How Does A Credit Card Work

How Credit Cards Work Learn how credit cards are short term loans that let you make purchases, pay bills, or withdraw cash. find out how credit cards work, their types, fees, rewards, and how they differ from debit cards. A credit card is tied to a revolving line of credit that a bank has issued you. a debit card is tied to your bank account. this is an important distinction. with a credit card transaction, the.

How Do Credit Cards Work Gifographic For Kids Mocomi A credit card is a small plastic card that lets you borrow money from a financial provider. if you borrow funds for a significant period of time, you’ll pay a fee for the privilege — called interest. use credit cards if you want a secure and convenient way to pay. they’re also excellent tools to build your credit score — a three digit. Learn how credit cards work, from their basic functionality to smart usage tips. find out the types, benefits, risks, and best practices of credit cards, and how they can impact your credit score. As of 2018, first time late fees were capped at $27; and fees for a second late payment within six months were limited to $38. late fees also can’t cost more than the minimum payment due. Wallethub senior researcher. credit cards work on a buy now pay later basis. when you use a credit card to make a purchase, you’re borrowing money from the credit card’s issuer to complete the transaction, and then repaying the amount at the end of the billing cycle, either in part or in full. if you pay a credit card’s bill in full each.

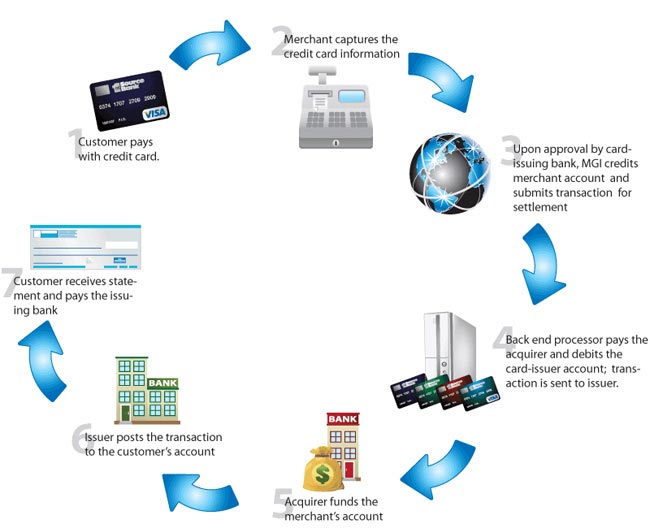

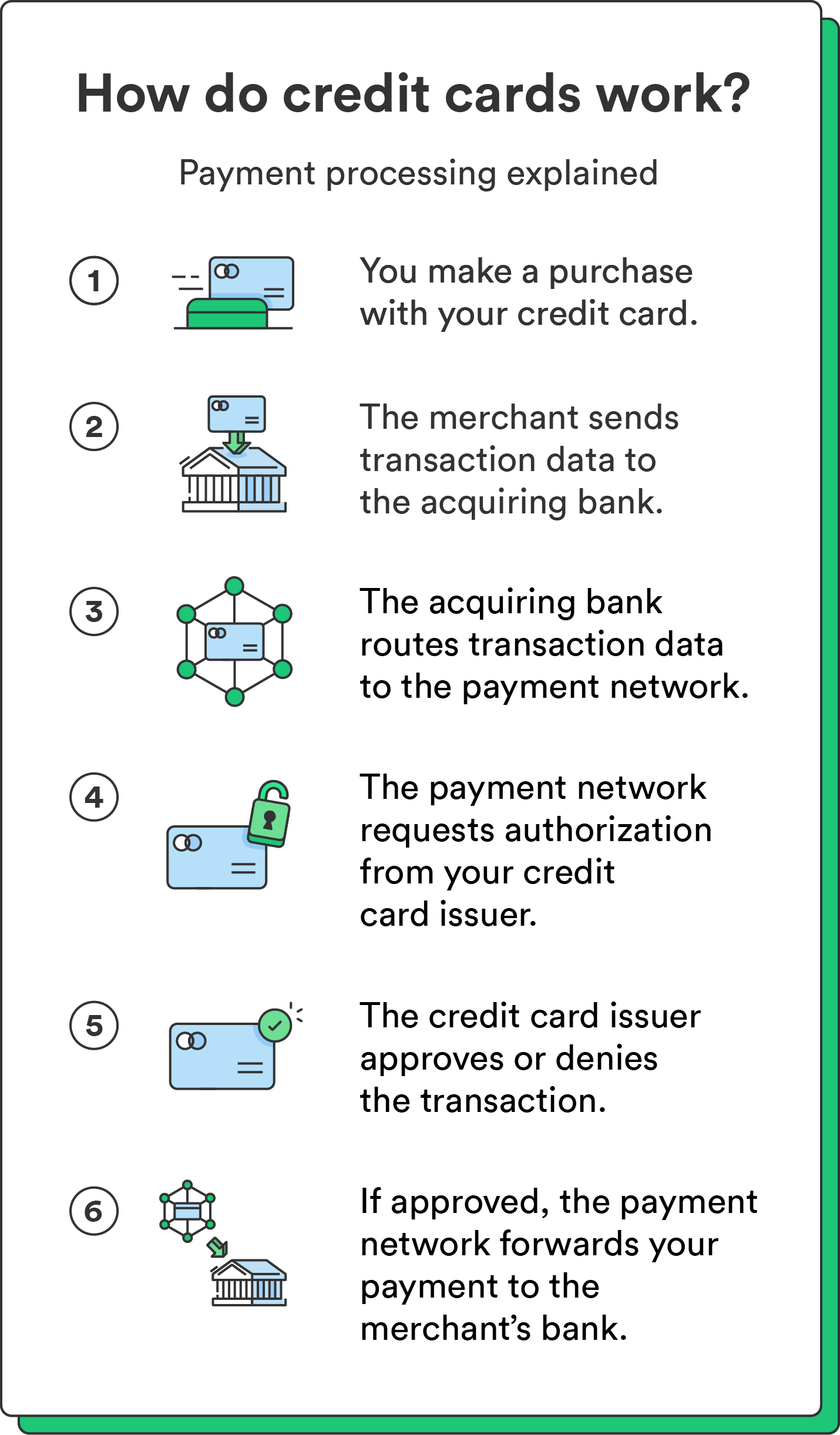

How Credit Cards Work Money World Basics As of 2018, first time late fees were capped at $27; and fees for a second late payment within six months were limited to $38. late fees also can’t cost more than the minimum payment due. Wallethub senior researcher. credit cards work on a buy now pay later basis. when you use a credit card to make a purchase, you’re borrowing money from the credit card’s issuer to complete the transaction, and then repaying the amount at the end of the billing cycle, either in part or in full. if you pay a credit card’s bill in full each. Learn the basics of credit cards, how they let you borrow money and affect your credit score. compare different types of credit cards and how to apply for one. Credit cards are a convenient way to make purchases. when you make a purchase, your account details are sent to the merchant’s bank and forwarded by the card’s network for authorization by the issuer. the funds are then sent to the merchant. you receive a statement from the credit card issuer once a month that details your purchase history.

How Do Credit Cards Work The Beginners Guide Chime Learn the basics of credit cards, how they let you borrow money and affect your credit score. compare different types of credit cards and how to apply for one. Credit cards are a convenient way to make purchases. when you make a purchase, your account details are sent to the merchant’s bank and forwarded by the card’s network for authorization by the issuer. the funds are then sent to the merchant. you receive a statement from the credit card issuer once a month that details your purchase history.

Credit Card 101 How Do Credit Cards Work Mintlife Blog

Comments are closed.