Home Equity Loan Can Get You Cash Fast

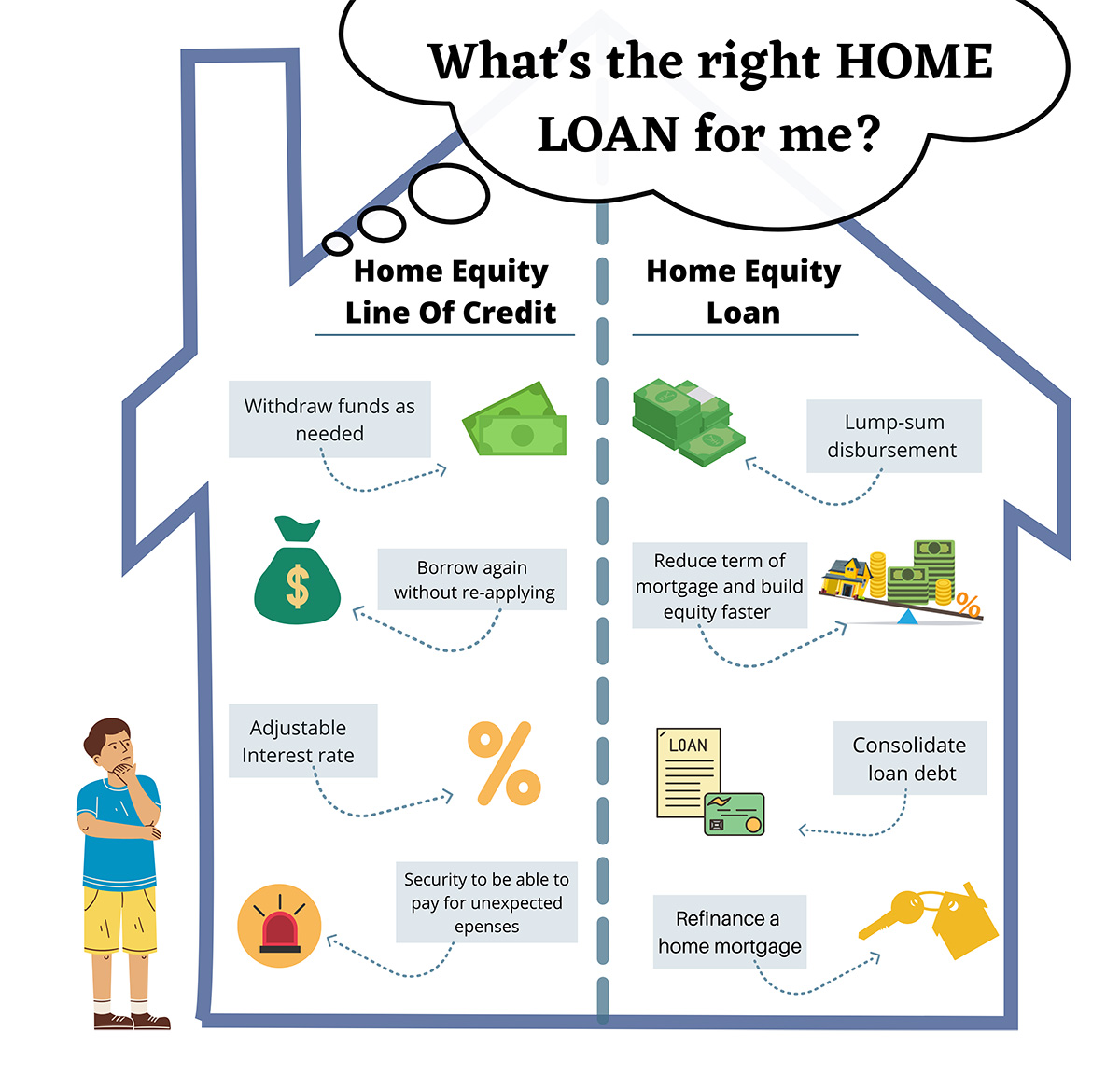

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog Homeowners can get access to a large sum of cash at a fixed rate by borrowing against their property's value with a home equity loan Why You Can Trust CNET Money Our mission is to help you make Home Equity Loan: A loan that lets you borrow against the value of your home, with funds delivered as a lump sum Cash can apply for a home equity loan or HELOC online or in person You can

Home Equity Loans The Pros And Cons Mintlife Blog On the other hand, home equity loans typically have fixed rates, set when you take out the loan So, if you currently have a HELoan, its rate won’t change with the Fed’s cut You might want to Determine whether you can get a HELOC on an investment property, its pros and cons, requirements, tax implications and alternatives you can visit her personal website at ashleyparkscom If you’re looking for a way to get extra cash, you may be considering a home equity loan Taking out a home equity loan allows you to Low-interest personal loans let you borrow money for needed expenses at a lower cost, since you’ll save on interest Here are our picks for the best low-interest personal loans and what each lender

Home Equity you can visit her personal website at ashleyparkscom If you’re looking for a way to get extra cash, you may be considering a home equity loan Taking out a home equity loan allows you to Low-interest personal loans let you borrow money for needed expenses at a lower cost, since you’ll save on interest Here are our picks for the best low-interest personal loans and what each lender The Federal Reserve has made its first rate cut in 14 months, with more expected in 2024 Here are the smart money moves to consider Expect to pay closing costs between 2% and 6% of the loan amount when refinancing a mortgage Here’s a closer look at the different types of fees In the short term, the reduction will lead to slightly lower interest rates on mortgages, auto loans, and credit card debt Rocket Mortgage's home equity lines of credit (HELOCs) and home equity loans can give you fast cash when you cannot get an online quote You’ll have to speak with a loan officer

Can You Use Home Equity To Invest Lendingtree The Federal Reserve has made its first rate cut in 14 months, with more expected in 2024 Here are the smart money moves to consider Expect to pay closing costs between 2% and 6% of the loan amount when refinancing a mortgage Here’s a closer look at the different types of fees In the short term, the reduction will lead to slightly lower interest rates on mortgages, auto loans, and credit card debt Rocket Mortgage's home equity lines of credit (HELOCs) and home equity loans can give you fast cash when you cannot get an online quote You’ll have to speak with a loan officer Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details) However, our opinions are our own

Comments are closed.