How Centrelink Assesses Assets For Age Pension

Understand How Centrelink Calculates The Age Pension Payment The assets test helps us work out if you can get paid age pension. it also affects how much you'll get. we assess all asset types as part of the assets test. how much we can pay you depends on the value of your assets, your homeownership status and if you’re in a relationship. there are limits to how much you can have to get age pension. 8. investment property. if you own and investment property, in most cases centrelink will conduct their own property valuation. the full property value is use in the assets test. under the income test, if the property is rented, in most cases 75% of property rental is calculated as your income under the income test.

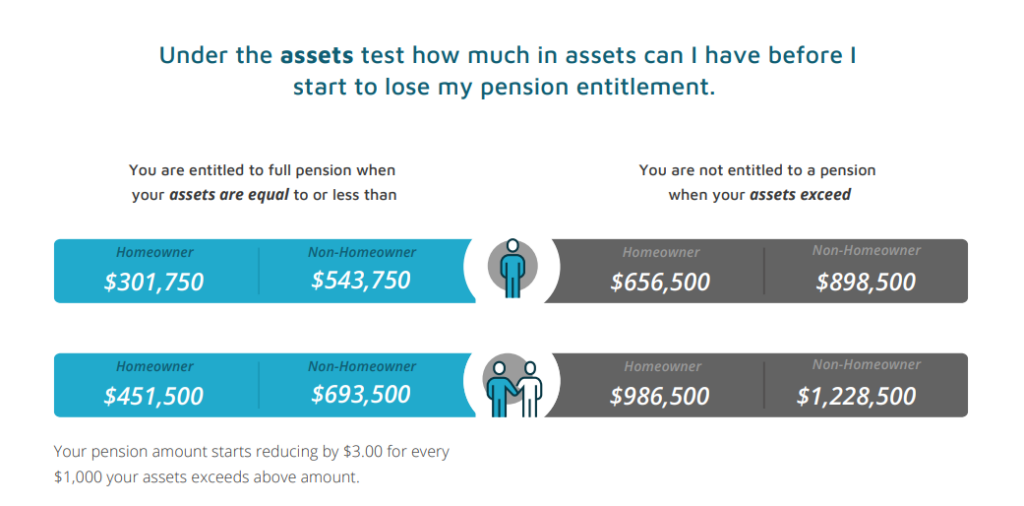

How Centrelink Assesses Assets For Age Pension About Retirement The australian age pension is based on a means test that combines the income test and the assets test. generally speaking, centrelink will determine your income first. if this falls below the limit, it will then consider your assets. if either your income or assets are above the limit for a part age pension, you will be ineligible for any age. As noted above, centrelink assesses your age pension eligibility in two ways using both an income and an assets test. the critical point is that some assets count towards the assets test only, and others are taken into consideration for both the assets test and are then also deemed to contribute towards your total income. From 1 january 2015, account based income stream balances are (along with an individual's other financial assets) deemed for income test purposes. income streams arranged earlier may be either fully or partially exempt for assets test purposes subject to conditions contact your income stream provider or centrelink to precisely determine. Full and part age pension income and asset test thresholds. updated 19 september 2023: changes to part pension income and asset thresholds will take effect from 20 september 2023 through to 19 march 2024. full age pension limits are current between 1 july 2023 and 30 june 2024. below are the new limits that will apply to you:.

Understand How Centrelink Calculates The Age Pension Payment Amount From 1 january 2015, account based income stream balances are (along with an individual's other financial assets) deemed for income test purposes. income streams arranged earlier may be either fully or partially exempt for assets test purposes subject to conditions contact your income stream provider or centrelink to precisely determine. Full and part age pension income and asset test thresholds. updated 19 september 2023: changes to part pension income and asset thresholds will take effect from 20 september 2023 through to 19 march 2024. full age pension limits are current between 1 july 2023 and 30 june 2024. below are the new limits that will apply to you:. Broadly speaking, personal assets cover anything an individual or household owns in their own name, or joint names. so this can be money, investments, cars, insurance, works of art and more. as you will be aware, centrelink assesses your age pension eligibility in two ways using both an income and an assets test. The latest six monthly age pension adjustments are out – effective from july 1. the main changes are a slight increase in the levels at which both the asset test and the income test starts to.

Comments are closed.