Hecm For Purchase Reverse Mortgage

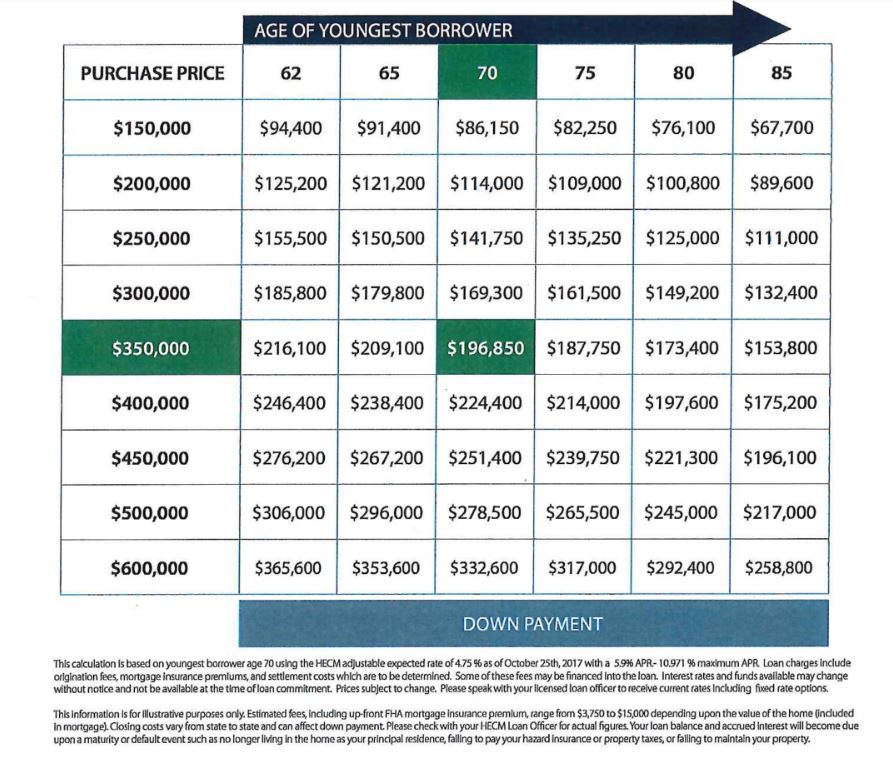

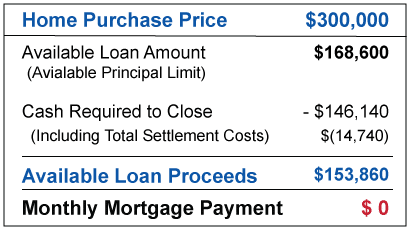

Use Hecm Reverse Mortgage To Buy Your Retirement Home The Arizona Reportв ў Homeowners age 62 or older can use a reverse mortgage called an HECM for Purchase to buy a home without upping their monthly debt, but it’s not cheap CMG's Sean Kirksey explains why the HECM for Purchase product is a path for growth for his company and the industry as a whole

2024 Guide To Reverse Mortgage Purchase Hecm Purchase As NRMLA prepares to host its 2024 Annual Meeting and Expo in San Diego, President Steve Irwin offers a preview A reverse mortgage allows you to tap into your home equity in retirement, but there are caveats Here are the best reverse mortgage companies and what they offer Reverse mortgages eventually must be paid back, usually by the borrower’s spouse or other heirs Here are the rules to follow Guild Mortgage is now referring to its reverse loan offerings, including FHA and private-label jumbo, as Flexible Payment Mortgages

Hecm For Purchase Buy Your Next Home Without A Mortgage Payment Reverse mortgages eventually must be paid back, usually by the borrower’s spouse or other heirs Here are the rules to follow Guild Mortgage is now referring to its reverse loan offerings, including FHA and private-label jumbo, as Flexible Payment Mortgages Seniors with equity in their homes who intend to stay there and want to supplement their income are turning to reverse mortgages They are gaining popularity when the price of groceries, gas, and If your home needs significant maintenance or repairs, the costs can quickly consume the funds from a reverse mortgage, leaving you with little financial gain An alternative to downsizing is the HECM Here’s how the Fed’s rate-cut move will affect your life, including your credit cards, car loans, home loans, high-yield savings accounts, certificates of deposits and other financial accounts FHA loans can be easier to qualify for than conventional loans, making them a good option if you have a lower credit score, higher debt, or a smaller down payment

Comments are closed.