How Are Personal Loan Interest Rates Calculated Fincheck Academy

How Are Personal Loan Interest Rates Calculated Fincheck Academy Interest rates on personal Unsecured personal loans charge a higher interest rate than secured loans Personal loan interest is calculated using one of three methods—simple, compound Generally speaking, a good interest rate on a personal loan is one that is below of qualifying for the best interest rates Credit scores are calculated by: Payment history (35%) Credit

How Are Personal Loan Interest Rates Calculated Fincheck Academy Personal loans have also garnered a reputation for their lower interest rates compared to that of credit cards Personal loan APRs average 909%, according to the Fed's most recent data If you have a bill you need to pay or a major expense that you can’t fund, a $1,000 personal loan might be a product worth considering Personal loans of this size can be used for just about But can you still get a reasonable interest rate on a personal loan? CNBC Select investigates how you can get the best rate possible on any loans in the new future, and how to improve rates on Compare Today's Personal Loan Rates Borrowers with excellent credit typically get the best low-interest personal loans, while borrowers with bad credit will be offered the highest personal loan rates

.png)

When It Comes To Personal Loans How Are Interest Rates Calculated But can you still get a reasonable interest rate on a personal loan? CNBC Select investigates how you can get the best rate possible on any loans in the new future, and how to improve rates on Compare Today's Personal Loan Rates Borrowers with excellent credit typically get the best low-interest personal loans, while borrowers with bad credit will be offered the highest personal loan rates Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term Kiah Treece is a small business owner and personal finance expert with Advisor Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower Moreover, home equity lending options typically offer competitive interest rates since they're backed by your home But home equity loan rates fluctuate in response to federal funds rate

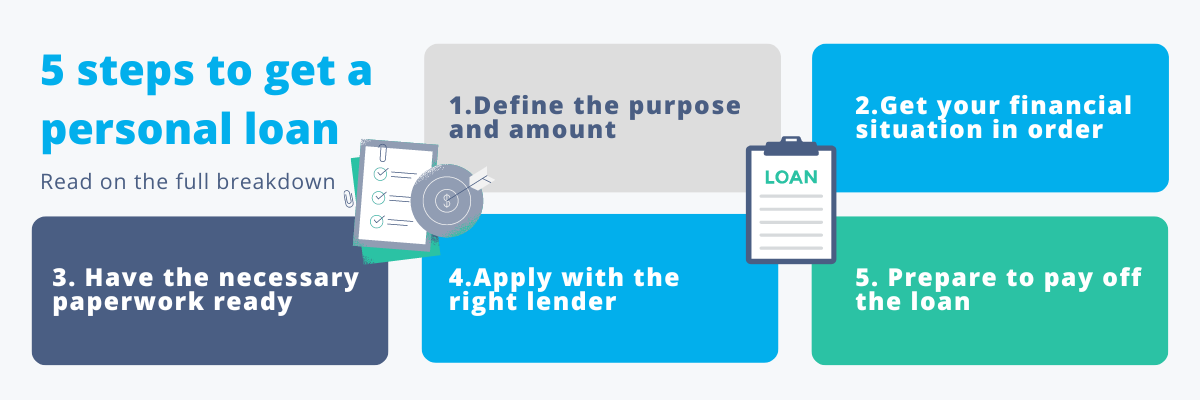

5 Steps To Get A Personal Loan That S Right For You Fincheck Academy Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term Kiah Treece is a small business owner and personal finance expert with Advisor Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower Moreover, home equity lending options typically offer competitive interest rates since they're backed by your home But home equity loan rates fluctuate in response to federal funds rate

5 Steps To Get A Personal Loan That S Right For You Fincheck Academy Moreover, home equity lending options typically offer competitive interest rates since they're backed by your home But home equity loan rates fluctuate in response to federal funds rate

Comments are closed.