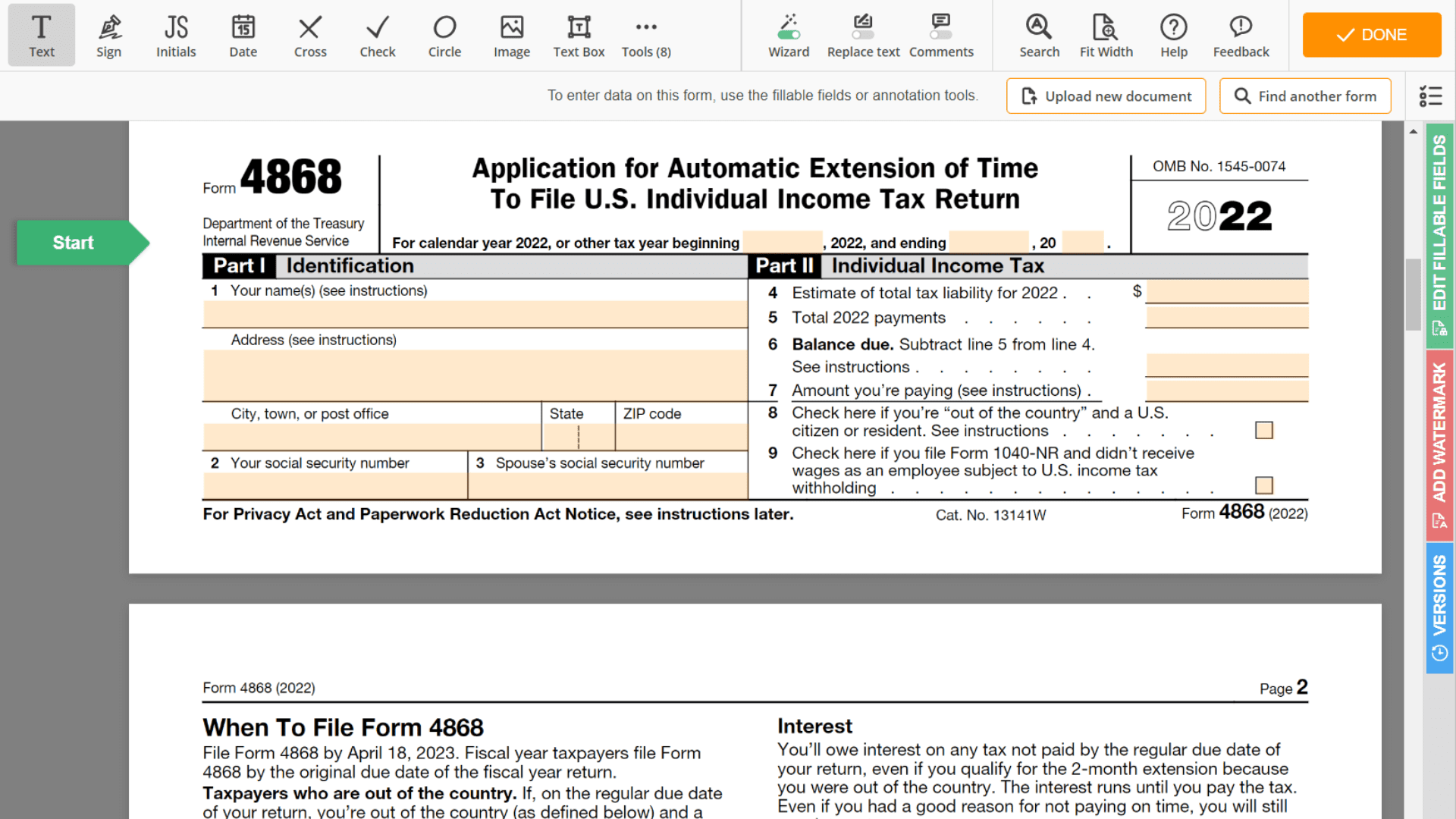

How To File A Tax Extension For Free Form 4868 Applicable For 2022 Due By April 18th 2023

How To File A Free Tax Extension Form 4868 Complete Instructions The following companies partner with the irs free file program, so that you can e file your tax filing extension for free. please be aware that filing an extension gives you time to e file your federal tax return. if you have a balance due, the deadline to pay is still april 15, 2024. however, if you want to file your taxes now with free, easy. When you file your 2022 return, include the amount of any payment you made with form 4868 on the appropriate line of your tax return. the instructions for the following line of your tax return will tell you how to report the payment. form 1040, 1040 sr, or 1040 nr, schedule 3, line 10. form 1040 pr, line 12.

Irs 4868 Form Printable рџ ќ Get Tax Extension Form 4868 For Form 4868 is used by individuals to apply for six (6) more months to file form 1040, 1040nr, or 1040nr ez. a u.s. citizen or resident files this form to request an automatic extension of time to file a u.s. individual income tax return. The deadline to file an extension for 2023 tax returns has passed. the cut off date to submit form 4868 was tax day, april 15. if you didn't file for an extension in time, returns filed after the. You can file an extension for your taxes this tax year by submitting irs form 4868 with the internal revenue service (irs) online or by mail. this must be done before the last day for filing taxes. filing an extension for your taxes gives you additional months to prepare your tax return no matter the reason you need the extra time. Irs form 4868: how to file for a tax extension. if you're planning to miss the tax filing deadline, it's in your best interest to file an extension. here's what you need to know to fill out form 4868.

Form 4868 Irs How To File For A Tax Extension Smartasset You can file an extension for your taxes this tax year by submitting irs form 4868 with the internal revenue service (irs) online or by mail. this must be done before the last day for filing taxes. filing an extension for your taxes gives you additional months to prepare your tax return no matter the reason you need the extra time. Irs form 4868: how to file for a tax extension. if you're planning to miss the tax filing deadline, it's in your best interest to file an extension. here's what you need to know to fill out form 4868. Select file an extension in the left menu. if you don't see file an extension, open a section of your return, search for extend and select jump to extend. you can also select tax tools then tools from the left menu and choose file an extension. you can't file an extension after april 15, 2024. follow the instructions to e file your extension. Form 4868 is available to any u.s. taxpayer needing extra time to file their federal tax return. by completing and sending it to the irs, they will receive a six month tax return due date.

Comments are closed.