How To File Audited Financial Statement Afs In The Philippines

How To File Audited Financial Statement Afs In The Philippines Filing afs with the bir. filing your audited financial statement with the bir may be done manually or online. manual filing involves visiting your local regional district office (rdo) of the bir and filing hard copies of the afs at the bir office. for online filing, you can do it via electronic audited financial statements (eafs) system. The sec electronic filing and submission tool (efast) is an online facility to be used for submitting the audited financial statement (afs), general information sheet (gis), sworn statement for foundations (ssf), general form for financial statements (gffs), special form for financial statement (sffs) and other reportorial requirements.

Audited Financial Statements For Sole Proprietorship Philippines March 22, 2019. sec clarifies manner of preparation and filing of afs under the revised corporation code. the securities and exchange commission (sec) has issued a notice clarifying the manner of preparation and submission of audited financial statements (afs) in accordance with the revised corporation code of the philippines. the reportorial. Corporations whose afs are being audited by the commission on audit (coa); provided, that the following documents are attached to their afs: a. an affidavit signed by the president and treasurer (or chief finance officer, where applicable), attesting to the fact that the company has timely provided coa with the financial statements and supporting documents and that the audit of coa has just. 1. go to bir’s website bir.gov.ph and click eafs. 2. register for an account. input details such as taxpayer’s information, authorized tax agent representative, login information, and click submit to proceed. 3. after clicking on submit, you will receive an email from bir asking you to activate your bir afs esubmission account. Filing the audited financial statement in the philippines . as mentioned above, there are a number of key finance related documents that must be submitted during audit season. one of these is the annual income tax return or aitr. another one of these key documents is the audited financial statement, commonly known as – the afs!.

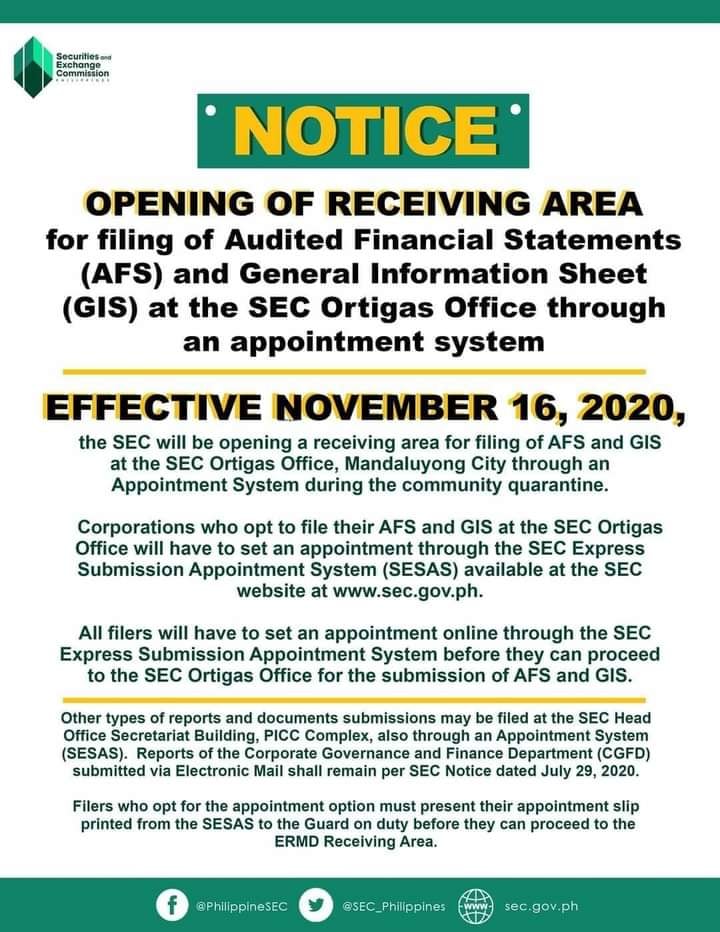

Opening Of Receiving Area For Filing Of Audited Financial Statements 1. go to bir’s website bir.gov.ph and click eafs. 2. register for an account. input details such as taxpayer’s information, authorized tax agent representative, login information, and click submit to proceed. 3. after clicking on submit, you will receive an email from bir asking you to activate your bir afs esubmission account. Filing the audited financial statement in the philippines . as mentioned above, there are a number of key finance related documents that must be submitted during audit season. one of these is the annual income tax return or aitr. another one of these key documents is the audited financial statement, commonly known as – the afs!. Section 9. other requirements for audited financial statements. 1. the annual financial statements, other than the consolidated financial statements, shall be stamped “received” by the bureau of internal revenue (bir) or its authorized banks, unless the bir allows an alternative proof of submission for its authorized banks (e.g. The securities and exchange commission (sec), in its memorandum circular (mc) no. 02, series of 2024 has set the deadlines for the filing and submission of the 2023 audited financial statements (afs) and general information sheet of corporations through the electronic filing and submission tool (efast).

Filing Annual Financial Statements General Information Sheet Section 9. other requirements for audited financial statements. 1. the annual financial statements, other than the consolidated financial statements, shall be stamped “received” by the bureau of internal revenue (bir) or its authorized banks, unless the bir allows an alternative proof of submission for its authorized banks (e.g. The securities and exchange commission (sec), in its memorandum circular (mc) no. 02, series of 2024 has set the deadlines for the filing and submission of the 2023 audited financial statements (afs) and general information sheet of corporations through the electronic filing and submission tool (efast).

Learn More About The Audited Financial Statement Afs

Comments are closed.