How To File A Tax Extension Form 4868 2022 Youtube

Learn How To Fill The Form 4868 Application For Extension Of Time To In this video i show you how to prepare and file form 4868, application for automatic extension of time to file u.s. individual income tax return with the ir. Tax season is halfway over. if you haven't filed your 1040 yet it may be time for you to consider filing a tax extension. in this video, i walk you through w.

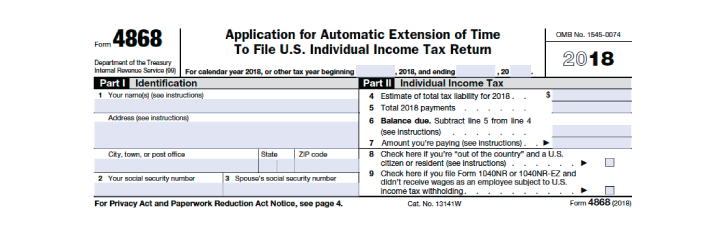

How To File A Free Tax Extension Form 4868 Complete Instructions How to file a tax extension for free this video covers the irs tax extension and the most important aspects of filing an irs extension. this is a free guid. The fastest and easiest way to get an extension is through irs free file on irs.gov. taxpayers can electronically request an extension on form 4868 pdf. filing this form gives taxpayers until october 17 to file their tax return. to get the extension, taxpayers must estimate their tax liability on this form and should timely pay any amount due. Request an extension by mail. file form 4868, application for automatic extension of time to file u.s. individual income tax return. you can file by mail, online with an irs e filing partner or through a tax professional. estimate how much tax you owe for the year on the extension form: subtract the taxes you already paid for the filing year. Form 4868 is used by individuals to apply for six (6) more months to file form 1040, 1040nr, or 1040nr ez. a u.s. citizen or resident files this form to request an automatic extension of time to file a u.s. individual income tax return.

Form 4868 Irs How To File For A Tax Extension Smartasset Request an extension by mail. file form 4868, application for automatic extension of time to file u.s. individual income tax return. you can file by mail, online with an irs e filing partner or through a tax professional. estimate how much tax you owe for the year on the extension form: subtract the taxes you already paid for the filing year. Form 4868 is used by individuals to apply for six (6) more months to file form 1040, 1040nr, or 1040nr ez. a u.s. citizen or resident files this form to request an automatic extension of time to file a u.s. individual income tax return. You can file an extension for your taxes this tax year by submitting irs form 4868 with the internal revenue service (irs) online or by mail. this must be done before the last day for filing taxes. filing an extension for your taxes gives you additional months to prepare your tax return no matter the reason you need the extra time. Filing irs form 4868 gives you an automatic six month extension to file your tax return. you can request an extension for free, but you still need to pay taxes owed by tax day. updated apr 16.

File Personal Tax Extension 2021 Irs Form 4868 Online You can file an extension for your taxes this tax year by submitting irs form 4868 with the internal revenue service (irs) online or by mail. this must be done before the last day for filing taxes. filing an extension for your taxes gives you additional months to prepare your tax return no matter the reason you need the extra time. Filing irs form 4868 gives you an automatic six month extension to file your tax return. you can request an extension for free, but you still need to pay taxes owed by tax day. updated apr 16.

Comments are closed.