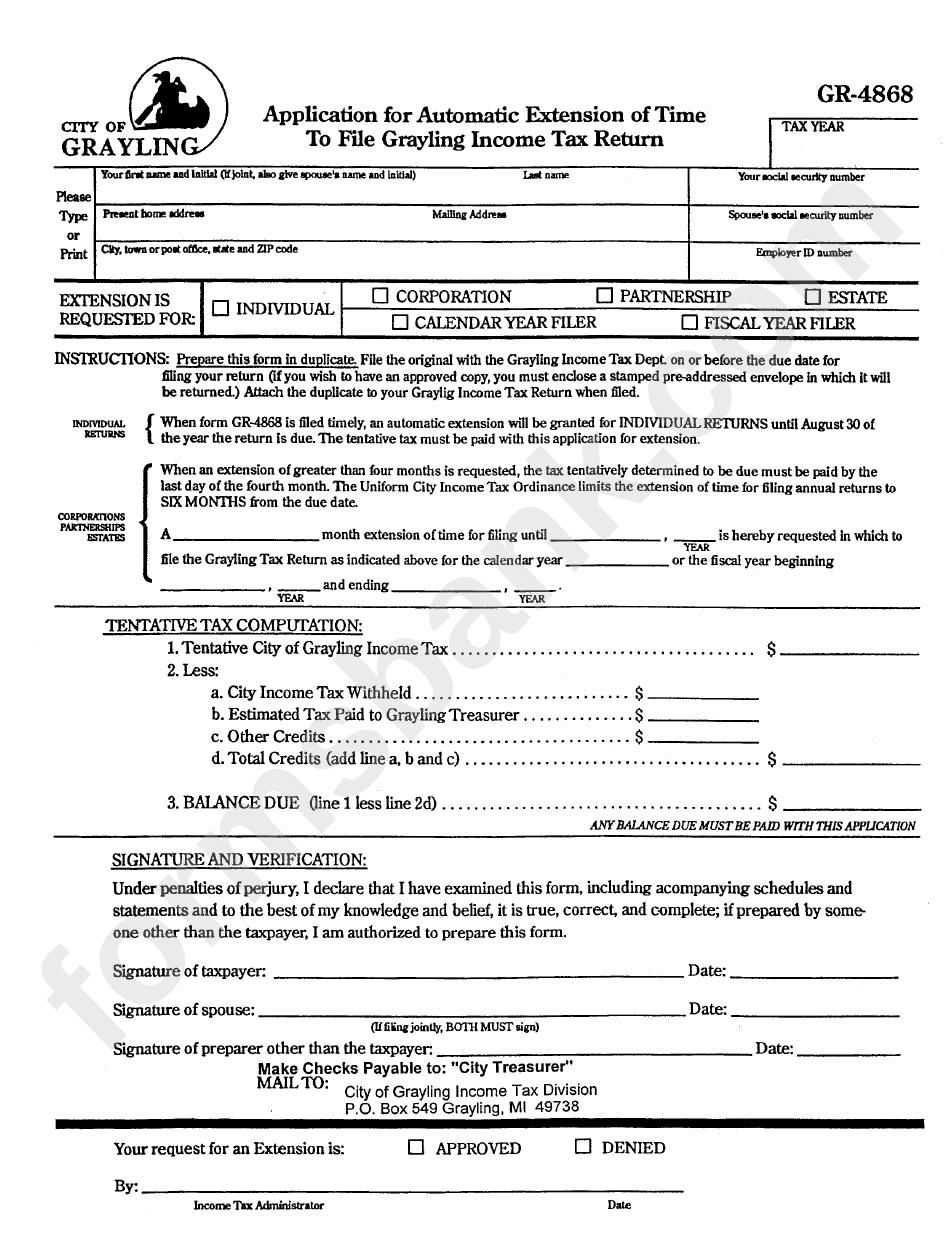

Form Gr 4868 Application For Automatic Extension Of Time To File Form 4868 ensures that you get an extended period of months from the date of the deadline to file your tax returns in the first place. this means, for the year 2021, your extension date will be october 17th, 2022. however, form 4868 does not extend the period for you to pay the taxes you owe, only to extend the period until you have to file the. When you file your 2023 return, include the amount of any payment you made with form 4868 on the appropriate line of your tax return. the instructions for the following line of your tax return will tell you how to report the payment. form 1040, 1040 sr, or 1040 nr, schedule 3, line 10. form 1040 ss, part i, line 12. Irs form 4868 is the “application for automatic extension of time to file.” it gives you an additional six months to get your tax return to the irs. tax payments are still due on april 15 in most years, even if you get an extension of time to file your return (unless you are in a combat zone or natural disaster zone and subject to an automatic extension). Form 4868 is available to any u.s. taxpayer needing extra time to file their federal tax return. by completing and sending it to the irs, they will receive a six month tax return due date.

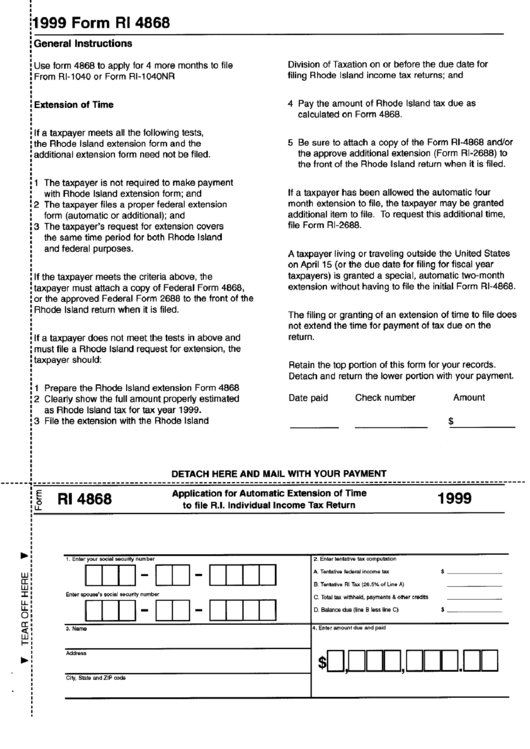

Form Ri 4868 Application For Automatic Extension Of Time To File R I Irs form 4868 is the “application for automatic extension of time to file.” it gives you an additional six months to get your tax return to the irs. tax payments are still due on april 15 in most years, even if you get an extension of time to file your return (unless you are in a combat zone or natural disaster zone and subject to an automatic extension). Form 4868 is available to any u.s. taxpayer needing extra time to file their federal tax return. by completing and sending it to the irs, they will receive a six month tax return due date. Form 4868, the application for automatic extension of time to file u.s. individual income tax return, is an irs form used by taxpayers seeking additional time to submit their tax returns. this article explores who can file form 4868, how to file it, key considerations for taxpayers, and addresses frequently asked questions. Form 4868, ‘application for automatic extension of time to file u.s. individual income tax return,’ is the irs form that individual taxpayers use to request an automatic six month tax extension for their federal tax return (form 1040). although a completed form 4868 automatically extends the deadline for filing your return, it doesn’t.

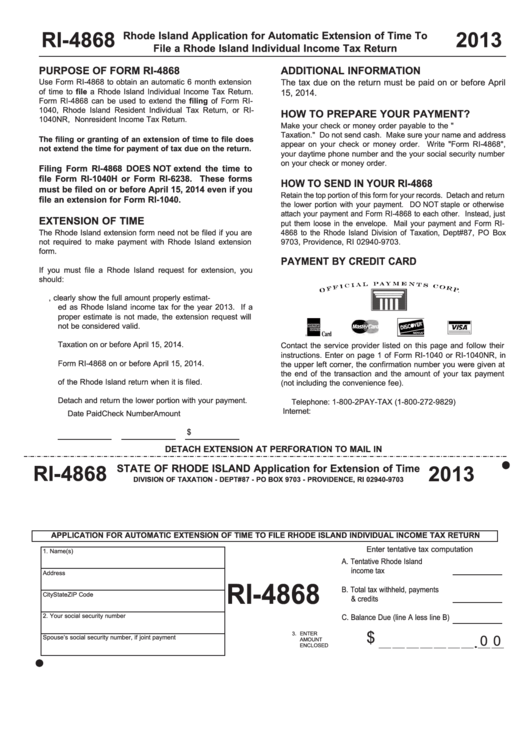

Form Ri 4868 Rhode Island Application For Extension Of Time 2013 Form 4868, the application for automatic extension of time to file u.s. individual income tax return, is an irs form used by taxpayers seeking additional time to submit their tax returns. this article explores who can file form 4868, how to file it, key considerations for taxpayers, and addresses frequently asked questions. Form 4868, ‘application for automatic extension of time to file u.s. individual income tax return,’ is the irs form that individual taxpayers use to request an automatic six month tax extension for their federal tax return (form 1040). although a completed form 4868 automatically extends the deadline for filing your return, it doesn’t.

Irs Tax Extension Form 4868 Printable Form

Comments are closed.