How To Read A Credit Report On Equifax 2025

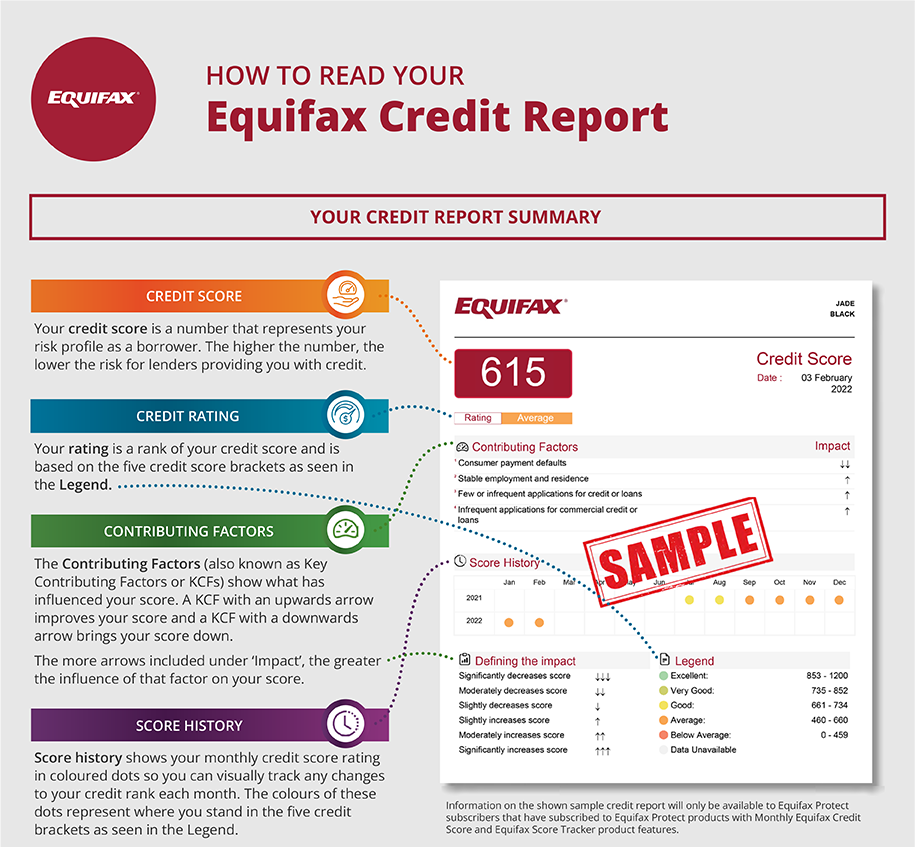

How To Read Your Equifax Credit Report Equifax Personal How to read a 24 month history. read the grid from left to right. the first field represents the previous month’s activity based on the date reported. for the example above, the “4” in the first field of the grid means the account was rated r4 in november 2005. Just like school report cards summarize a student’s performance, your credit reports do the same for your financial history. your credit reports include information about the types of credit accounts you’ve had, your payment history and other information such as your credit limits. your credit reports are important pieces of financial.

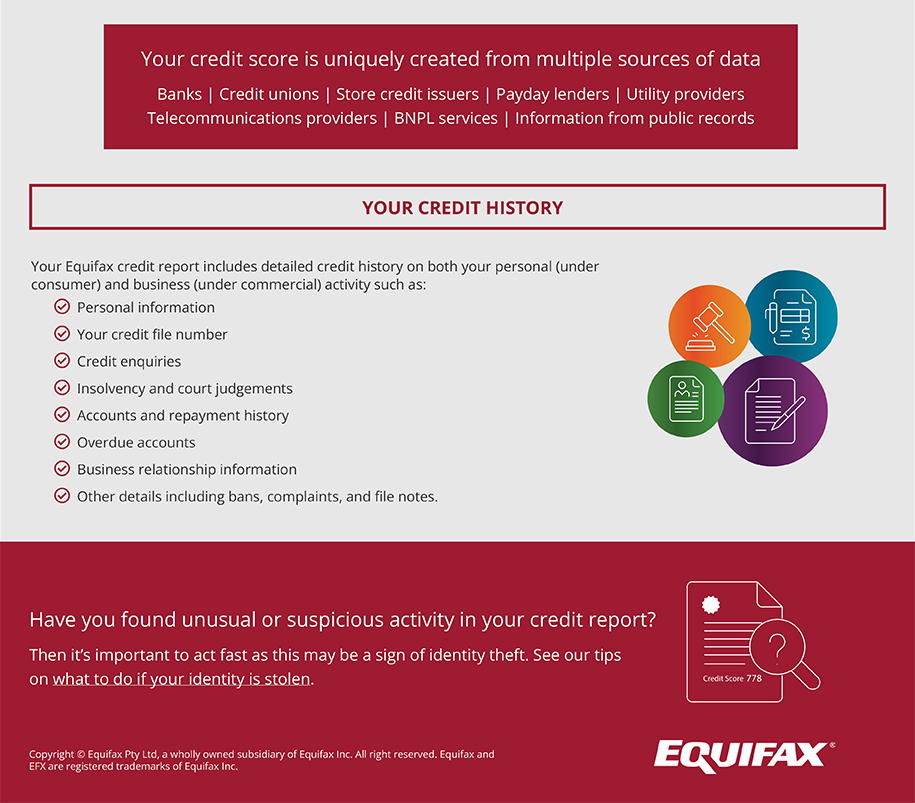

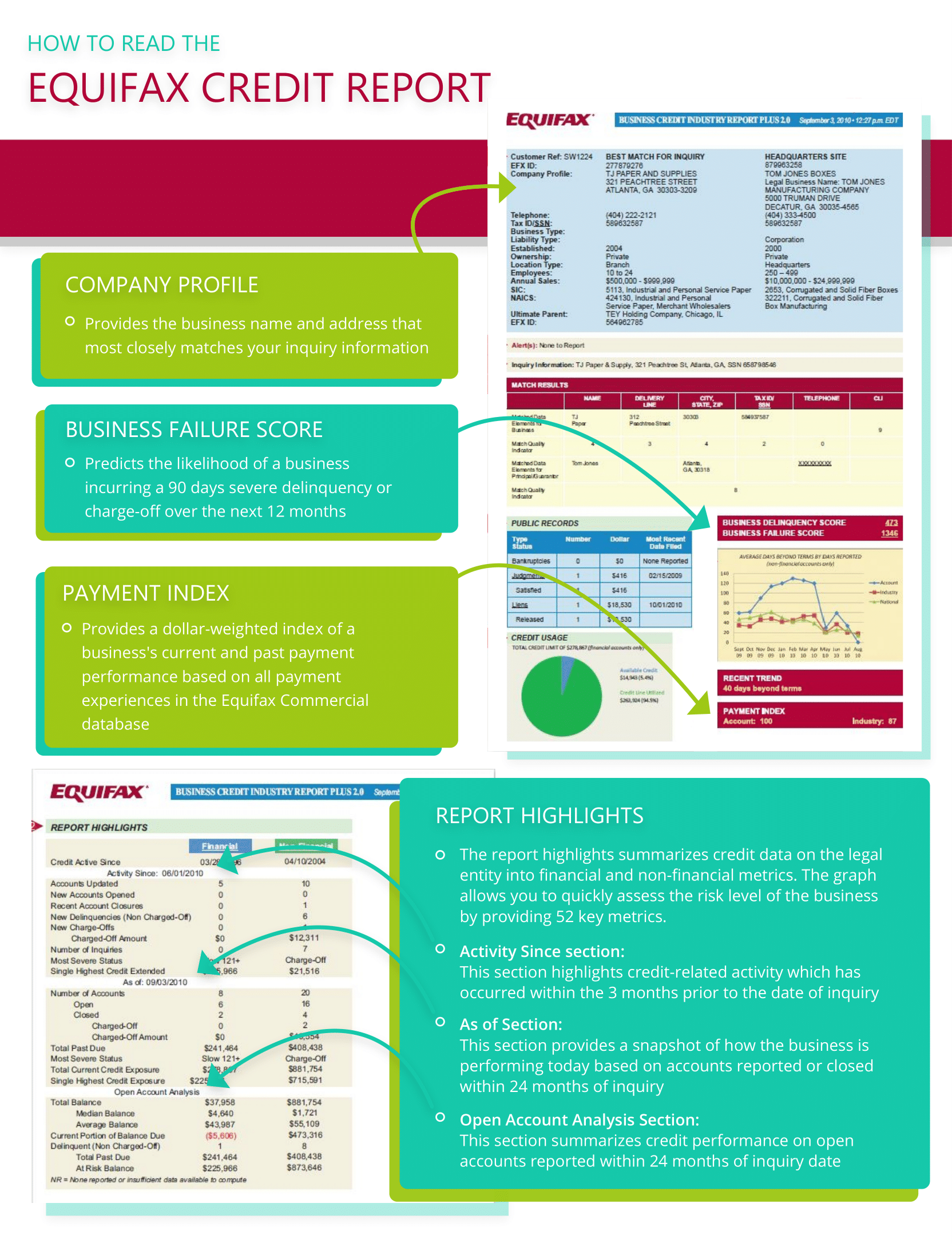

How To Read Your Equifax Credit Report Equifax Personal Was reported to equifax; type of account; customer’s member number; date account was opened with credit grantor; balance of account (approximate range); additional information on account. [38] consumer statement section: rptd, purge:date reported and date information will be deleted from the credit report declaration:. Section 1: understanding equifax credit reports. section 2: retrieving an equifax credit report. section 3: key components of an equifax credit report. section 4: interpreting the personal information section. section 5: analyzing the accounts section. section 6: examining the public records section. Credit account information as reported to equifax by your lenders and creditors. this information includes the types of accounts, the date those accounts were opened, your credit limit or loan amount, current balances on the accounts and payment history. inquiry information. The model involves the usage of different data points and algorithms to do credit score calculations and come up with credit ratings. equifax considers: your total monthly revolving balance, current credit utilization ratio (the percentage of your available credit used), average daily balance, and. length of credit history.

Equifax Credit Report Cic Commercial Credit Credit account information as reported to equifax by your lenders and creditors. this information includes the types of accounts, the date those accounts were opened, your credit limit or loan amount, current balances on the accounts and payment history. inquiry information. The model involves the usage of different data points and algorithms to do credit score calculations and come up with credit ratings. equifax considers: your total monthly revolving balance, current credit utilization ratio (the percentage of your available credit used), average daily balance, and. length of credit history. How to read an equifax credit report. an equifax credit report has five sections that detail identity, credit history and other public information: 1. personal information. this section has identifying information like your full name, address, birthday and social security number. Equifax: you can dispute online or by mail to equifax information services, llc, p.o. box 740256, atlanta, ga 30374 0256. dispute over the phone at (866) 349 5191. experian: you can dispute.

How To Read Equifax Credit Report How to read an equifax credit report. an equifax credit report has five sections that detail identity, credit history and other public information: 1. personal information. this section has identifying information like your full name, address, birthday and social security number. Equifax: you can dispute online or by mail to equifax information services, llc, p.o. box 740256, atlanta, ga 30374 0256. dispute over the phone at (866) 349 5191. experian: you can dispute.

Comments are closed.