How To File A Government Entity Diesel Fuel Tax Return

How To File A Government Entity Diesel Fuel Tax Return Youtube Line 14. enter the amount of california diesel fuel tax paid to a retail vendor in california on the diesel fuel that is included in line 7. if you purchased tax paid fuel in a prior period but used the fuel in the current period, complete the california diesel fuel tax paid to retail vendor worksheet on the back of the return. Diesel fuel tax – licensed government entities (dg) – filing claims for refund. state and local government entities are not exempt from the diesel fuel tax. they may file a claim for refund of the tax paid on diesel fuel used in an off highway manner using form cdtfa 501 dg, government entity diesel fuel tax return. state and local.

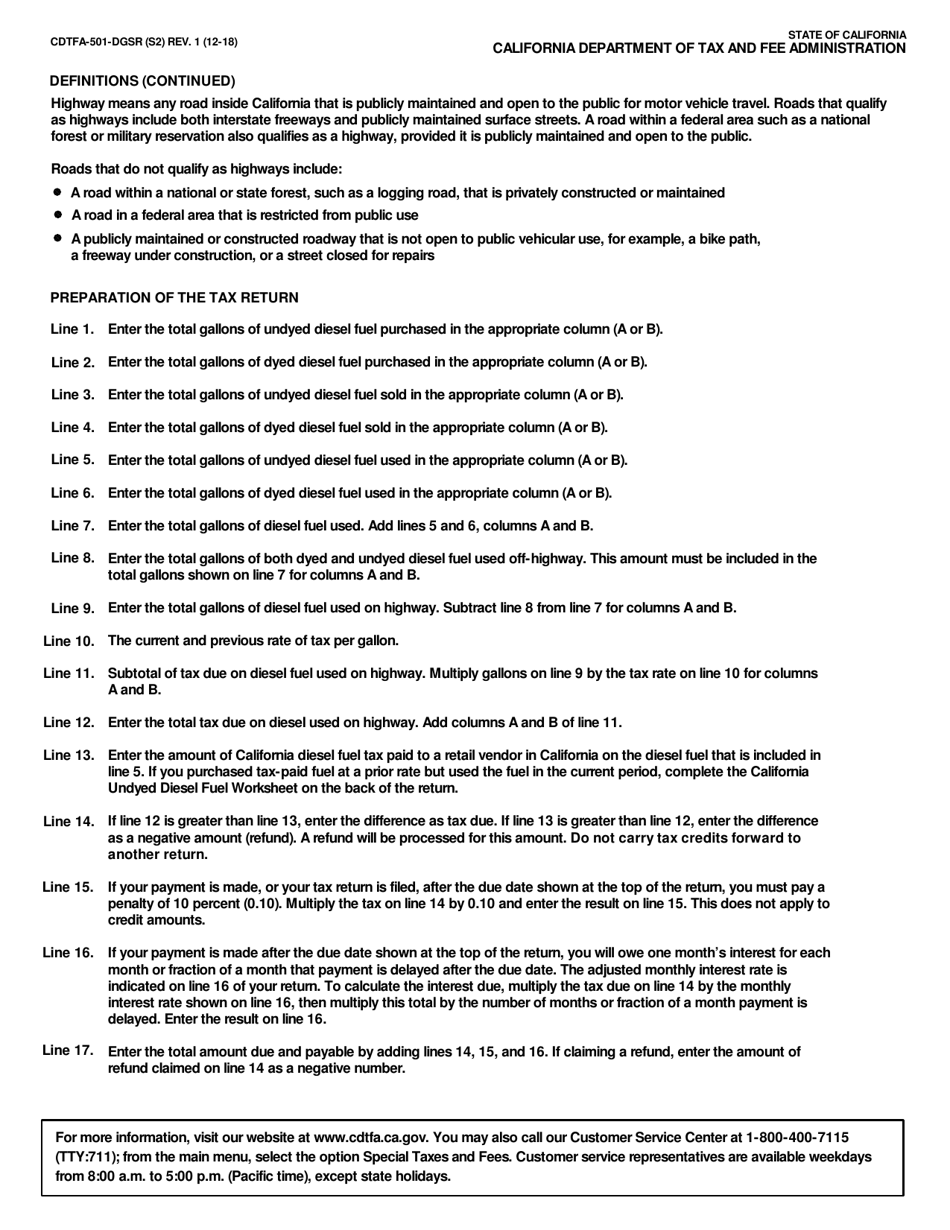

Form Cdtfa 501 Dgsr Download Fillable Pdf Or Fill Online Government Tax returns, reports, and schedule filings. all applicable motor vehicle fuel and diesel fuel tax returns, reports, and schedules (filings) can be filed online. a filing must be made even if no transactions occurred during the reporting period. filings are due on the last day of the month following the reporting period. Cdtfa.ca.gov the california department of tax and fee administration (cdtfa) administers california's sales and use, fuel, tobacco, and other tax. Federal tax obligations. employment taxes. also known as payroll taxes, government entities must withhold federal income tax from employees' wages. social security & medicare. government entities may be required to withhold social security and medicare taxes from employees' wages and pay a matching amount. section 218 agreements. File and pay tax. local government users report acquisitions, inventory sales, and usage using a local government user of diesel fuel tax return (form dr 309634 ). instructions (form dr 309634n ) are available. form dr 309634 is also used to report fuel used on the highway and to pay tax for the use of dyed diesel on the highway. you can file a.

Comments are closed.