How To Get Low Interest Rate Loan Finservpost

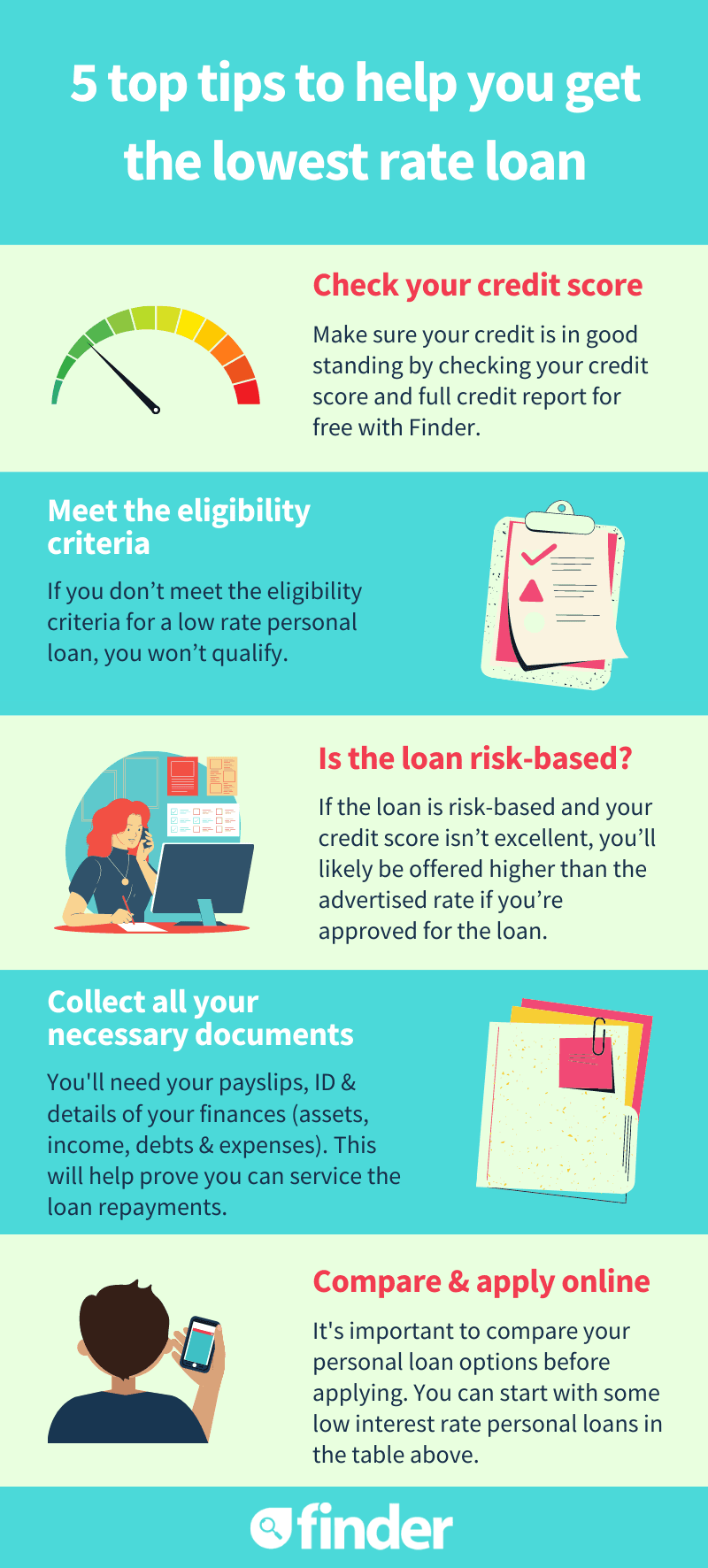

How To Get Low Interest Rate Loan Finservpost Securing a low interest rate loan in india can be a transformative step towards achieving financial stability and realizing your aspirations. by understanding the eligibility criteria, enhancing your creditworthiness, choosing the right lender, and maximizing the benefits of the loan, you can navigate the financial landscape with confidence and empower your financial journey. 1. know your credit score. an excellent credit score gives you the best chance of receiving a low interest rate on a personal loan. before applying, check your credit report to ensure your score.

Low Interest Rate Personal Loans List Of Low Rate Loans Of The average personal loan interest rate was hovering around 11% in q2 2023. while securing any interest rate below this average can be considered a low rate for a personal loan, some lenders. Link copied! personal loan interest rates range from 7% to 36%, but the average rate for a 24 month loan was 12.49% in the first quarter of 2024, according to the federal reserve. to qualify for a. The average interest rate on a two year personal loan is 11.23%, according to the federal reserve.but depending on your credit history, income and other factors, you may be able to qualify for a. Interest rates for personal loans most often fall in the 6% – 36% range. according to the federal reserve, the national average rate for a 2 year personal loan was 9.41% at the beginning of 2022. if you can get an interest rate below the national average, that’s considered a low, or good, rate. however, the interest rate that you land on.

How To Get A Personal Loan With A Low Interest Rate The average interest rate on a two year personal loan is 11.23%, according to the federal reserve.but depending on your credit history, income and other factors, you may be able to qualify for a. Interest rates for personal loans most often fall in the 6% – 36% range. according to the federal reserve, the national average rate for a 2 year personal loan was 9.41% at the beginning of 2022. if you can get an interest rate below the national average, that’s considered a low, or good, rate. however, the interest rate that you land on. Best for high loan amounts: lightstream personal loan. best for money back guarantee: discover personal loans. best for low minimum apr: american express personal loan. best for low credit scores. If you qualify, wells fargo offers a “relationship discount” of 0.25% off your interest rate. wells fargo doesn’t charge origination fees or prepayment penalties. loans from $3,000 to $100,000. repayment terms range from one to seven years. note: the majority of applicants don’t qualify for the lowest rate.

Quick Tips On How To Get Low Interest Rates On Your Loans Quick Loa Best for high loan amounts: lightstream personal loan. best for money back guarantee: discover personal loans. best for low minimum apr: american express personal loan. best for low credit scores. If you qualify, wells fargo offers a “relationship discount” of 0.25% off your interest rate. wells fargo doesn’t charge origination fees or prepayment penalties. loans from $3,000 to $100,000. repayment terms range from one to seven years. note: the majority of applicants don’t qualify for the lowest rate.

Tips On How To Get The Best Low Interest Loans Talk Business

Comments are closed.