How Does An Ira Work U S Bank

How Do Iras Work U S Bank Here’s a look at the requirements and benefits of each. ira. 401 (k) maximum annual contribution. $7,000 year ($8,000 if age 50 ) $23,000 year ($30,500 if age 50 ) setup. you set it up yourself through your bank or an investment broker, like u.s. bancorp investments. an ira is also a common option for those whose employers don’t offer a 401. Open an ira. an individual retirement account (ira) is a tax advantaged investment account designed to help you save toward retirement. iras are one of the most effective ways to save and invest for the future. they allow your money to grow on a tax deferred or tax free basis, depending on the type of account (see the table below for details).

How Does An Ira Work U S Bank You can easily open and fund an ira. whether you prefer investing on your own or want personal investment guidance, we have options available to fit your needs. however you choose to invest – automated vs. self directed, or by working with a financial professional – you’ll enjoy the benefits of opening an ira, like tax advantaged growth. An ira can be set up by anyone who has earned income, regardless of whether they have a 401(k) plan at work. most 401(k) plans offer a limited choice of mutual funds and exchange traded funds (etfs). An ira is a retirement savings account that provides you with tax free investment growth and a range of other tax advantages. anyone who earns income—and even certain people who don’t—can. June 28, 2024. the ira (individual retirement account) is the classic car of retirement savings accounts. it was created by the government to give individuals a tax advantaged retirement savings option not tied to a person’s employer. if you don’t have access to a workplace retirement plan like a 401 (k), or you want to put aside additional.

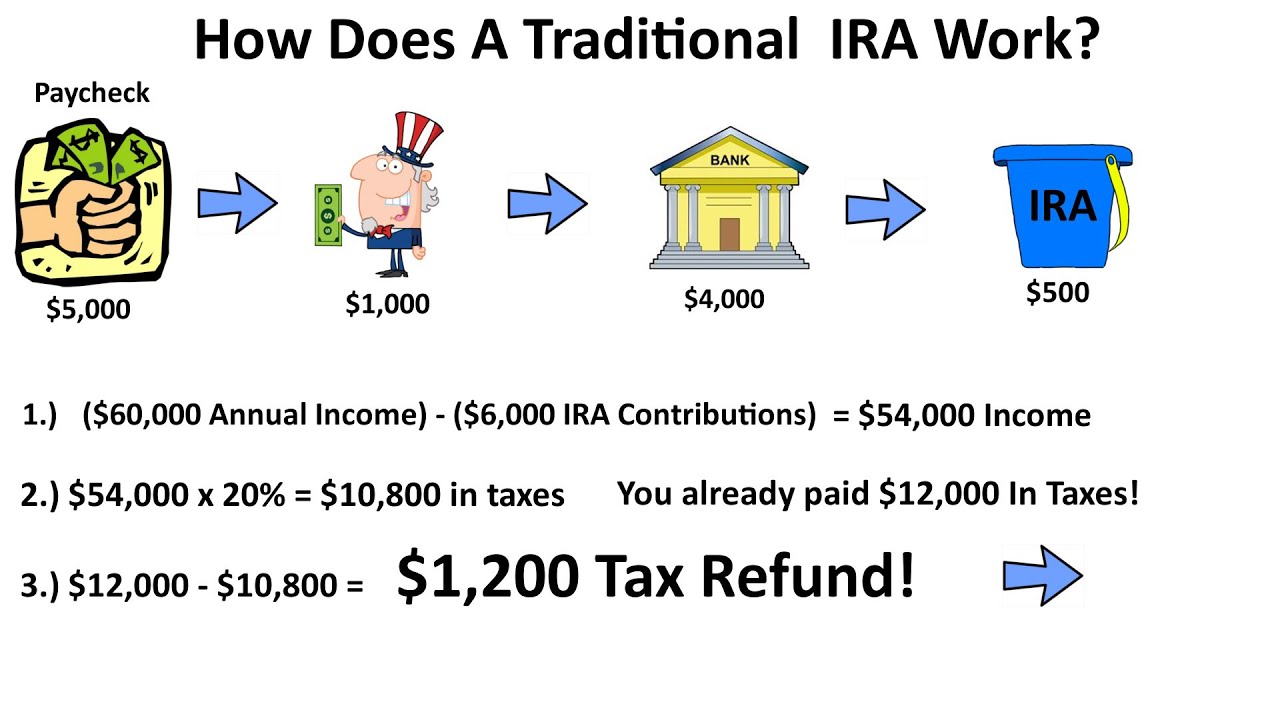

How Does An Ira Work Traditional Ira Explained In A Flow Chart Tax An ira is a retirement savings account that provides you with tax free investment growth and a range of other tax advantages. anyone who earns income—and even certain people who don’t—can. June 28, 2024. the ira (individual retirement account) is the classic car of retirement savings accounts. it was created by the government to give individuals a tax advantaged retirement savings option not tied to a person’s employer. if you don’t have access to a workplace retirement plan like a 401 (k), or you want to put aside additional. An ira, or individual retirement account, is a tax advantaged account designed to help americans save and invest for retirement. many banks and brokerages offer iras, and they take several forms. A sep ira is an account that’s available to the self employed or business owners. it offers the tax advantages of an ira, and the employer can contribute the lesser of 25 percent of income or.

What Is An Ira And How Does It Work 2024 An ira, or individual retirement account, is a tax advantaged account designed to help americans save and invest for retirement. many banks and brokerages offer iras, and they take several forms. A sep ira is an account that’s available to the self employed or business owners. it offers the tax advantages of an ira, and the employer can contribute the lesser of 25 percent of income or.

Comments are closed.