How To Form An Llc In California 8 Steps Guide For Llc In Ca

How To Form An Llc In California 8 Steps Guide For Llc In Ca The llc filing fee in california is $70. if you want a certified copy of your registration, that’s an extra $5. foreign llcs (llcs formed in another state that wish to do business in california. Step 1: choose a name for your california llc. the first step to form a california llc is to choose a business name. under california law, llcs cannot choose a name that’s so similar to another.

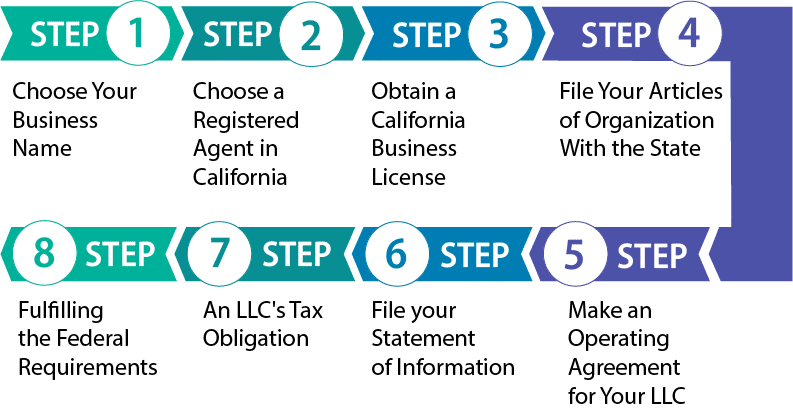

How To Form An Llc In California 8 Steps Guide For Llc In Ca There are several key steps to launching a business in the state of california. these steps will vary according to the type of business you intend to start and the county and city in which the business will be located. therefore, be sure to check specific rules and regulations within the county and city in which you want to conduct business. Step 2: choose a registered agent in california. after you find the right name for your llc, you will need to nominate a registered agent, known in california as an agent for service of process. this is a necessary step in your articles of organization (i.e., the document used to file and register your llc with the secretary of state). Step 5: make an operating agreement for your ca llc. california requires llcs to draw up an operating agreement and have its members agree to it. this can be done right before or after the articles of organization are filed. the state does allow a verbal agreement, but a written agreement works better. If your llc will make more than $250,000, you will have to pay a fee. llcs must estimate and pay the fee by the 15th day of the 6th month, of the current tax year. california income rounded. if the total california income rounded to the nearest whole dollar is: the fee amount is: $250,000 $499,999.

How To Form An Llc In California Step 5: make an operating agreement for your ca llc. california requires llcs to draw up an operating agreement and have its members agree to it. this can be done right before or after the articles of organization are filed. the state does allow a verbal agreement, but a written agreement works better. If your llc will make more than $250,000, you will have to pay a fee. llcs must estimate and pay the fee by the 15th day of the 6th month, of the current tax year. california income rounded. if the total california income rounded to the nearest whole dollar is: the fee amount is: $250,000 $499,999. All llcs doing business in california must pay an annual minimum franchise tax of $800 (figure as of 2023). you submit the annual tax to the ftb using form 3522 (llc tax voucher). additional taxes. llcs with net income over $250,000 must pay an additional fee based on their total annual income (2023). In order to form an llc in california, you’ll need to complete the following steps: name your california llc. pick a california registered agent. submit the articles of organization. create a california llc operating agreement. get an ein. file your boi report.

How To Form An Llc In California In 8 Simple Steps Youtube All llcs doing business in california must pay an annual minimum franchise tax of $800 (figure as of 2023). you submit the annual tax to the ftb using form 3522 (llc tax voucher). additional taxes. llcs with net income over $250,000 must pay an additional fee based on their total annual income (2023). In order to form an llc in california, you’ll need to complete the following steps: name your california llc. pick a california registered agent. submit the articles of organization. create a california llc operating agreement. get an ein. file your boi report.

Comments are closed.