How To Calculate Npv Using Excel

How To Calculate Npv In Excel 9 Steps With Pictures Wikihow Step 1) to manually calculate npv in excel, write the following formula: xxxxxxxxxx. = (1 discount rate) ^ number of years. our discount rate sits in cell b10, so i am creating an absolute reference to it. the number of years denotes the year in which the cash flow occurs. Using the npv function to calculate npv the second excel method uses the built in npv function. it requires the discount rate (again, represented by the wacc), and the series of cash flows from.

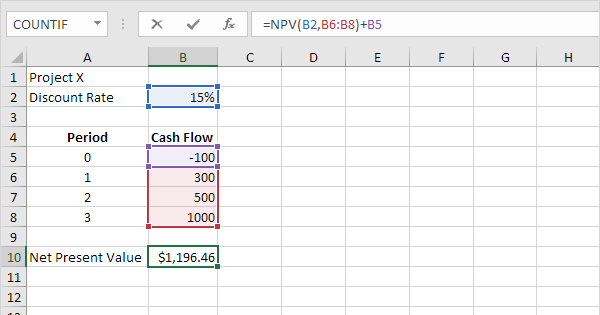

Npv Formula In Excel In Easy Steps Based on these inputs, you want to calculate the net present value using two functions. the formula in cell g2 is for calculating the npv where we are not considering the dates: =npv(f2,c3:c8) c2. the formula in cell h2 is using the xnpv where dates are also considered: =xnpv(f2,c2:c8,d2:d8). You can use the below formula to calculate the npv value for this data: =npv(d2,b2:b7) the above formula gives the npv value of $15,017, which means that based on these cash flows and the given discount rate (also called the cost of capital), the project will be profitable and generate profit worth $15,017. Learn how to use the excel npv function to discount future cash flows and find the net present value of an investment. see formula examples, tips, and common errors to avoid when calculating npv in excel. It could be also the annual interest rate. npv: below this column header you’ll be calculating the net present value. entering the built in npv formula. now, in the destination cell, which is e2 in the current exercise, enter the following formula: =npv(d2,b2:b12) calculate npv in excel using the npv function.

How To Calculate Net Present Value Npv And Internal Rate Of Return Learn how to use the excel npv function to discount future cash flows and find the net present value of an investment. see formula examples, tips, and common errors to avoid when calculating npv in excel. It could be also the annual interest rate. npv: below this column header you’ll be calculating the net present value. entering the built in npv formula. now, in the destination cell, which is e2 in the current exercise, enter the following formula: =npv(d2,b2:b12) calculate npv in excel using the npv function. Learn how to use the npv function in excel to calculate the net present value of an investment with a series of future payments and income. see the formula syntax, usage, and examples with different discount rates and cash flows. The npv function uses the following equation to calculate the net present value of an investment: how to use the npv function in excel? to understand the uses of the function, let’s consider a few examples: example – using the function. suppose we are given the following data on cash inflows and outflows: the required rate of return is 10%.

How To Calculate Net Present Value Npv In Excel Youtube Learn how to use the npv function in excel to calculate the net present value of an investment with a series of future payments and income. see the formula syntax, usage, and examples with different discount rates and cash flows. The npv function uses the following equation to calculate the net present value of an investment: how to use the npv function in excel? to understand the uses of the function, let’s consider a few examples: example – using the function. suppose we are given the following data on cash inflows and outflows: the required rate of return is 10%.

Npv Function In Excel Formula Examples How To Use

Comments are closed.