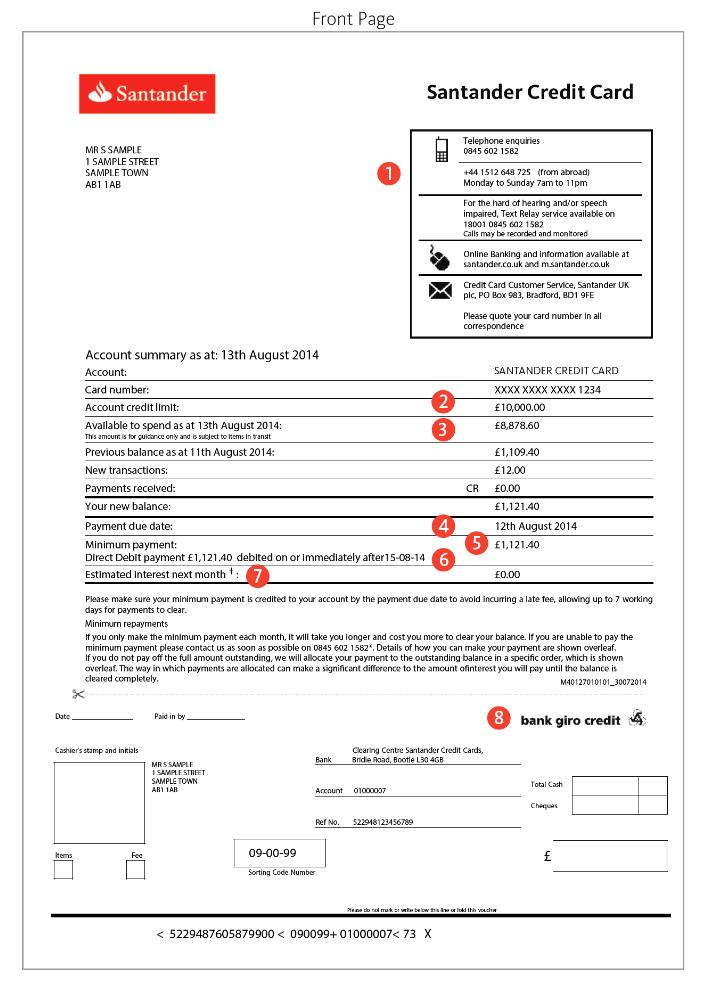

How To Use Santander Payoff To Pay Off Your Debt Quickly Free Sample

How To Use Santander Payoff To Pay Off Your Debt Quickly Free Sample Steps to help pay off debt (and still have a life) if you’d like to potentially pay off debt quickly, while still having a little fun, try following this roadmap for doing both. 1. set your target. take a look at your total debt. add your student loan and credit card balances, outstanding personal loans and car loans—all you have. Take the extra money you used to pay off the first debt and add it to the minimum payment for this one until it’s paid off. step 4: continue this process until all debts are paid. debt snowball. with the debt snowball strategy, you’ll pay off your smallest debt first then apply the payments you were using toward it to pay for the next.

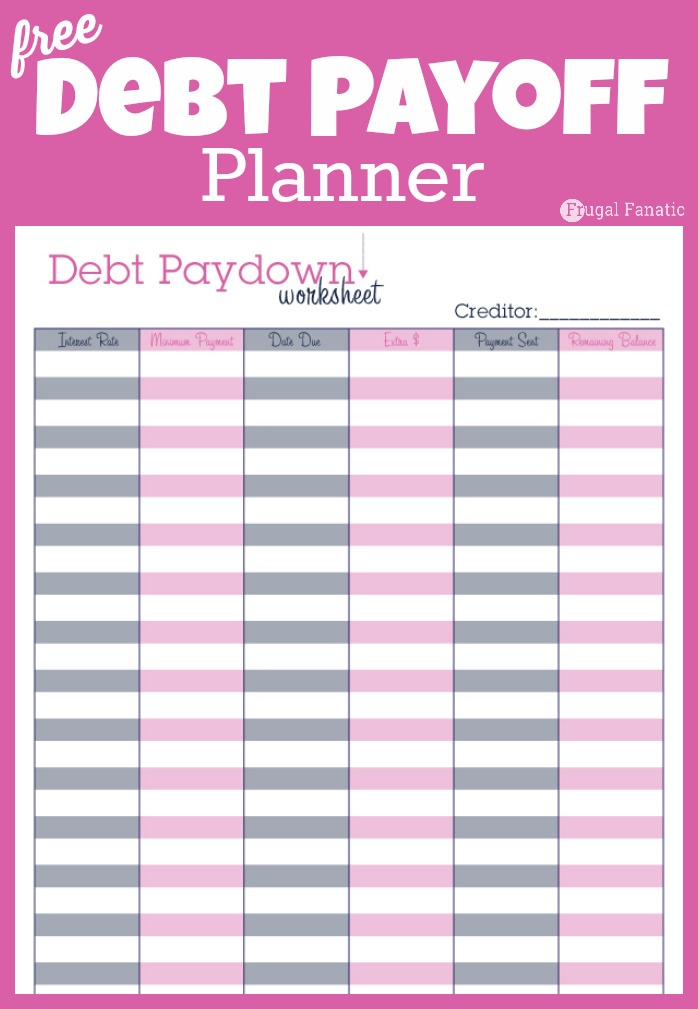

Debt Payoff Planner Free Printable In fact, these types of payments are viewed more positively by credit bureaus than any other factor. 2. debt with the highest interest rates. cards with the highest interest rates are the ones that place you at the most risk of racking up more debt, thus hurting your credit score. by paying these cards off first, you are reducing your debt risk. Step #2: create tight feedback loops and accountability. once you’ve determined your debt payoff date, you’re ready to move on to step #2. and by the way, congratulations are in order. most people have no idea how much debt they have, let alone the exact month they’re going to pay it off. 1. set up a payment plan. how to attract clients and succeed. credit card debt. get a secured credit card. 2. apply for a medical credit card. 3. consider other credit options. 5. don't blow your tax refund — use it to pay down debt. resist the urge to spend unexpected windfalls, no matter how small. research has shown that people tend to be more likely to take out.

Best Ways To Pay Off Debt вђ Cnbconnect 1. set up a payment plan. how to attract clients and succeed. credit card debt. get a secured credit card. 2. apply for a medical credit card. 3. consider other credit options. 5. don't blow your tax refund — use it to pay down debt. resist the urge to spend unexpected windfalls, no matter how small. research has shown that people tend to be more likely to take out. 5. create a $1,000 emergency fund. it’s really important to have an emergency buffer even while paying off debt. if something happens, you can use this cash instead of going back to your credit cards. plan to contribute to your emergency fund a little bit at a time, e.g., $100 a paycheck. Gamify the challenge by joining the more money challenge for extra inspiration. 4. cut cable. you don’t need cable. netflix can get you through the lonely cable free nights while you get out of debt. that money adds up fast and can help you get rid of those debt payments for good! 5. experiment with a spending freeze.

Paying Off Debt The Smart Way Wheeler Accountants 5. create a $1,000 emergency fund. it’s really important to have an emergency buffer even while paying off debt. if something happens, you can use this cash instead of going back to your credit cards. plan to contribute to your emergency fund a little bit at a time, e.g., $100 a paycheck. Gamify the challenge by joining the more money challenge for extra inspiration. 4. cut cable. you don’t need cable. netflix can get you through the lonely cable free nights while you get out of debt. that money adds up fast and can help you get rid of those debt payments for good! 5. experiment with a spending freeze.

Comments are closed.