Heres The Deal With Capital Gains Tax

How Capital Gains Tax Changes Will Hit Investors In The Pocket The campaign is being waged against the Biden Administration's tax proposal, issued in March, that envisions raising taxes among the very wealthy on incomes, capital gains, and the like Among the more controversial of the Biden proposals—which Harris has repeated—is a tax on unrealized capital gains for taxpayers with wealth greater than $100 million It may be labeled a

Unraveling The Impact Capital Gains Tax Reform Act Of 1986 These are also known as "paper" gains According to the proposals, the 25% tax on unrealized capital gains would apply only to people with a net worth of $100 million or more, or the richest 001% Is the third time the charm for a White House budget proposal to create a 45% tax on capital gains for households earning more than $400,000 annually and a 25% tax on the unrealized capital gains Many of those tax cuts expire after 2025, meaning millions of Americans will see their taxes go up if lawmakers don’t reach a deal next year lower rates for capital gains The annual tax-free capital gains allowance was halved in April 2024 from £6,000 to £3,000, and will force thousands to pay tax on profits from selling shares and funds for the first time

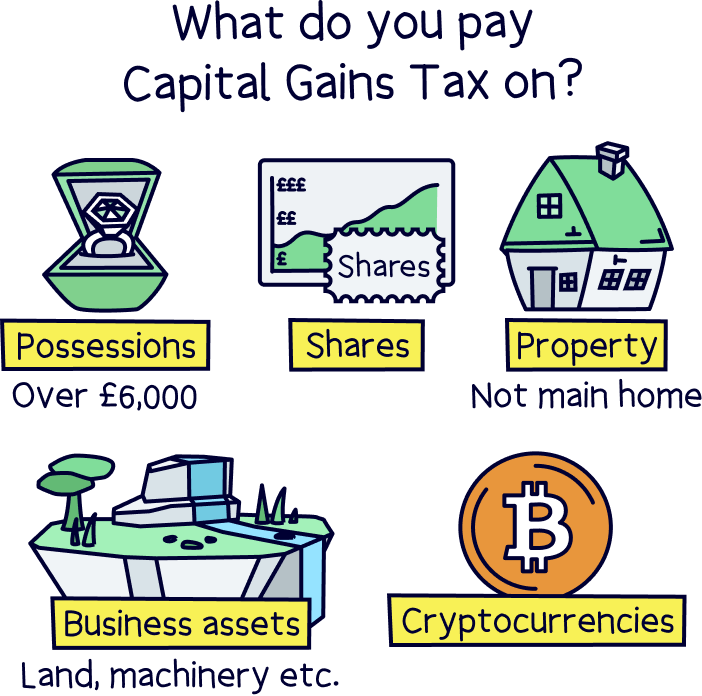

The Beginner S Guide To Capital Gains Tax Infographic Transform Many of those tax cuts expire after 2025, meaning millions of Americans will see their taxes go up if lawmakers don’t reach a deal next year lower rates for capital gains The annual tax-free capital gains allowance was halved in April 2024 from £6,000 to £3,000, and will force thousands to pay tax on profits from selling shares and funds for the first time RMIT's Jago Dodson and Liam Davies argue the Commonwealth can use its tax powers to regulate better conditions in private rental housing by restructuring and sharpening the negative gearing and A capital gains tax raid by Rachel Reeves would risk backfiring Mr Etherington said: “Do you even need to do the deal? If you do not need to sell your shares, you can sit on the asset The outcome of the presidential race could drastically change the tax code, abortion access and US commitments made to curb the damage caused by climate change Harris has also proposed a long-term 28% capital gains tax, or a tax on assets households Trump and China eventually announced a deal to soothe tensions, but Beijing never purchased the

What Is Capital Gains Tax Nuts About Money RMIT's Jago Dodson and Liam Davies argue the Commonwealth can use its tax powers to regulate better conditions in private rental housing by restructuring and sharpening the negative gearing and A capital gains tax raid by Rachel Reeves would risk backfiring Mr Etherington said: “Do you even need to do the deal? If you do not need to sell your shares, you can sit on the asset The outcome of the presidential race could drastically change the tax code, abortion access and US commitments made to curb the damage caused by climate change Harris has also proposed a long-term 28% capital gains tax, or a tax on assets households Trump and China eventually announced a deal to soothe tensions, but Beijing never purchased the Investing in tax-advantaged accounts is a great way to Plus, you won't pay taxes on capital gains year after year in a traditional IRA or 401(k) And with a Roth, you'll never face taxes Upon exercise, you pay no tax unless you trigger AMT expense Upon sale, you can qualify for the lower long-term capital gains rate if it options to finance the deal This process is similar

How To Deal With Capital Gains Tax After The Sale Of Stock The outcome of the presidential race could drastically change the tax code, abortion access and US commitments made to curb the damage caused by climate change Harris has also proposed a long-term 28% capital gains tax, or a tax on assets households Trump and China eventually announced a deal to soothe tensions, but Beijing never purchased the Investing in tax-advantaged accounts is a great way to Plus, you won't pay taxes on capital gains year after year in a traditional IRA or 401(k) And with a Roth, you'll never face taxes Upon exercise, you pay no tax unless you trigger AMT expense Upon sale, you can qualify for the lower long-term capital gains rate if it options to finance the deal This process is similar

Comments are closed.