How To Shop For A Car Loan Consumer Reports

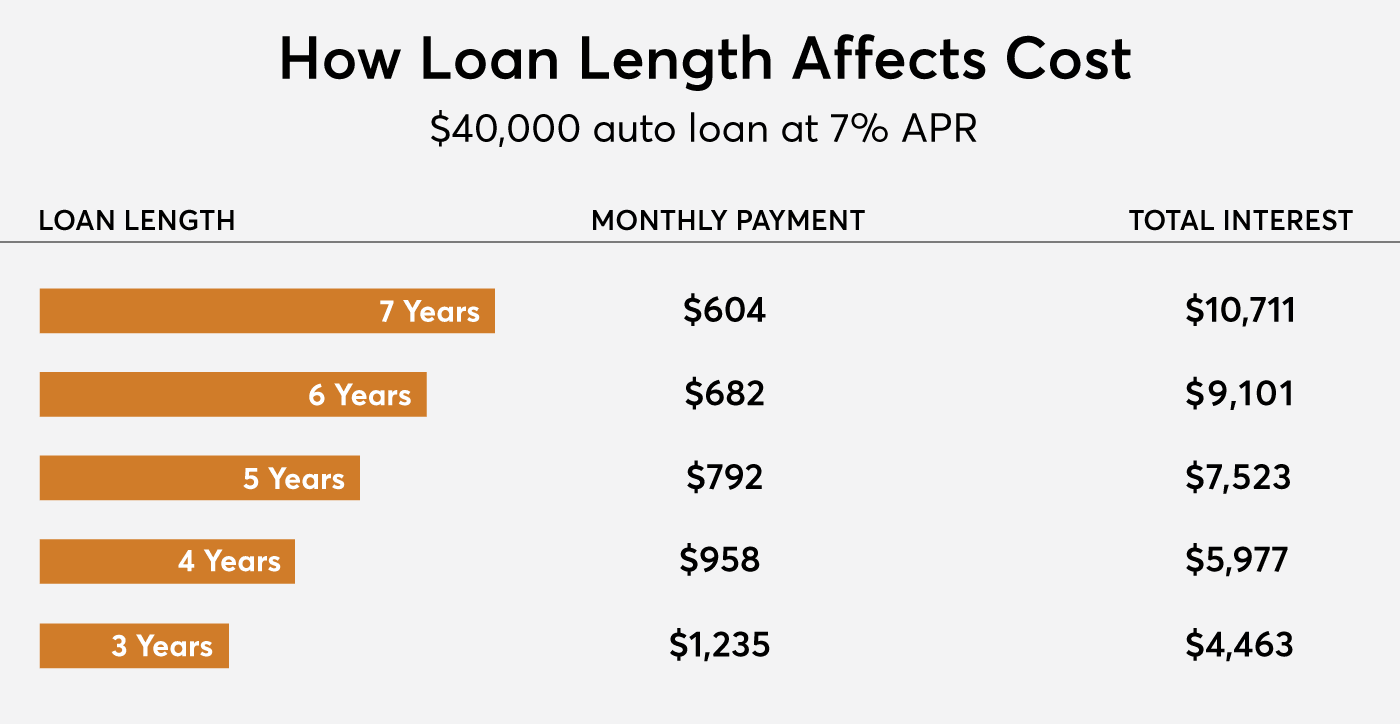

How To Shop For A Car Loan Consumer Reports Typically, a higher credit score means you’ll get a lower interest rate. the opposite is true for those with lower credit scores. that’s because a good score, which is based on a history of. For example, if you borrow $15,000 at a 6.5 percent apr for 36 months, your monthly payment will be $460 and the total interest will be $1,550. the same auto loan stretched out to 60 months would.

How To Shop For A Car Loan Consumer Reports 1. know the sources of auto financing. you can shop around for auto financing even before you shop for a vehicle. banks, credit unions, and dealerships are the most common places to find an auto loan. consider getting one or more loan quotes from a bank, credit union or other lender before going to the dealership. Steps for getting an auto loan. getting a new car or auto loan affects your overall money picture. whether you’re a first time borrower or a pro, seeing what questions to ask and steps to take can help you avoid common pitfalls, so you can drive off the lot with confidence. 1. know before you shop for a car or auto loan. Español. shopping for the best deal on an auto loan will generally have little to no impact on your credit score (s). the benefit of shopping will far outweigh any impact on your credit. in some cases, applying for multiple loans over a long period of time can impact your credit score (s). lenders can make requests, also known as inquiries, to. Shopping for the best deal on an auto loan will generally have little to no impact on your credit score (s). the benefit of shopping will far outweigh any impact on your credit. in some cases, applying for multiple loans over a long period of time can lower your credit score (s).

How To Shop For A Car Loan Consumer Reports Español. shopping for the best deal on an auto loan will generally have little to no impact on your credit score (s). the benefit of shopping will far outweigh any impact on your credit. in some cases, applying for multiple loans over a long period of time can impact your credit score (s). lenders can make requests, also known as inquiries, to. Shopping for the best deal on an auto loan will generally have little to no impact on your credit score (s). the benefit of shopping will far outweigh any impact on your credit. in some cases, applying for multiple loans over a long period of time can lower your credit score (s). Lenders know that multiple applications for a car loan within a short period of time indicate you are shopping for the best terms, not buying multiple cars. scoring systems have been designed to reflect that reality. therefore, as long as the inquiries were all made within a certain period of time, usually 14 days but sometimes longer, they are. U.s. bank is another reliable lender with some of the best car loan rates. apply for preapproval to use at participating dealerships and unlock an apr as low as 4.74 percent for up to sixty months.

Comments are closed.