How To Teach Your Kids About Money

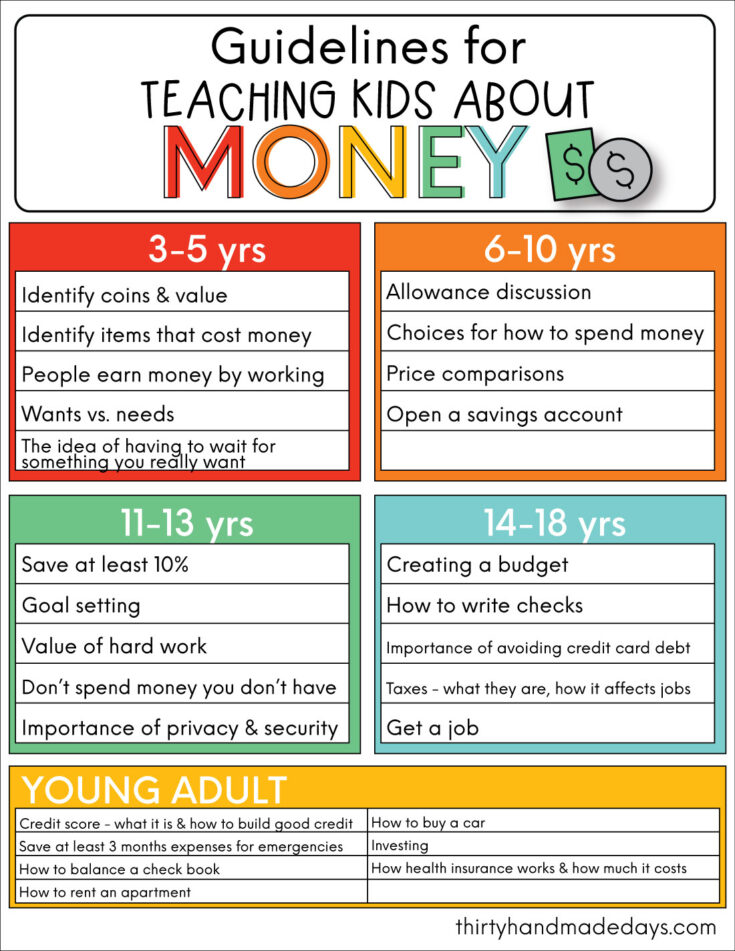

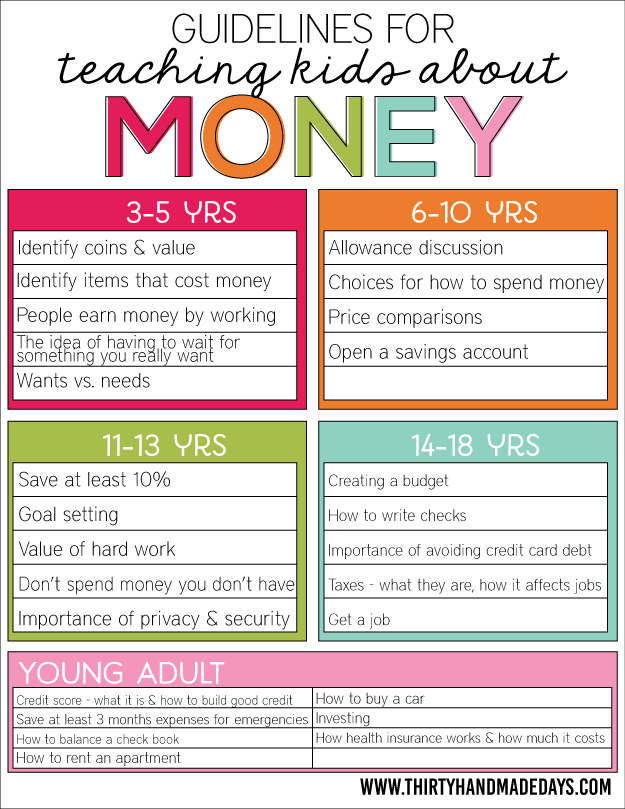

Guidelines For Teaching Kids About Money From Thirty Handmade Days Learn how to instill money habits in your kids at different ages, from preschool to teen. find tips on saving, spending, giving, earning, and avoiding debt with your children. Money can feel like a taboo topic in a lot of households, but talking about it regularly can take the awkwardness out of it.kids see and do everything that we do, and that's true when it comes to.

Guidelines For Teaching Kids About Money Teaching kids about money at ages 6 8. by this age, kids are starting to develop a deeper understanding of how money works. they understand that grown ups have jobs to make money and that much of. Teaching ages 2 and 3 about money. very young children won't fully understand the value of money, but they can start getting introduced to it. a fun way to do this is to learn the names of coins. According to the president's advisory council, by the age of 5, your child needs to know the following four things to be on track to living a “financially smart” life: you need money to buy things. you earn money by working. you may have to wait before you can buy something you want. The amount parents give their kids varies, but the survey found that it closely correlates with age: 4 year olds get an average of $4.18, 5 year olds get an average of $4.79 and 6 year olds get an average of $5.82. 6. play games to build skills. introducing family games like life and monopoly is a fun way to teach older kids about money.

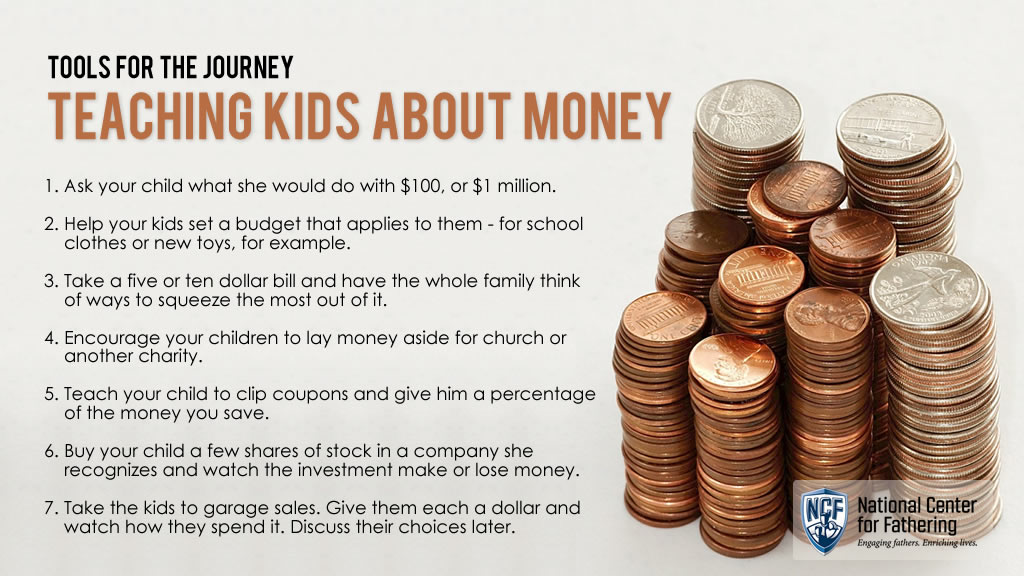

Teaching Kids About Money National Center For Fathering According to the president's advisory council, by the age of 5, your child needs to know the following four things to be on track to living a “financially smart” life: you need money to buy things. you earn money by working. you may have to wait before you can buy something you want. The amount parents give their kids varies, but the survey found that it closely correlates with age: 4 year olds get an average of $4.18, 5 year olds get an average of $4.79 and 6 year olds get an average of $5.82. 6. play games to build skills. introducing family games like life and monopoly is a fun way to teach older kids about money. Using physical cash is much more effective in teaching kids about the value of money," everett says. "for kids under 8 years of age, coins are the most effective because of the differences in size. The “wish list” moodboard. photo credit: shutterstock. another creative way to teach your child the value of money and the need to save is to have them create a “wish list.”. you can use pictures or cutouts from toy brochures to stick onto a piece of cardboard, discussing the cost of each item and how much saving is needed to achieve.

Comments are closed.