Income Tax Third Amendment Rules 2024 Notification Of Form Itr 7

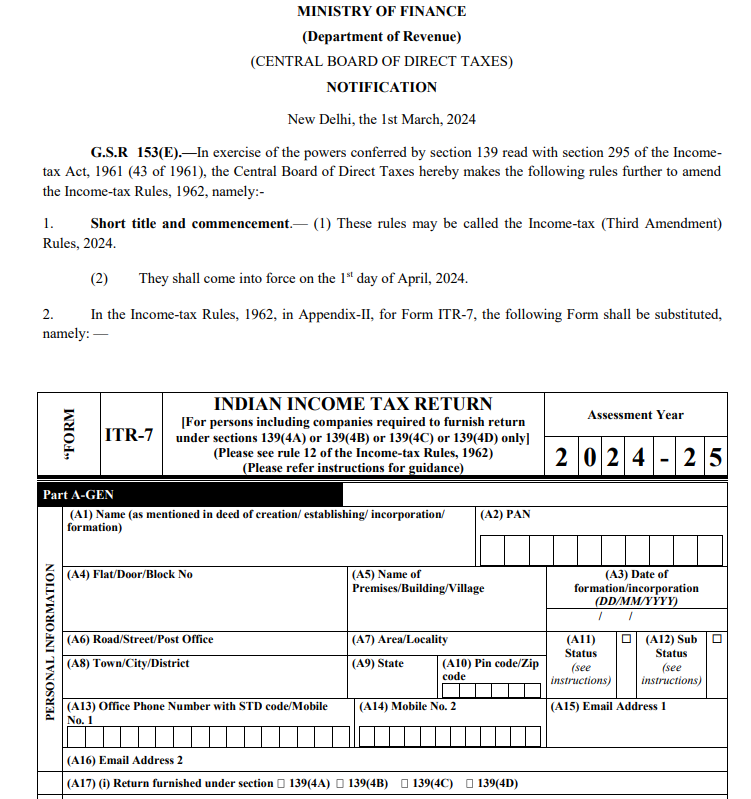

Income Tax Third Amendment Rules 2024 Notification Of I Notification no. 24 2024 income tax dated: 1st march, 2024. g.s.r 153(e).—in exercise of the powers conferred by section 139 read with section 295 of the income tax act, 1961 (43 of 1961), the central board of direct taxes hereby makes the following rules further to amend the income tax rules, 1962, namely: 1. short title and commencement. Short title and commencement.—. (1) these rules may be called the income tax (third amendment) rules, 2024. (2) they shall come into force on the 1st day of april, 2024. 2. in the income tax rules, 1962, in appendix ii, for form itr 7, the following form shall be substituted, namely: —. “form.

Income Tax Third Amendment Rules 2024 Notification Of Form Itr 7 The income tax rules, 1962, namely: 1. short title and commencement.— (1) these rules may be called the income tax (third amendment) rules, 2024. st(2) they shall come into force on the 1 day of april, 2024. 2. in the income tax rules, 1962, in appendix ii, for form itr 7, the following form shall be substituted, namely: — “form itr 7. Itr 7 can be filed with the income‐tax department electronically on the e‐ filing web portal of income‐ tax department ( incometax.gov.in) and verified in any one of the following manners– i. digitally signing the verification part, or ii. authenticating by way of electronic verification code (evc), or iii. aadhaar otp iv. y sending. Cbdt notifies revised income tax return form (itr 7) under section 139 of the income tax act, 1961, in respect of ay 2024 25, vide notification 24 2024. form itr 7 is meant for persons, including companies, who are required to file their returns under specific sections 139 (4a), 139 (4b), 139 (4c), or 139 (4d) of the income tax act, 1961. Introduction. the cbdt has notified 1 the income tax return form 7 (itr 7) for the assessment year 2024 25. the applicability of the itr 7 form remains unchanged in the new form. the new itr 7 requires additional details from taxpayers, and some changes in the itr form are consequential to the amendments made by the finance act 2023.

Cbdt Notifies Itr 7 Form For Ay 2024 25 Cbdt notifies revised income tax return form (itr 7) under section 139 of the income tax act, 1961, in respect of ay 2024 25, vide notification 24 2024. form itr 7 is meant for persons, including companies, who are required to file their returns under specific sections 139 (4a), 139 (4b), 139 (4c), or 139 (4d) of the income tax act, 1961. Introduction. the cbdt has notified 1 the income tax return form 7 (itr 7) for the assessment year 2024 25. the applicability of the itr 7 form remains unchanged in the new form. the new itr 7 requires additional details from taxpayers, and some changes in the itr form are consequential to the amendments made by the finance act 2023. The cbdt has notified 1 the income tax return form 7 (itr 7) for the assessment year 2024 25. the applicability of the itr 7 form remains unchanged in the new form. the new itr 7 requires additional details from taxpayers, and some changes in the itr form are consequential to the amendments made by the finance act 2023. the changes in form itr. Short title and commencement. (1) these rules may be called the income tax (third amendment) rules, 2024. (2) they shall come into force on the 1st day of april, 2024. 2. in the income tax rules, 1962 , in appendix ii, for form itr 7, the following form shall be substituted, namely: [f. no. 370142 1 2024 tpl (part 1)] surbendu thakur, under.

Comments are closed.