Incentive Stock Options The Basics Taxes

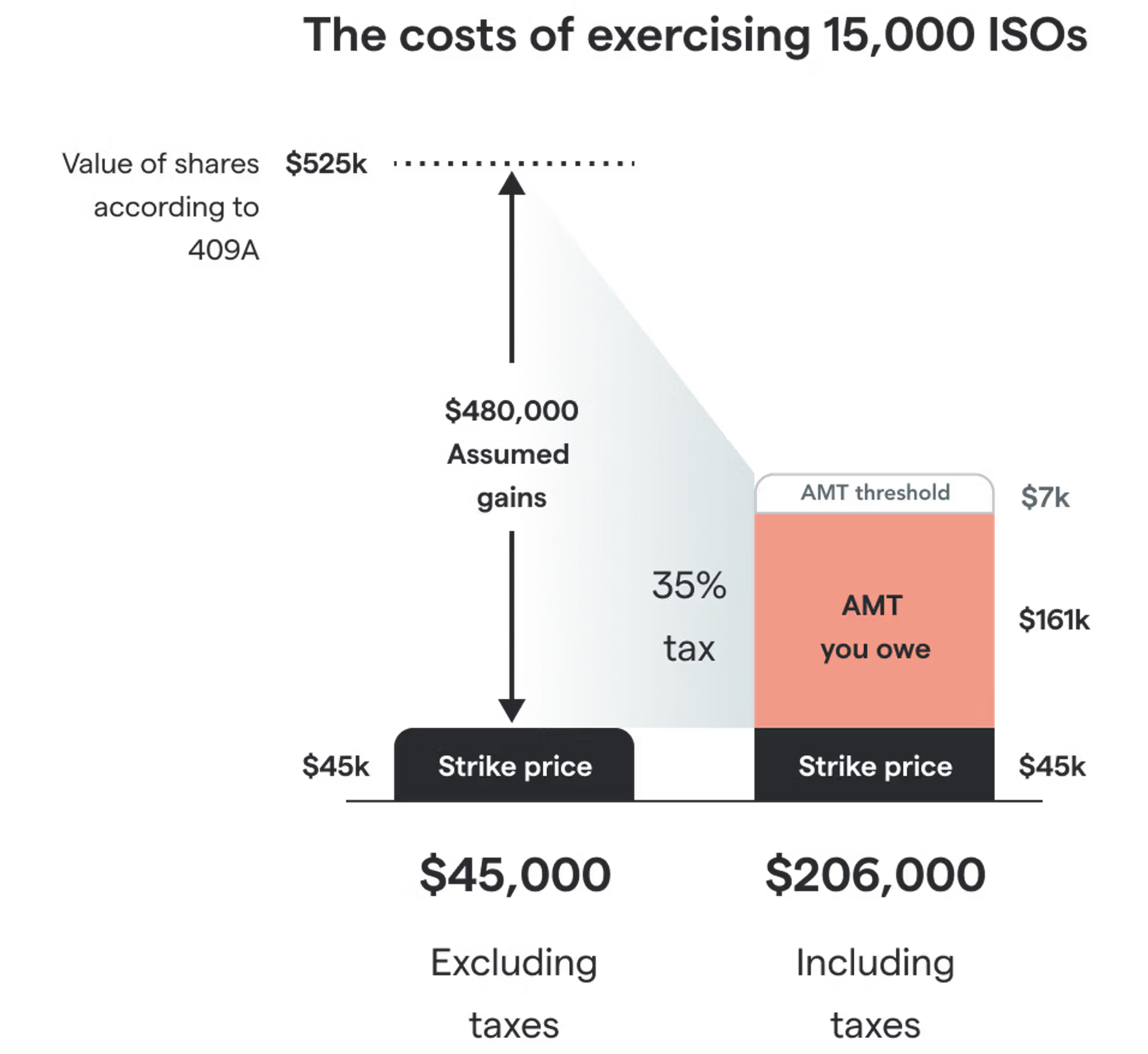

Incentive Stock Option Iso Basics вђ Equityftw You make a $147 pre tax gain on each iso you sell ($150 − $3 strike price) for each sold iso, you owe $66.15 in ordinary taxes ($147 × 45%) your net gain is $80.85 per iso. but when you exercised your isos earlier, you already paid $45,000 for the strike price and $161,000 in taxes. If incentive stock options (isos) are part of your compensation package, understanding all of the details and tax implications can help you maximize your benefits.

Incentive Stock Options Isos And Taxes The Complete Guide вђ Secfi In other words–the key benefits of isos is the ability to buy shares of your company’s stock at a discount and the potential for preferential tax treatment over other types of employee stock options. how are incentive stock options taxed? isos are reported for tax purposes at two different times, when exercised and when sold. Incentive stock options, or isos, can feel pretty complex because they are.what does it mean to exercise?when should you exercise?when should you sell?wha. Types of employee stock options. two types of employee stock options are available in the united states: incentive stock options (iso) and non qualified stock options (nso). they both function the same way: they allow you to be a partial owner in your company. isos and nsos mainly differ in how and when they’re taxed—isos could qualify for. An incentive stock option (iso) gives an employee the right to buy shares of company stock at a discounted price. the profit on qualified isos is usually taxed at the capital gains rate, not the.

Comments are closed.