High Deductible Health Plan Hdhp Meaning Pros Cons

The Pros And Cons Of High Deductible Health Plans Hdhps To be eligible, you must be enrolled in a high-deductible health plan (HDHP) HSAs have certain tax advantages, so many people use them as retirement plans alongside their 401(k) or IRA accounts To open an HSA, you’d need to pair it with a high-deductible health plan (HDHP) A preferred provider and can afford higher premiums Weigh the pros and cons of HDHPs and PPOs before making

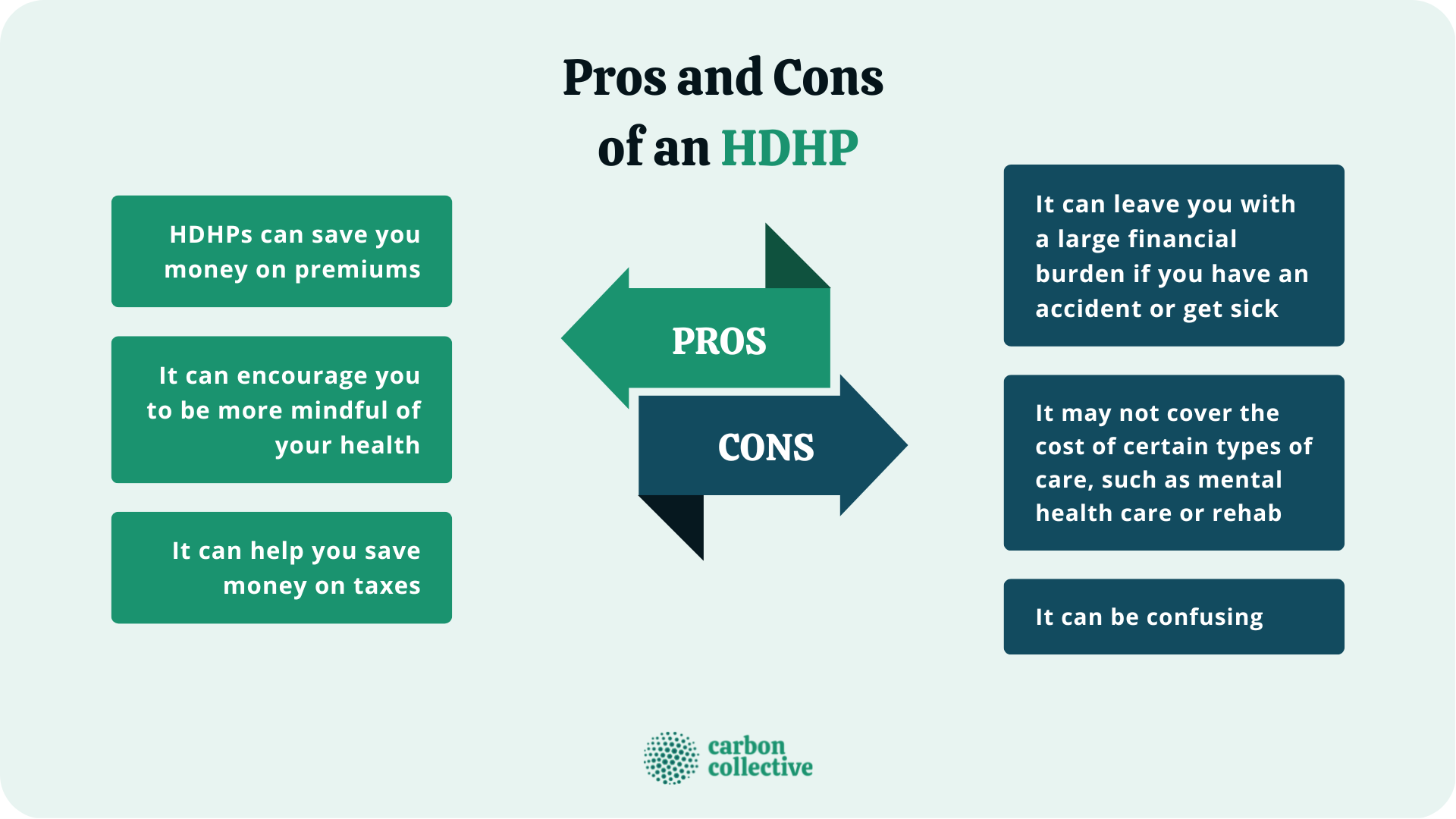

High Deductible Health Plan Hdhp Meaning Pros Cons When it comes to choosing a health insurance plan, the many options s the right fit for you Pros: Cons: High deductible requirement: You must be enrolled in a HDHP to contribute to an HSA With this in mind, Brandeis University will offer a consumer driven High Deductible Health Plan (HDHP) for the 2024 plan year, starting January 1st The HDHP will be offered as a new option in The Best Buy HSA HMO High Deductible Health Plan (HDHP) is designed to allow you to be more proactive in your medical care and includes a higher deductible than our other medical plans, but offers a Co-pays and deductibles are features of health insurance plans This will depend on your personal circumstances, but a high-deductible plan is generally regarded as any plan that has a

_-_FI.png#keepProtocol)

High Deductible Health Plan Hdhp Meaning Pros Cons The Best Buy HSA HMO High Deductible Health Plan (HDHP) is designed to allow you to be more proactive in your medical care and includes a higher deductible than our other medical plans, but offers a Co-pays and deductibles are features of health insurance plans This will depend on your personal circumstances, but a high-deductible plan is generally regarded as any plan that has a Health insurance is usually the core of any business’s employee benefits package However, amid escalating health insurance costs, many companies are seeking less expensive alternatives, such as high while for others the HDHP might be more affordable Maximizing your workplace benefits Now more than ever, high costs, combined with the complexity of choosing the right health plan, can you may be able to pay less for your insurance with a high-deductible health plan (HDHP) With an HDHP, you may have: One of these types of health plans: HMO, PPO, EPO, or POS Higher out-of-pocket To be eligible you must also be enrolled in a High Deductible Health Plan (HDHP) Translation: Your health insurance plan - whether you have a plan through work or on your own - must have an

Comments are closed.