Income Taxation Chapter 3 Introduction To Income Taxation P2 Youtub

Income Taxation Chapter 3 Introduction To Income Taxation #grossincome definition, gross income related #concept and types of #taxpayer. Discussion of #grossincome concept, #inclusion and #exclusion and types of #individual and #corporate taxpayer.

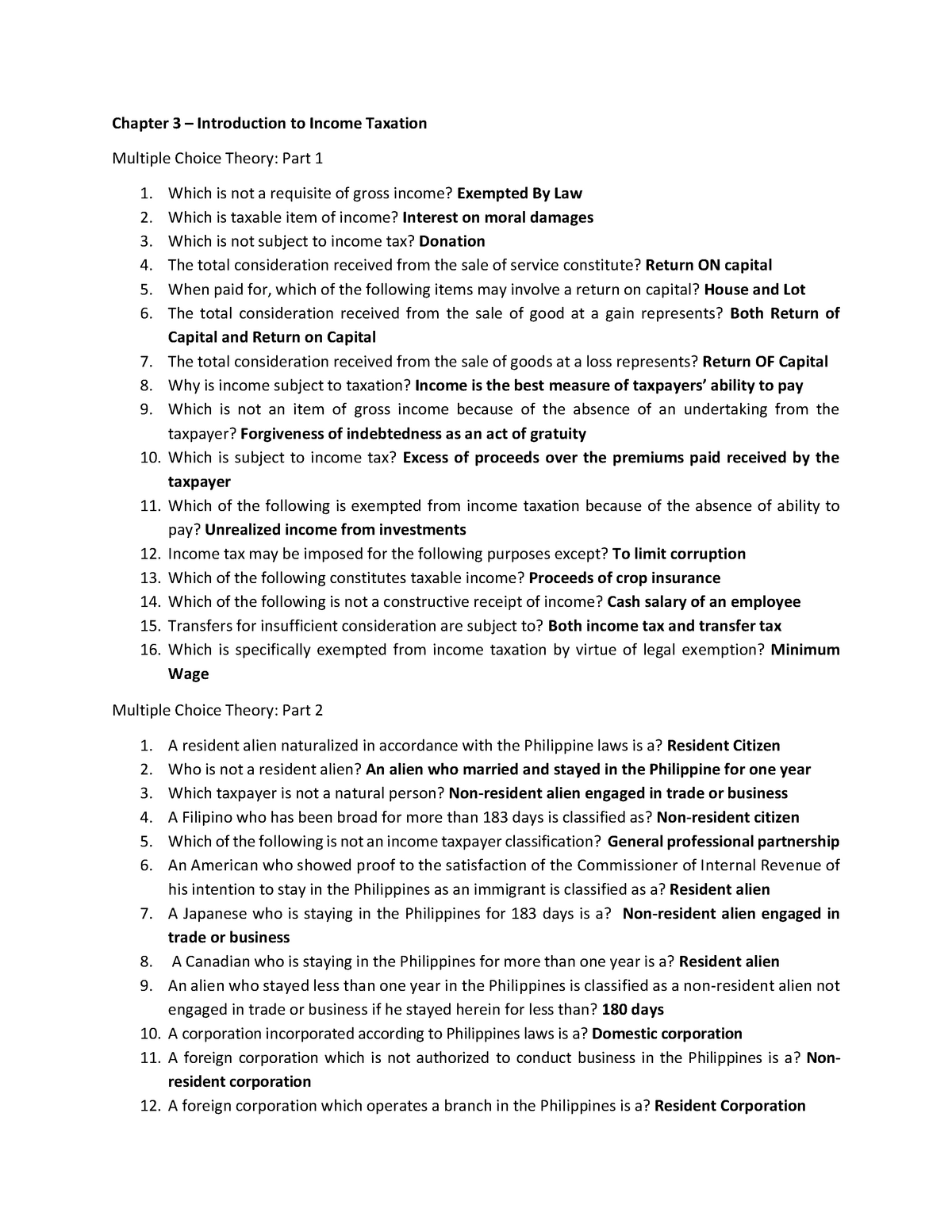

Income Taxation Chapter 1 Introduction To Taxation Part 1a Youtubeо Chapter 3 introduction to income taxation. why is income subject to tax? income is regarded as the best measure of taxpayer’s ability to pay tax. it is an excellent object of taxation in the allocation of government costs. income for taxation purposes “gross income” – taxable income in layman’s term. Income tax may be imposed for the following purposes, except: a. to provide large amounts of revenue b. to limit corruption c. to offset regressive sales and consumption of taxes d. to mitigate the evils arising from the inequalities int the distribution of income and wealth. Chapter 3: introduction to income taxation (problems) beth negotiated a p1,000,000 non interest bearing promissory note to candy. candy paid beth p950,000. on due date, beth paid candy p1,000,000. which is true? a. beth earned p50,000 return on capital. Discussion of general principles of income taxation#tax #incometax #generalprinciples.

Tax Introduction To Income Taxation Youtube Chapter 3: introduction to income taxation (problems) beth negotiated a p1,000,000 non interest bearing promissory note to candy. candy paid beth p950,000. on due date, beth paid candy p1,000,000. which is true? a. beth earned p50,000 return on capital. Discussion of general principles of income taxation#tax #incometax #generalprinciples. First £5,000 of savings income = starting rate band, 0%. first £1,000 £500 £0 of savings income above starting rate band = nil rate band, 0%. taxable income up to £37,500 = basic rate, 20%. taxable income £37,500 £150,000 = higher rate, 40%. taxable income over £150,000 = additional rate, 45%. This chapter discusses income taxation in the philippines. it defines income as wealth gained from labor, capital, or the sale of assets. income is distinguished from capital as a flow rather than the original investment. for taxation, income must represent a realized gain and not be excluded by law. income sources are classified as domestic, foreign, or partly domestic foreign, and are taxed.

Chapter 3 Tax Chapter 3 вђ Introduction To Income Taxat First £5,000 of savings income = starting rate band, 0%. first £1,000 £500 £0 of savings income above starting rate band = nil rate band, 0%. taxable income up to £37,500 = basic rate, 20%. taxable income £37,500 £150,000 = higher rate, 40%. taxable income over £150,000 = additional rate, 45%. This chapter discusses income taxation in the philippines. it defines income as wealth gained from labor, capital, or the sale of assets. income is distinguished from capital as a flow rather than the original investment. for taxation, income must represent a realized gain and not be excluded by law. income sources are classified as domestic, foreign, or partly domestic foreign, and are taxed.

Lecture 2 Introduction To Income Tax Youtube

Comments are closed.