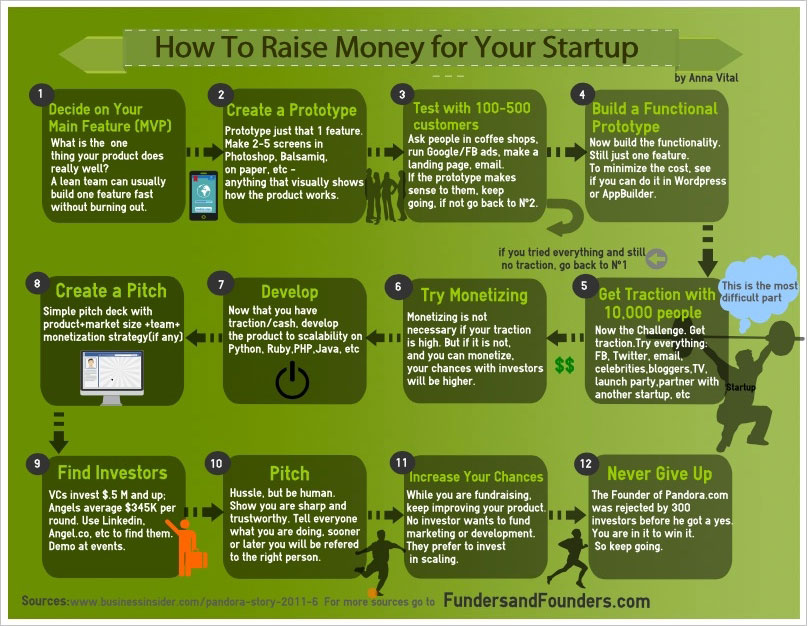

How To Raise Money For Your Startup Infographic

How To Raise Money For Your Startup Infographic Bit Rebels This template is a great tool for educators, ngos, business consultants and other individuals willing to share tips on securing funding for startups. it can be resized to fit a social media post, a presentation and a poster on the wall. help startups get funding with this information packed infographic template, or check out our library of 500. Pie in the sky. today’s creative infographic from fundera uses pie to visualize each stage of startup funding, from pre seed funding to initial public offering. it’s worth noting that numbers presented here are hypothetical in nature, and that startups can have all kinds of paths to success (or failure).

How To Raise Money For Your Startup Infographic 5. credit cards. a small business credit card is a type of financing that can be used for nearly any business need. it comes with a variety of interest rates and terms so comparison shopping is a must. like with most credit cards, the payment period typically spans 30 days. however, it can vary. Clearly state your objective in the first 30 seconds of your pitch. you’ll want to tell your potential investors why they should give your startup money and how their funds can benefit the company. follow the inverted pyramid format for your sales pitch. Despite the wide array of funding sources, there are three general categories: bootstrapping, debt, and equity. in recent years, crowdfunding on platforms such as fundable have become a powerful source of funding for both bootstrapping and equity techniques. big checks from investors may grab headlines and be an ideal solution for your funding. 8. don’t run your business like raising money is your mo 9. practice your pitches with “junk” investors 10. draft a pitch deck right after raising a round “ the venture capital business is 100% a game of outliers — it’s extreme competition. marc andreessen insider tips when preparing to talk to investors.

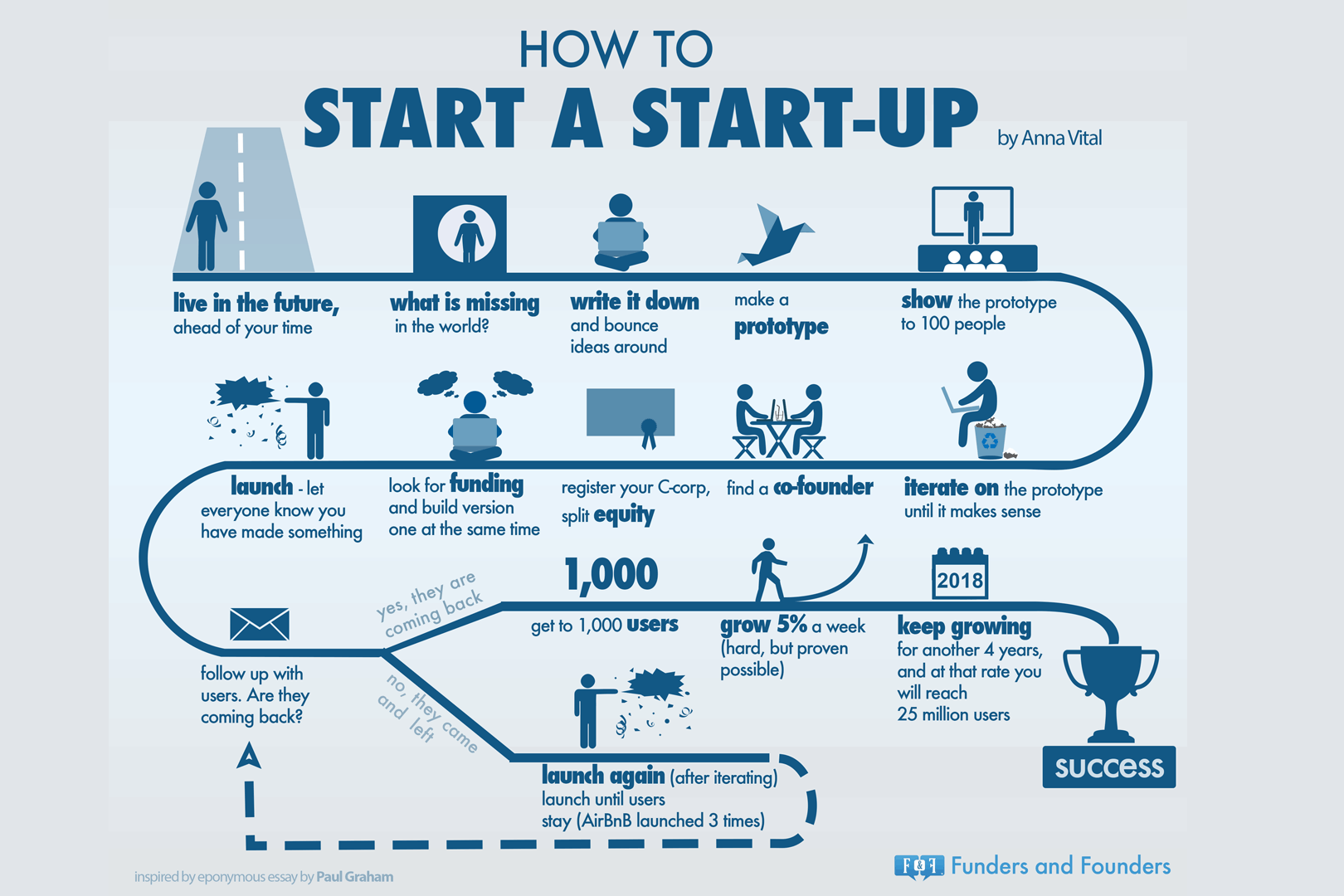

How To Start A Startup Infographic Future Startup Despite the wide array of funding sources, there are three general categories: bootstrapping, debt, and equity. in recent years, crowdfunding on platforms such as fundable have become a powerful source of funding for both bootstrapping and equity techniques. big checks from investors may grab headlines and be an ideal solution for your funding. 8. don’t run your business like raising money is your mo 9. practice your pitches with “junk” investors 10. draft a pitch deck right after raising a round “ the venture capital business is 100% a game of outliers — it’s extreme competition. marc andreessen insider tips when preparing to talk to investors. As the founder of multiple startups, i want to take a look at raising money through the lens of three phases and one reason: phase one: pre launch. each phase has its own unique needs and. Evaluate your company’s financial health. to secure funding, it’s essential to evaluate your startup’s financial health by analyzing revenue, expenses, cash flow, and profitability. understanding these metrics will help you determine the amount of funding necessary and showcase your startup’s potential for growth.

Comments are closed.