How To Calculate Present Value Youtube

How To Calculate Present Value Youtube What’s better than watching videos from alanis business academy? doing so with a delicious cup of freshly brewed premium coffee. visit lannacoffe. Net present value explained in a clear and simple way, in just a few minutes! two steps: first understanding the idea of present value and future value, and.

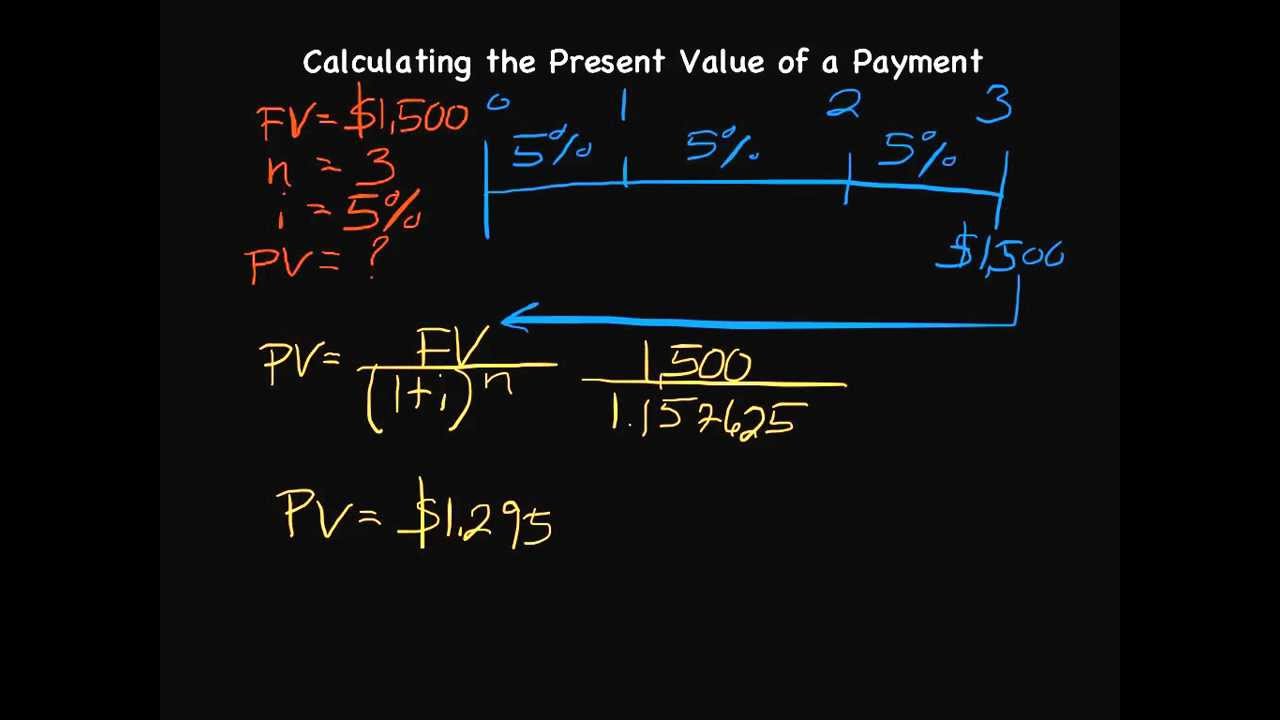

Episode 166 How To Calculate The Present Value Youtube This video provides a simple example of how to calculate present value in excel using =pv, using =npv, and using the simple discounting formula. And the net present value is heavily reliant on the pv. we can even see this in the name! the net present value is just the present value, net of the investment. valuation. the value of a company, or a stock, a business, etc, is all fundamentally based on the present value of future expectations. Npv formula. in practice, the xnpv excel function is used to calculate the net present value (npv). =xnpv (rate, values, dates) where: rate → the appropriate discount rate based on the riskiness and potential returns of the cash flows. values → the array of cash flows, with all cash outflows and inflows accounted for. Pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one period of time, you need to raise the (1 r) by the number of periods.

How To Calculate Present Value Youtube Npv formula. in practice, the xnpv excel function is used to calculate the net present value (npv). =xnpv (rate, values, dates) where: rate → the appropriate discount rate based on the riskiness and potential returns of the cash flows. values → the array of cash flows, with all cash outflows and inflows accounted for. Pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one period of time, you need to raise the (1 r) by the number of periods. Present value. so $1,000 now is the same as $1,100 next year (at 10% interest). how to calculate future payments. let us stay with 10% interest. that means that. Net present value (npv) is used to calculate the current value of a future stream of payments from a company, project, or investment. to calculate npv, you need to estimate the timing and amount.

Comments are closed.