How To Fill Out Irs Form W9

All About W 9 Form What It Is What It Is Used For And How To Fill It Out Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs. See pub. 515, withholding of tax on nonresident aliens and foreign entities. the following persons must provide form w 9 to the payor for purposes of establishing its non foreign status. in the case of a disregarded entity with a u.s. owner, the u.s. owner of the disregarded entity and not the disregarded entity.

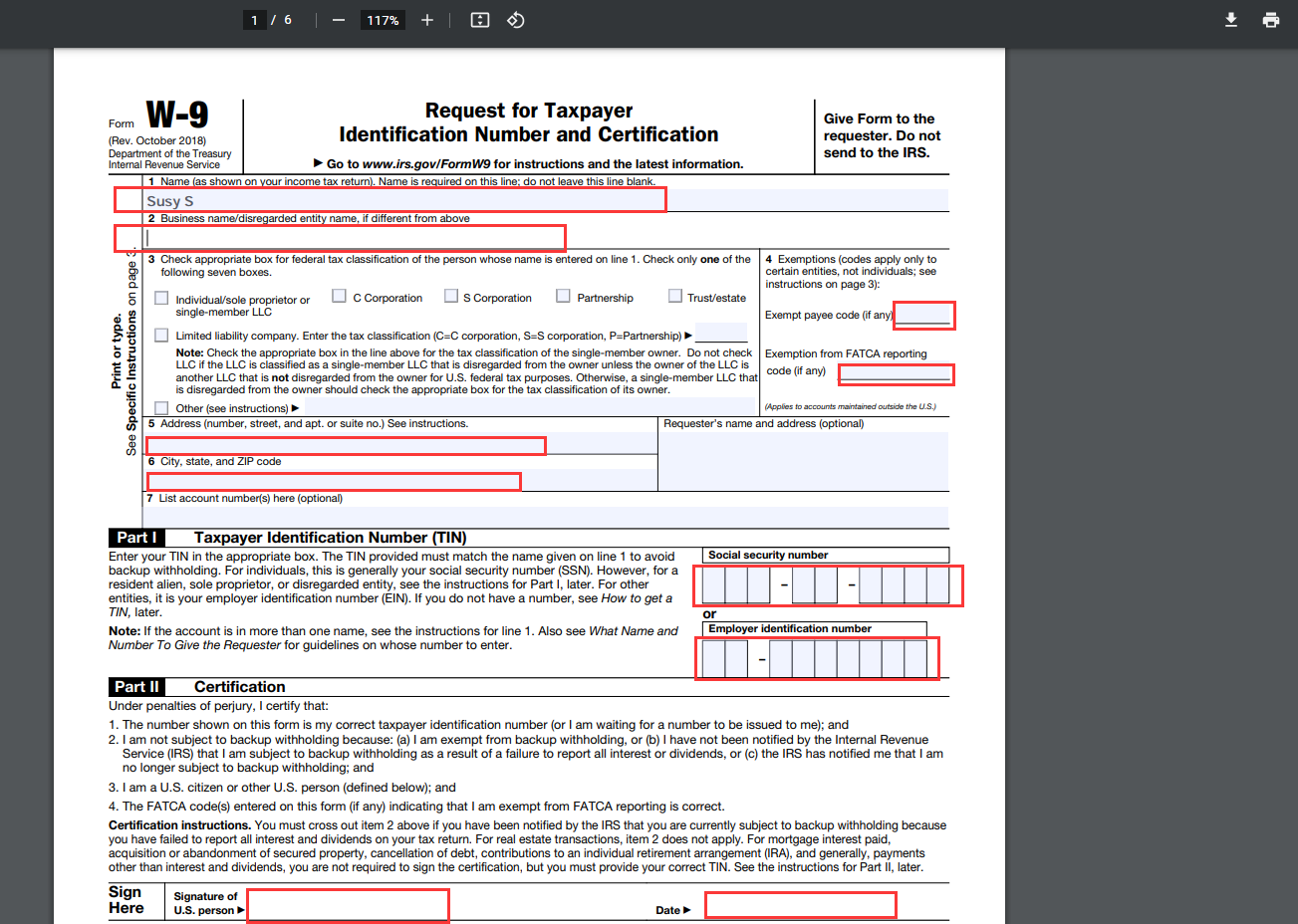

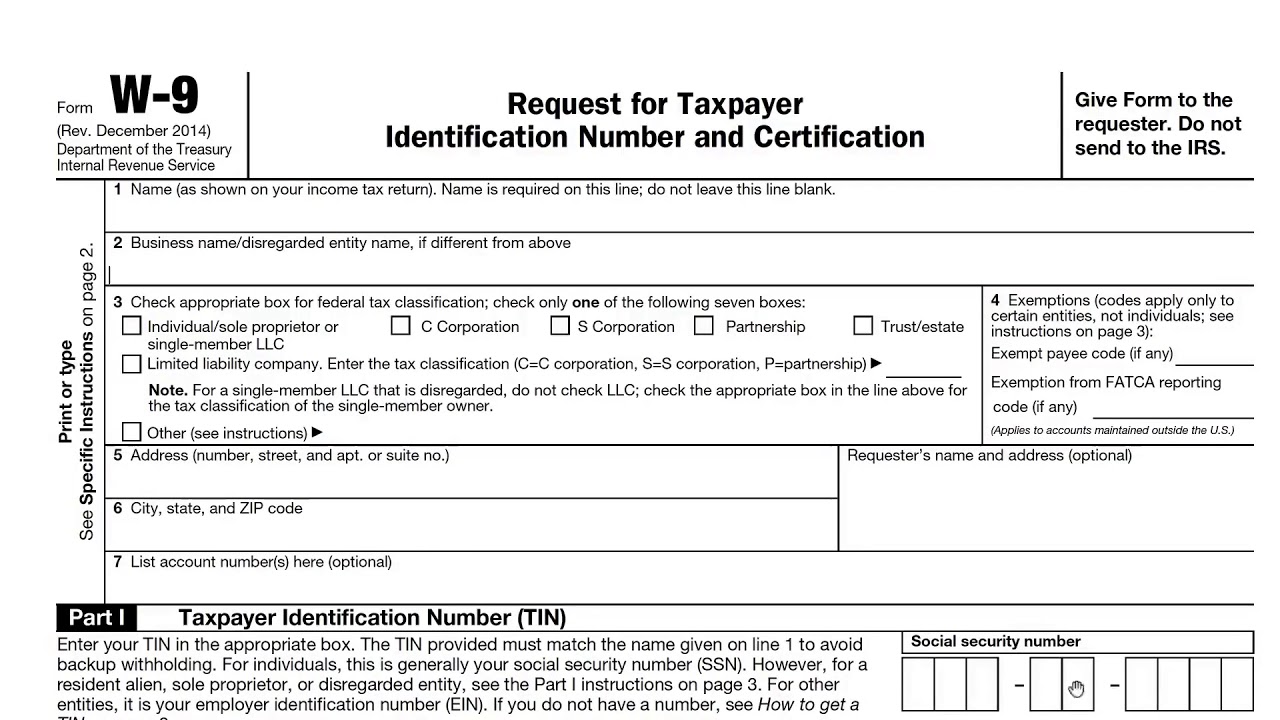

Irs W9 Form Step By Step Tutorial How To Fill Out W9 Tax Youtube The first section of form w 9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you. line 1: enter your name as it appears on your income tax return. line 2: enter your business name or disregarded entity name if it is different from the name that you. Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services. Section one of the w 9 is where you will need to fill in your name, and address. for box 1, type or write your full name. for box 2, type or write your business's name (if you have one). if not, leave it blank. for box 3, check the box that describes you or the legal status of your business. Independent contractors fill out the w 9 to confirm their tax responsibilities and provide information to their employer (s). in turn, employers use a contractor’s w 9 to complete a 1099 detailing the worker’s income. there are 18 different 1099 forms, each one relating to the nature of the income.

Comments are closed.