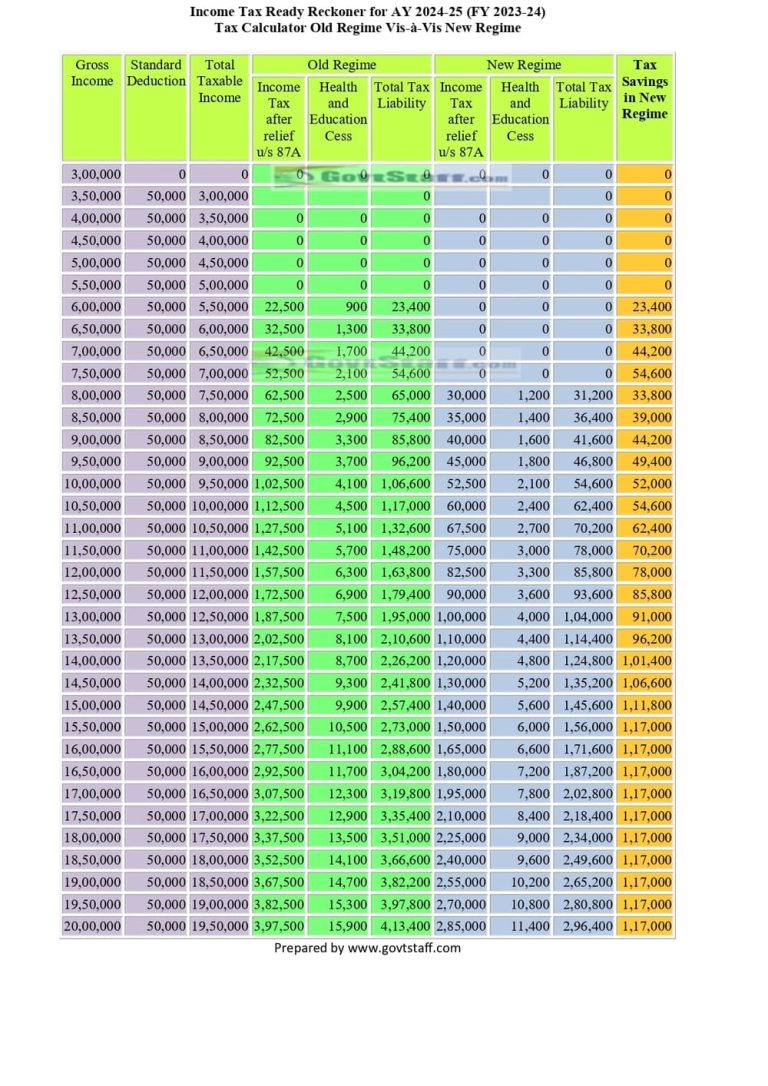

Income Tax Ready Reckoner For Ay 2024 25 Fy 2023 24 Tax 54 Off

Income Tax Ready Reckoner For Ay 2024 25 Fy 2023о Budget 2024 has proposed changes in the income tax slabs under the new tax regime The changes have been made at the lower level of the income tax slabs, and this will largely benefit the lower 7% of Income tax where total income is more than ₹1 crore 12% of Income tax where total income is more than ₹10 crores

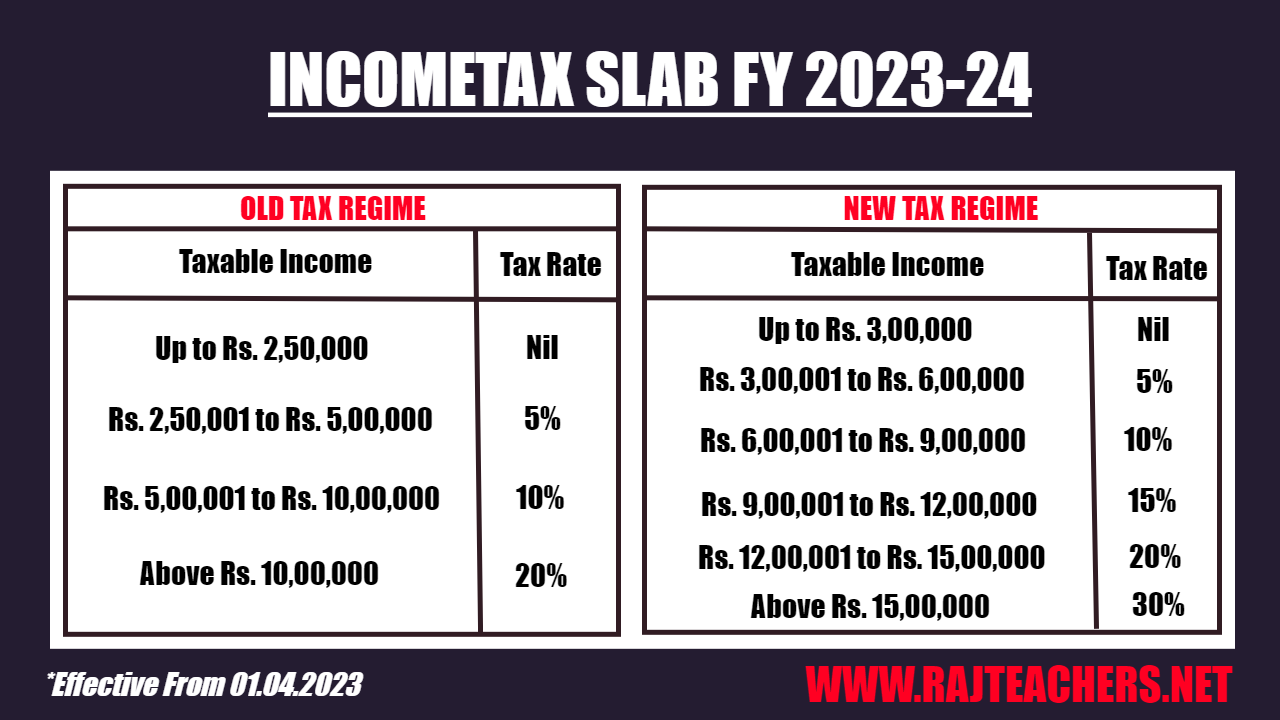

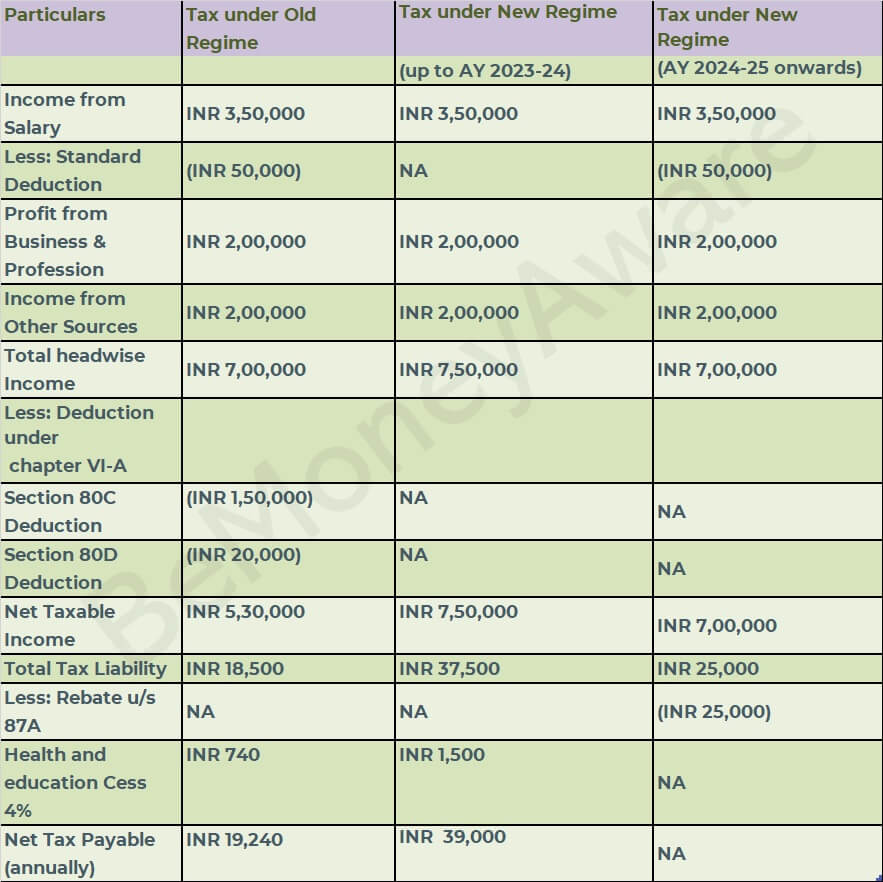

Income Tax Ready Reckoner For Ay 2024 25 Fy 2023о New Tax Regime: Income Tax Slab For All Individuals FY 2024-25 (Default) Taxation rules under lower tax rates than the former However, in 2023, the government made the new income tax regime The Income Tax calculator is an easy-to-use tool which helps you figure out the income tax which you are required to pay for the financial year To use this application for FY 2024-25, simply How to use the Bankbazaar Income Tax Calculator Online for FY 2024–25? If you want to save time and still get an accurate calculation of your income tax, use BankBazaar's free online income tax During the Union Budget proceedings for fiscal year 2023-24 for the Old Tax Regime Here are the tax slabs for FY 2024-25 (AY 2025-26) Up to Rs 3L NIL Rs 3L to Rs 6L 5% on income which

Know The New Income Tax Slab Rates For Fy 2023 24 Ay 2024 How to use the Bankbazaar Income Tax Calculator Online for FY 2024–25? If you want to save time and still get an accurate calculation of your income tax, use BankBazaar's free online income tax During the Union Budget proceedings for fiscal year 2023-24 for the Old Tax Regime Here are the tax slabs for FY 2024-25 (AY 2025-26) Up to Rs 3L NIL Rs 3L to Rs 6L 5% on income which However, this rebate is allowed if the total income of assessee chargeable to tax under section 115BAC(1A) is up to Rs 7,00,000 (For Assessment Year 2024-25) Alternate Minimum Tax (AMT) An A specified class of taxpayers must conduct income tax audits as per the income tax law This audit is a thorough inspection of the books of accounts of the taxpayer with business or professional Less: Exemptions on Salary income (other than HRA) which are not allowed under New Regime (eg Leave travel allowance, Education allowance, Hostel allowance etc) Less: Exemptions on Salary But keep in mind that capital gains tax rates are generally lower than the tax rates for ordinary income like wages Let's break down the 2023 and 2024 rates tax of up to 25% on the

Income Tax Ready Reckoner For Ay 2024 25 Fy 2023о However, this rebate is allowed if the total income of assessee chargeable to tax under section 115BAC(1A) is up to Rs 7,00,000 (For Assessment Year 2024-25) Alternate Minimum Tax (AMT) An A specified class of taxpayers must conduct income tax audits as per the income tax law This audit is a thorough inspection of the books of accounts of the taxpayer with business or professional Less: Exemptions on Salary income (other than HRA) which are not allowed under New Regime (eg Leave travel allowance, Education allowance, Hostel allowance etc) Less: Exemptions on Salary But keep in mind that capital gains tax rates are generally lower than the tax rates for ordinary income like wages Let's break down the 2023 and 2024 rates tax of up to 25% on the IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50 Enter how many dependents you will claim on your 2022 tax return This calculator estimates the Individual taxpayers are currently facing confusion regarding the choice between the old and new tax regimes, which were introduced in the Union Budget 2023 income tax calculator for FY 2024

Income Tax Slab Rates For A Y 2024 25 F Y 2023 24 ођ Less: Exemptions on Salary income (other than HRA) which are not allowed under New Regime (eg Leave travel allowance, Education allowance, Hostel allowance etc) Less: Exemptions on Salary But keep in mind that capital gains tax rates are generally lower than the tax rates for ordinary income like wages Let's break down the 2023 and 2024 rates tax of up to 25% on the IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50 Enter how many dependents you will claim on your 2022 tax return This calculator estimates the Individual taxpayers are currently facing confusion regarding the choice between the old and new tax regimes, which were introduced in the Union Budget 2023 income tax calculator for FY 2024

Comments are closed.