How To Read Your Credit Card Statement Take Charge America

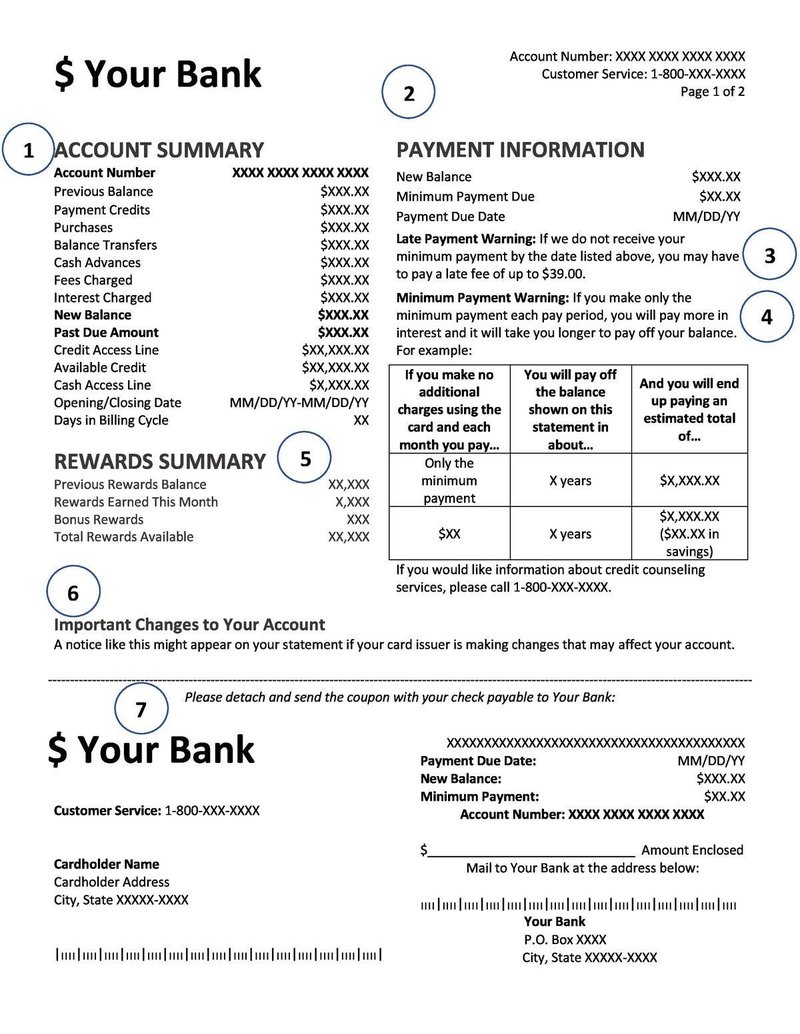

How To Read Your Credit Card Statementвђ Take Charge America Youtube Confused by your credit card statement? we break down the basics to make it understandable. learn more at takechargeamerica.org. This section will have the basics of your account and should include: your name and mailing address. make sure everything is exactly right, including spelling, so it’s correctly reported to the.

How To Read Your Credit Card Statement The Ascent 1. your previous balance. this is the amount, if any, you still owe on your card. 2. any payments or any credits to your account. this includes your monthly payment and any credits from returning. Last four digits of the card used. amount charged or credited. if you have authorized users on your account, the last four digits of the card used could help you identify where or who the purchase. 2022 totals year to date. total fees charged in 2022 total interest charged in 2022. $90.14 $18.27. the transactions section of your credit card statement will show each purchase you made during that statement period. you can see the date the purchase was made, what the merchant was and how much the charge was for. What this section tells you. how your current balance was calculated. it begins with the previous month’s balance, subtracts recent payments and credits, and adds purchases, interest charges and.

How To Read Your Credit Card Statement вђ Forbes Advisor 2022 totals year to date. total fees charged in 2022 total interest charged in 2022. $90.14 $18.27. the transactions section of your credit card statement will show each purchase you made during that statement period. you can see the date the purchase was made, what the merchant was and how much the charge was for. What this section tells you. how your current balance was calculated. it begins with the previous month’s balance, subtracts recent payments and credits, and adds purchases, interest charges and. Otherwise, you'll need to notify your credit card in writing within 60 days of the date the charge appeared on your billing statement. the credit card company will have 30 days to respond. your. It pays to understand your credit card statement, so read on to learn how to navigate it like a pro. how credit card statements work. credit card statements summarize your credit card usage in a particular billing cycle. with a credit card statement, you get a snapshot of your credit card account status at the end of your statement period.

Comments are closed.