Health Insurance 101 What Is Health Insurance

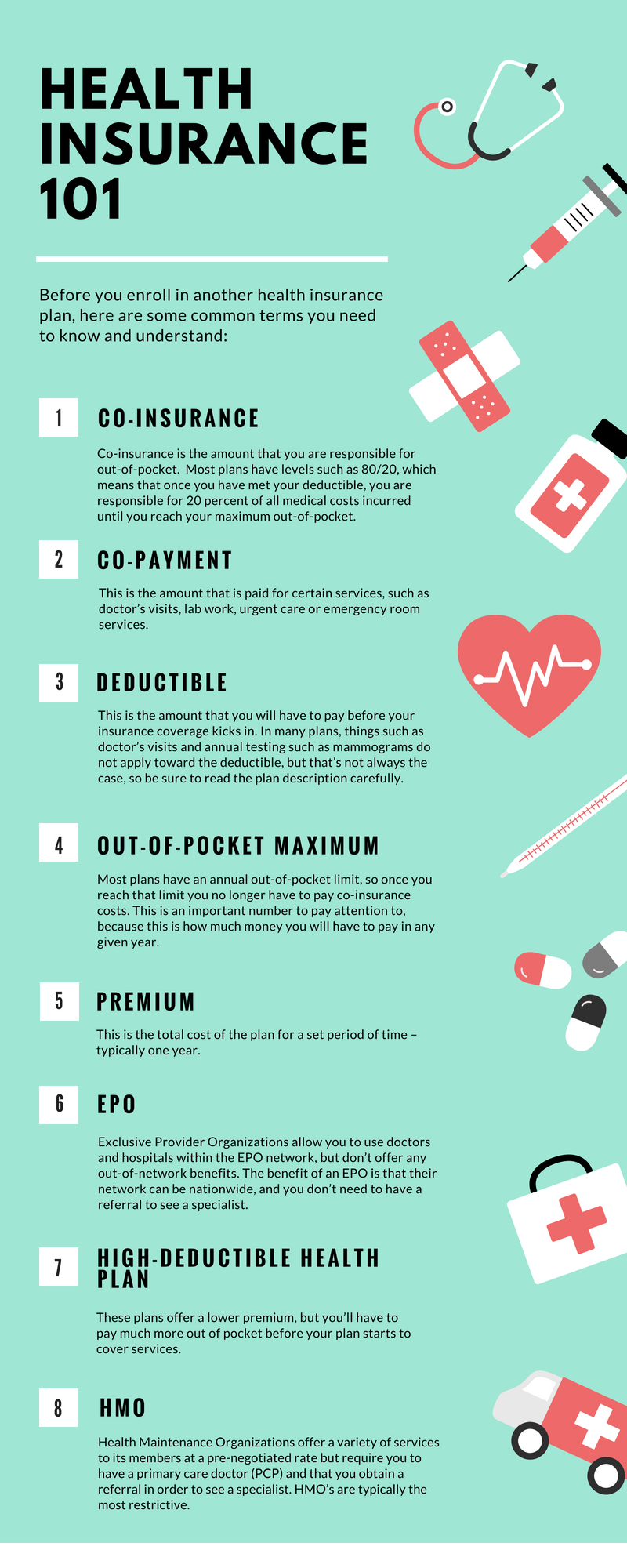

Infographic Health Insurance 101 Keystone Financial Group These are usually in the form of a percentage. for instance, let’s say you have a 10% coinsurance for a doctor’s visit that costs $100. you will pay $10 for every $100 your insurance pays for a doctor’s visit. out of pocket maximum: this is a cap on how much you’ll have to pay out of pocket for health care in one year. Health insurance is a contract between you and your insurance company insurer. when you purchase a plan, you become a member of that plan, whether that’s a medicare plan, medicaid plan, a plan through your employer or an individual policy, like an affordable care act (aca) plan. there are many reasons to have health insurance.

Health Insurance 101 The Basics Health Insurance 1 3 Youtube This health insurance 101 guide will walk you through all the basic healthcare processes, words, and facts that you need to know. the united states spends more on healthcare than any other high income nation; in 2021, more than $4.3 trillion was spent on healthcare alone. that’s $12,914 per person!. Health insurance works by splitting the cost of health care between you and your insurer. this cost sharing continues until you hit your maximum out of pocket limit for the year, after which your insurance covers 100% of your medical costs. once your policy renews, your out of pocket limit resets and you resume splitting costs with your insurer. An fsa lets you contribute money pre tax and use the funds to pay for qualifying medical expenses (with the exception of premiums). you can contribute to an fsa regardless of your health plan. one. Health insurance basics. this document explains key health insurance concepts that may be helpful to consumers in understanding their health coverage as well as to consumer advocates who help individuals resolve medical billing problems. this resource is not intended to describe everything that is important to know about insurance.

Infographic Health Insurance 101 Keystone Financial Group An fsa lets you contribute money pre tax and use the funds to pay for qualifying medical expenses (with the exception of premiums). you can contribute to an fsa regardless of your health plan. one. Health insurance basics. this document explains key health insurance concepts that may be helpful to consumers in understanding their health coverage as well as to consumer advocates who help individuals resolve medical billing problems. this resource is not intended to describe everything that is important to know about insurance. Health insurance is designed to help prepare for unexpected moments in life, like accidents or illnesses. without health insurance, you could be faced with paying medical bills yourself, and health care can be expensive. health insurance can keep you on track with preventive care — which may be covered by insurance at 100%, in many cases. Step 5: compare benefits. by this step, you'll likely have your options narrowed down to just a few plans. here are some things to consider next: check the scope of services. go back to that.

Comments are closed.