How To Fill Out Form 1040x Amended Tax Return Youtube

How To Fill Out Form 1040x Amended Tax Return Youtube Irs form 1040x amended tax return instructions: irs.gov taxtopics tc308 if you're asking how to amend a tax return, you're in the right spot!ther. Have you ever filed your tax return and then realized that you made a mistake?maybe you left out a credit or deduction? maybe even worse, you left off income.

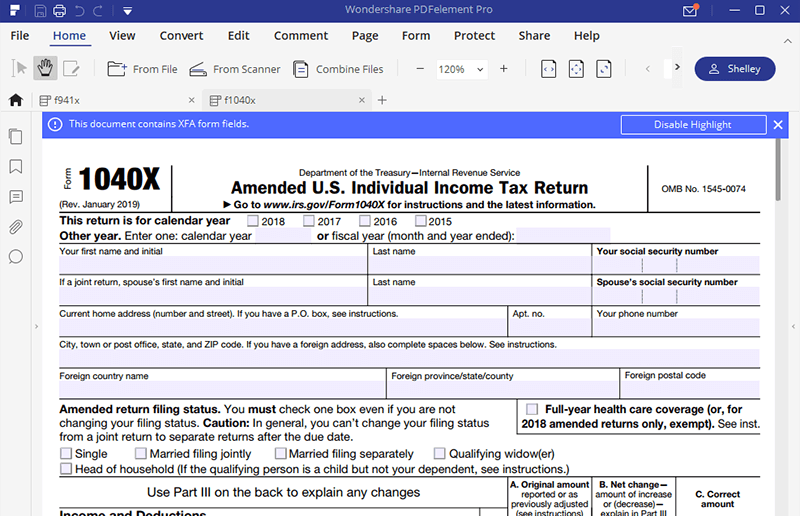

Learn How To Fill The Form 1040x Amended U S Individual Income Tax You can follow the link below to get the current version of this self calculating form. but before you download it please click like and or subscribe. the so. The above instructions apply to paper filing only. if you are electronically filing form 1040 x to amend form 1040 nr, you must complete the form 1040 x in its entirety. if you file form 1040 x claiming a refund or credit for more than the correct amount, you may be subject to a penalty of 20% of the disallowed amount. Paper filing is still an option for form 1040 x. file form 1040 x to: correct form 1040, 1040 sr, or 1040 nr (or older filings of form 1040 a or 1040 ez). make certain elections after the deadline. change amounts previously adjusted by the irs. make a claim for a carryback due to a loss or unused credit. 2. gather the necessary documents. you’ll need the information from your original tax return for the given tax year, any new documentation or forms, and the reason for the amendment. 3. complete form 1040 x: add your personal information, details of what’s changed, and your explanation for the changes.

How To Fill Out Amended Tax Return Form 1040x Form о Paper filing is still an option for form 1040 x. file form 1040 x to: correct form 1040, 1040 sr, or 1040 nr (or older filings of form 1040 a or 1040 ez). make certain elections after the deadline. change amounts previously adjusted by the irs. make a claim for a carryback due to a loss or unused credit. 2. gather the necessary documents. you’ll need the information from your original tax return for the given tax year, any new documentation or forms, and the reason for the amendment. 3. complete form 1040 x: add your personal information, details of what’s changed, and your explanation for the changes. Irs form 1040 x, also known as an amended tax return, is a form that taxpayers can file with the irs to correct mistakes made on a federal tax return. the form is typically used to fix errors. To fill out the 1040 x, you'll need a blank copy of the tax return you completed and the instructions for filling out that form. 4. complete the blank return with the amended information. on the blank return that matches the year of the original return, copy the correct information from your original return.

Irs Form 1040x Fill It To Amend Your Income Tax Return Irs form 1040 x, also known as an amended tax return, is a form that taxpayers can file with the irs to correct mistakes made on a federal tax return. the form is typically used to fix errors. To fill out the 1040 x, you'll need a blank copy of the tax return you completed and the instructions for filling out that form. 4. complete the blank return with the amended information. on the blank return that matches the year of the original return, copy the correct information from your original return.

Comments are closed.