Here S The Difference Between Term Life And Whole Life Insura

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

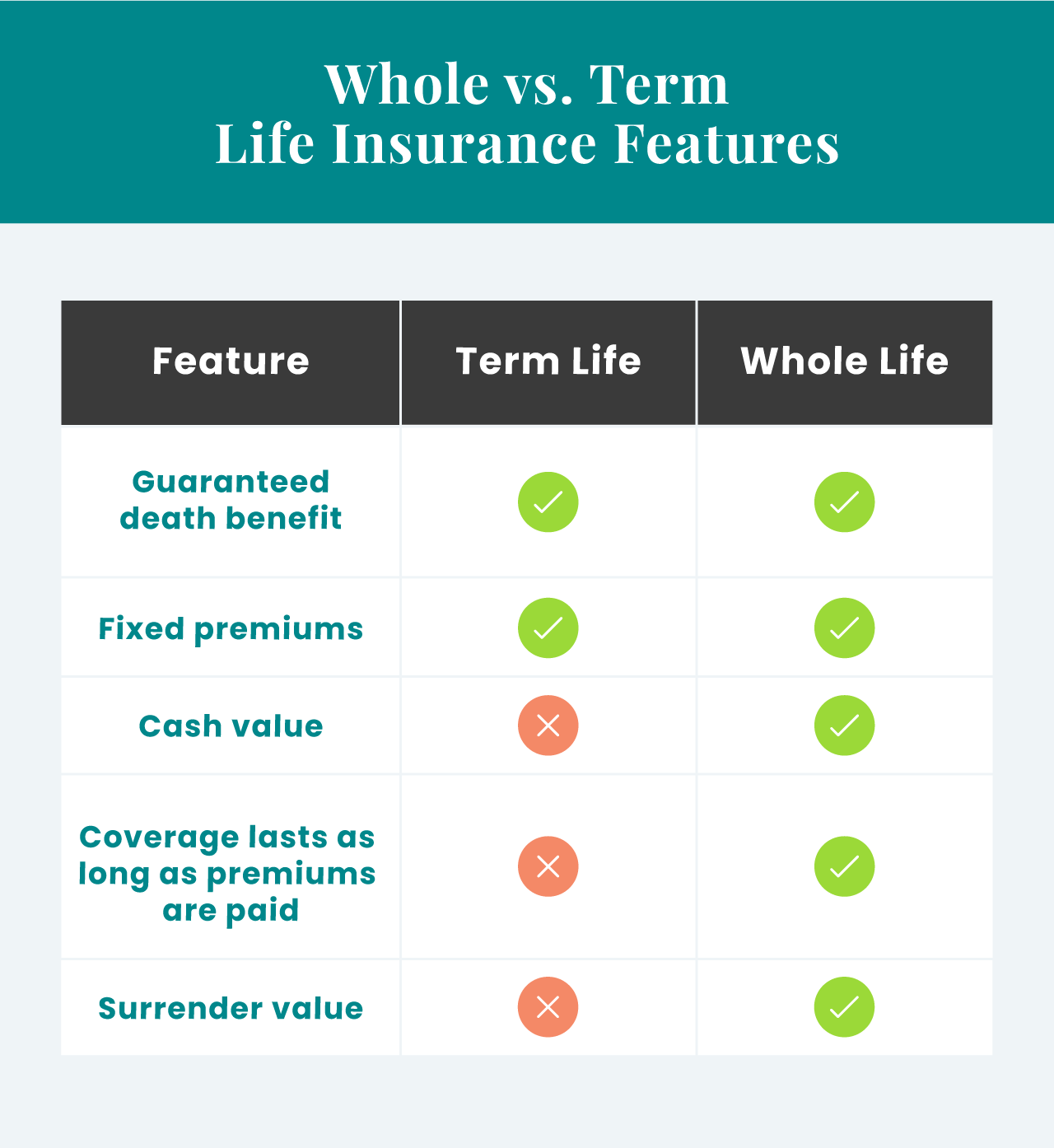

юааtermюаб юааvsюаб юааwholeюаб юааlifeюаб Insurance Whatтащюааsюаб юааthe Differenceюаб Key takeaways. term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. term life is just. Cash value. term life insurance builds no cash value while whole life policies contain a cash value account that builds over time at a fixed earnings rate. this guaranteed cash value growth in a.

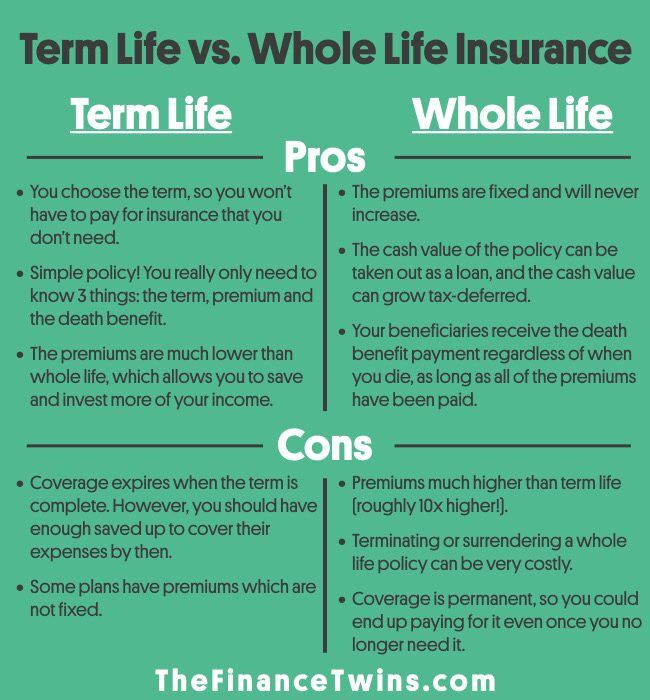

Term Life Vs Whole Life Insurance Learn About The Differences Term life insurance has relatively low premiums for coverage that lasts a set amount of time, usually 10, 20 or 30 years. whole life insurance tends to cost more, but policies typically last your. What is the cost of term life vs. whole life insurance? whole life is significantly more expensive than term life. a 30 year old who doesn’t smoke can expect to pay $26 per month ($312 per year) for a 20 year term life policy with a $500,000 payout, but $451 per month ($5,412 per year) for a whole life policy with the same payout. Term life insurance is in force for a specific time period, usually from 10 30 years. whole life insurance lasts for as long as you pay the premium and is intended to last your entire life. term life is usually less expensive, making a large death benefit more affordable during the time that you need it most, such as when you have young children. There are two primary differences between term life insurance and whole life insurance: how long coverage lasts. whether the policy has a cash value account. term life insurance locks in rates and.

Here S The Difference Between Term Life And Whole Life Ins Term life insurance is in force for a specific time period, usually from 10 30 years. whole life insurance lasts for as long as you pay the premium and is intended to last your entire life. term life is usually less expensive, making a large death benefit more affordable during the time that you need it most, such as when you have young children. There are two primary differences between term life insurance and whole life insurance: how long coverage lasts. whether the policy has a cash value account. term life insurance locks in rates and. Cost: generally, whole life insurance is significantly more expensive than term life insurance. in fact, it can be 10 to 15 times more costly for the same face amount of coverage. this higher cost. Choosing between term vs. whole life insurance will depend on your budget and whether you want permanent or temporary coverage. term life offers less expensive premiums, but coverage only lasts.

Here S The Difference Between Term Life And Whole Life Ins Cost: generally, whole life insurance is significantly more expensive than term life insurance. in fact, it can be 10 to 15 times more costly for the same face amount of coverage. this higher cost. Choosing between term vs. whole life insurance will depend on your budget and whether you want permanent or temporary coverage. term life offers less expensive premiums, but coverage only lasts.

Whole Vs Term Life Insurance Guide 2024 Insurance Hero

Comments are closed.