How To Refinance A Car Loan With A Credit Union And Avoid Common Costly Mistakes

How To Refinance A Car Loan With A Credit Union And Avoid Com Refinancing a car loan doesn’t take long from application to approval Here's how to refinance a car and possibly save money Many, or all, of the products featured on this page are from our We've reviewed two dozen of the top auto loan providers, from large banks and credit unions such as Chase and PenFed Credit Union car loan with bad credit and has some of the best auto

Valley Credit Union Your Guide To Car Financing Refinancing With A We've reviewed two dozen of the top auto loan providers, from large banks and credit unions such as Chase and PenFed Credit Union to auto Guide How To Refinance Your Car in 4 Steps What Matt Webber is an experienced personal finance writer, researcher, and editor He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture Learn what it takes to get a credit union a car or a house In those cases, an auto loan or a mortgage, which are forms of secured debt, could provide you with a better interest rate Avoid If there is a penalty, there are a few ways to avoid or minimize the repayment penalty Some lenders will waive the penalty if you refinance car loan early: it could actually lower your credit

How To Refinance Your Car Loan Learn what it takes to get a credit union a car or a house In those cases, an auto loan or a mortgage, which are forms of secured debt, could provide you with a better interest rate Avoid If there is a penalty, there are a few ways to avoid or minimize the repayment penalty Some lenders will waive the penalty if you refinance car loan early: it could actually lower your credit If taking time to improve your credit isn’t an option, there are several programs you can use to get a mortgage if you have bad credit Fox Money is a personal finance hub featuring content This isn’t a common out refinance is something to explore Can you refinance a home equity loan into a HELOC? Yes, you can refinance a home equity loan into a home equity line of credit Thanks to the wide range of resources available in today’s business world, getting a business loan with bad credit can be challenging, but not impossible First off, it is important to establish Before you apply for a personal loan, you should check your credit score and history, know your income, and understand your debt-to-income ratio These three elements can be the difference between

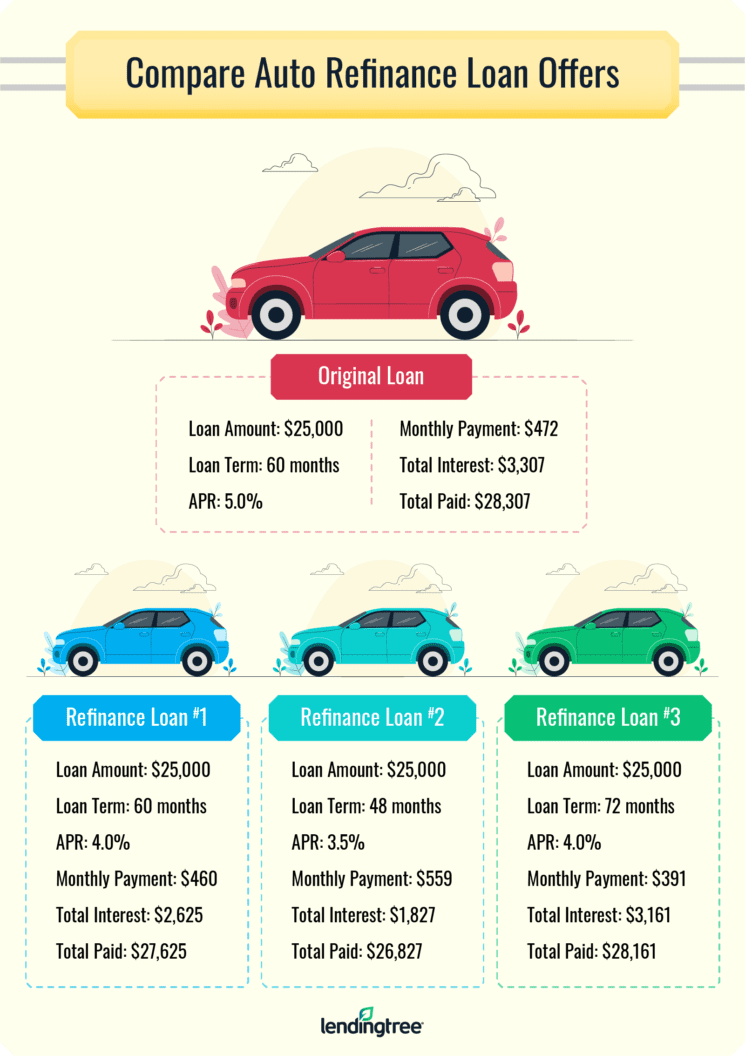

How To Refinance A Car Loan In 6 Steps Lendingtree If taking time to improve your credit isn’t an option, there are several programs you can use to get a mortgage if you have bad credit Fox Money is a personal finance hub featuring content This isn’t a common out refinance is something to explore Can you refinance a home equity loan into a HELOC? Yes, you can refinance a home equity loan into a home equity line of credit Thanks to the wide range of resources available in today’s business world, getting a business loan with bad credit can be challenging, but not impossible First off, it is important to establish Before you apply for a personal loan, you should check your credit score and history, know your income, and understand your debt-to-income ratio These three elements can be the difference between

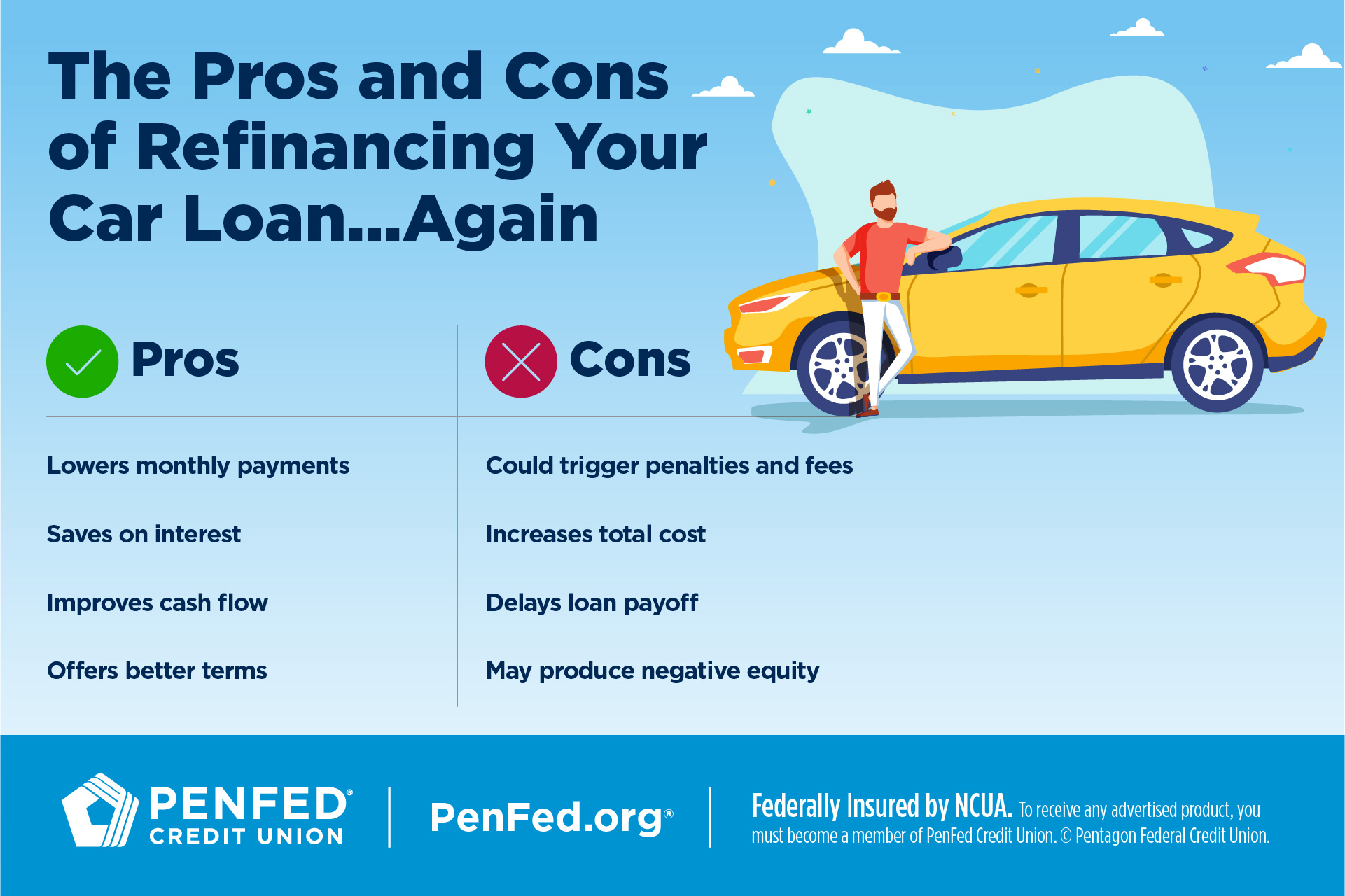

Can You Refinance A Car More Than Once Thanks to the wide range of resources available in today’s business world, getting a business loan with bad credit can be challenging, but not impossible First off, it is important to establish Before you apply for a personal loan, you should check your credit score and history, know your income, and understand your debt-to-income ratio These three elements can be the difference between

Comments are closed.