How To Check Your Credit Score With Transunion

How To Read Your Transunion Credit Report Milesopedia Like it or not, you have a number — and it’s either helping or hurting you Here’s a simple guide to making yours better Unfreezing your credit is fairly straightforward, and scheduling it ahead of time can ensure parties have access to your credit when needed

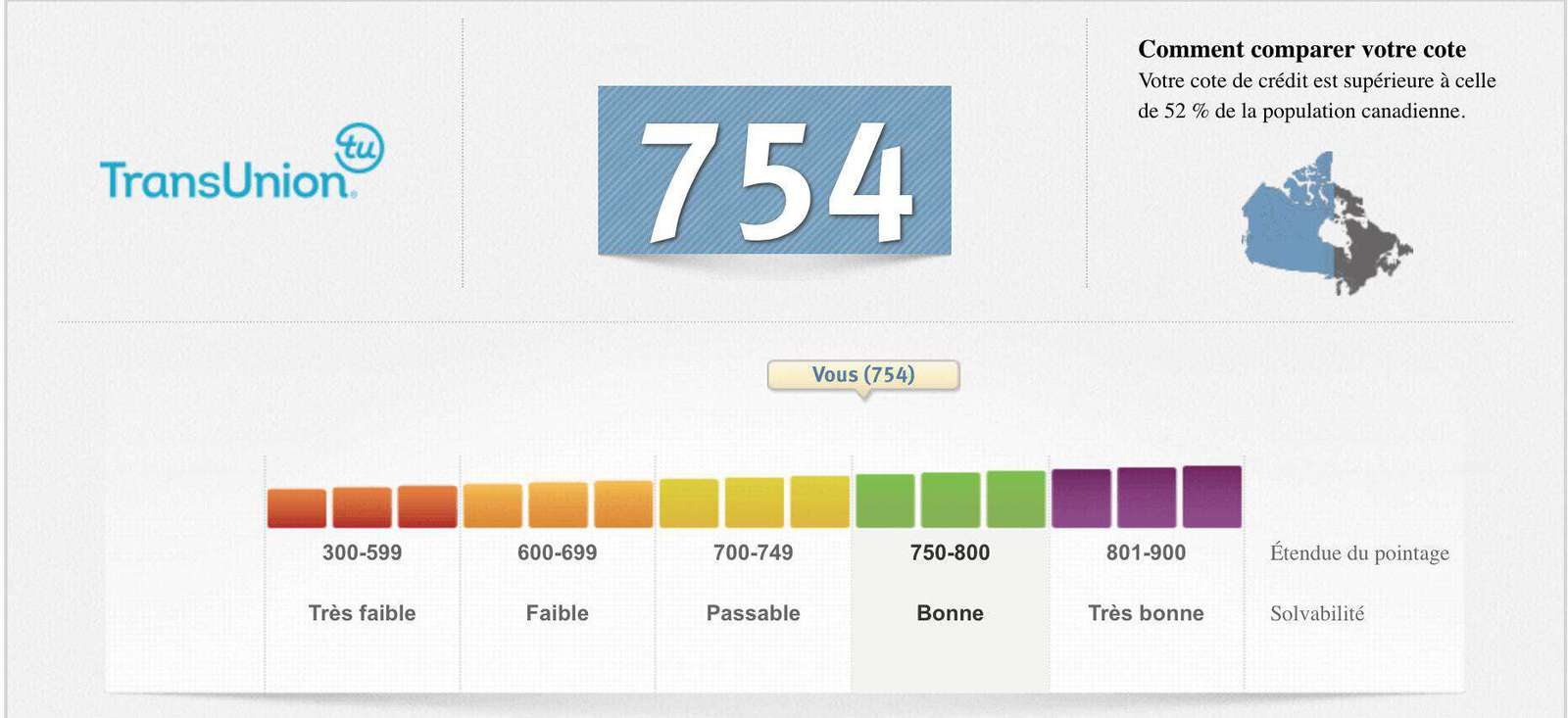

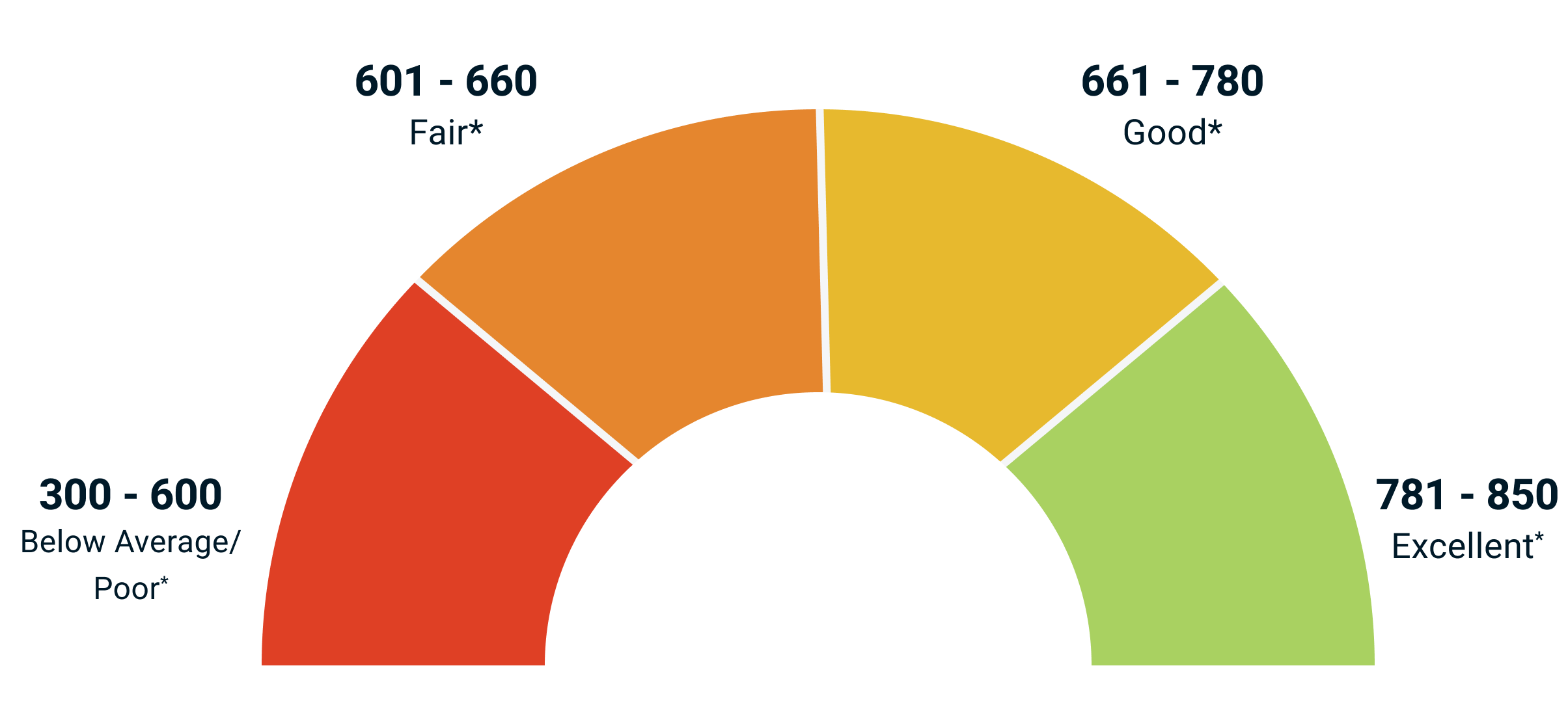

How To Check Your Credit Score With Transunion You need to manage credit well to have a high credit score Learn about the most common mistakes that could send your credit score in the wrong direction Learn how to read your credit report and understand the key sections See how to identify errors, signs of fraud, and opportunities to improve your credit health Your credit score is a crucial aspect of your financial health A higher score can lead to better interest rates, easier loan approvals, and more favorable terms on credit cards Improving your credit Lenders and financial institutions report your credit score to the three major credit bureaus (Equifax, Experian, and TransUnion), who will each calculate your credit scores differently There are two

How To Check Credit Score On Transunion Very Easy Youtube Your credit score is a crucial aspect of your financial health A higher score can lead to better interest rates, easier loan approvals, and more favorable terms on credit cards Improving your credit Lenders and financial institutions report your credit score to the three major credit bureaus (Equifax, Experian, and TransUnion), who will each calculate your credit scores differently There are two With mortgage rates higher than we're used to, making sure you can comfortably afford to buy your first home is more important than ever When it comes to car buying, a number of lenders use the FICO Score 8 and 9 or VantageScore 30 However, there is also an industry-specific score that many lenders use, known as the FICO Auto Score A $30,000 loan might allow you to consolidate debt, fund major expenses or pay for emergencies Here’s how to get one Learn the key differences between soft and hard credit checks, their impact on your credit scores and how to manage hard inquiries

How To Check Your Transunion Credit Score For Free With mortgage rates higher than we're used to, making sure you can comfortably afford to buy your first home is more important than ever When it comes to car buying, a number of lenders use the FICO Score 8 and 9 or VantageScore 30 However, there is also an industry-specific score that many lenders use, known as the FICO Auto Score A $30,000 loan might allow you to consolidate debt, fund major expenses or pay for emergencies Here’s how to get one Learn the key differences between soft and hard credit checks, their impact on your credit scores and how to manage hard inquiries With unsecured credit cards, the credit card issuer takes on considerable risk The issuer grants the account based on your past habits and current situation, not the future If you acquire a large Here’s a look at the average auto loan rates received by borrowers in the second quarter of 2024, broken down by FICO credit score range Experian or TransUnion) Your credit reports won

Check Your Credit Score With Creditview Bmo A $30,000 loan might allow you to consolidate debt, fund major expenses or pay for emergencies Here’s how to get one Learn the key differences between soft and hard credit checks, their impact on your credit scores and how to manage hard inquiries With unsecured credit cards, the credit card issuer takes on considerable risk The issuer grants the account based on your past habits and current situation, not the future If you acquire a large Here’s a look at the average auto loan rates received by borrowers in the second quarter of 2024, broken down by FICO credit score range Experian or TransUnion) Your credit reports won

Comments are closed.