How To Calculate Market Breadth Using Moving Averages Youtube

Forecasting Simple Moving Average Example 1 Youtube Get the script: patreon: patreon quantitativefinance want to connect?linkedin: linkedin in jason guevara #marketbreadth #quan. We perform market breadth analysis using moving averages on nifty 500 stocks to get a sense of health of the marketmoving averages are a powerful tool and he.

How To Calculate Market Breadth Using Moving Averages Youtube Traders use market breadth indicators to assess the overall health of a market or index. in part one of our video series with technical analysis expert andre. To calculate the zweig market breadth thrust indicator you need access to daily advancers and decliners on the nyse. breadth = advancingissues ( advancingissues decliningissues ); zweig breadth thrust indicator = a 10 day moving average of the breadth. we use a simple moving average in this article. Percent number of stocks above moving average. a breadth indicator gauges internal strength or weakness in the underlying index by the percentage of stocks trading above a specified moving average. short to medium term periods are covered by the 50 day moving average, while the 150 day and 200 day moving averages cover medium to long term. 6. s&p 500 200 day index. the 200 day moving average is a useful technical indicator, but it can take a while to look at the 200 day moving average of each stock in an index. this market breadth.

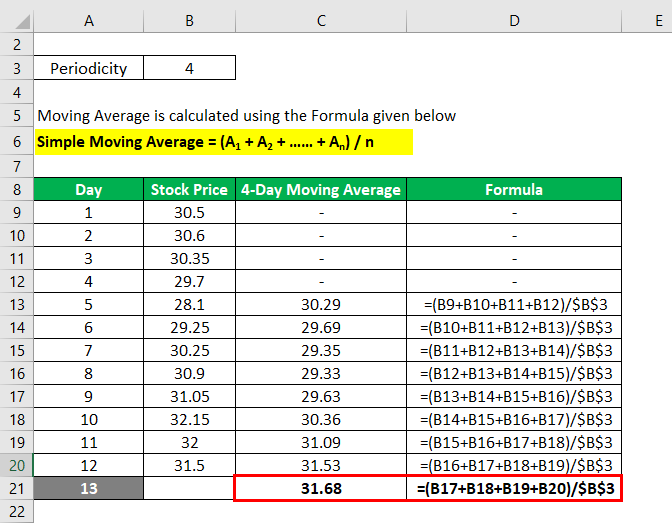

Moving Average Formula Calculator Examples With Excel Template Percent number of stocks above moving average. a breadth indicator gauges internal strength or weakness in the underlying index by the percentage of stocks trading above a specified moving average. short to medium term periods are covered by the 50 day moving average, while the 150 day and 200 day moving averages cover medium to long term. 6. s&p 500 200 day index. the 200 day moving average is a useful technical indicator, but it can take a while to look at the 200 day moving average of each stock in an index. this market breadth. The bottom line. when investors use the phrase market breadth, they are talking about a set of technical indicators that evaluate price movements in a given stock index. sometimes, an index may. Traders can use moving averages of different periods to identify trends across various timeframes. 2. support and resistance levels: moving averages can act as dynamic support or resistance levels. during an uptrend, the moving average often acts as support, with prices frequently bouncing off it.

Comments are closed.