Inflation Definition Measurement And Causes Economics Simplified

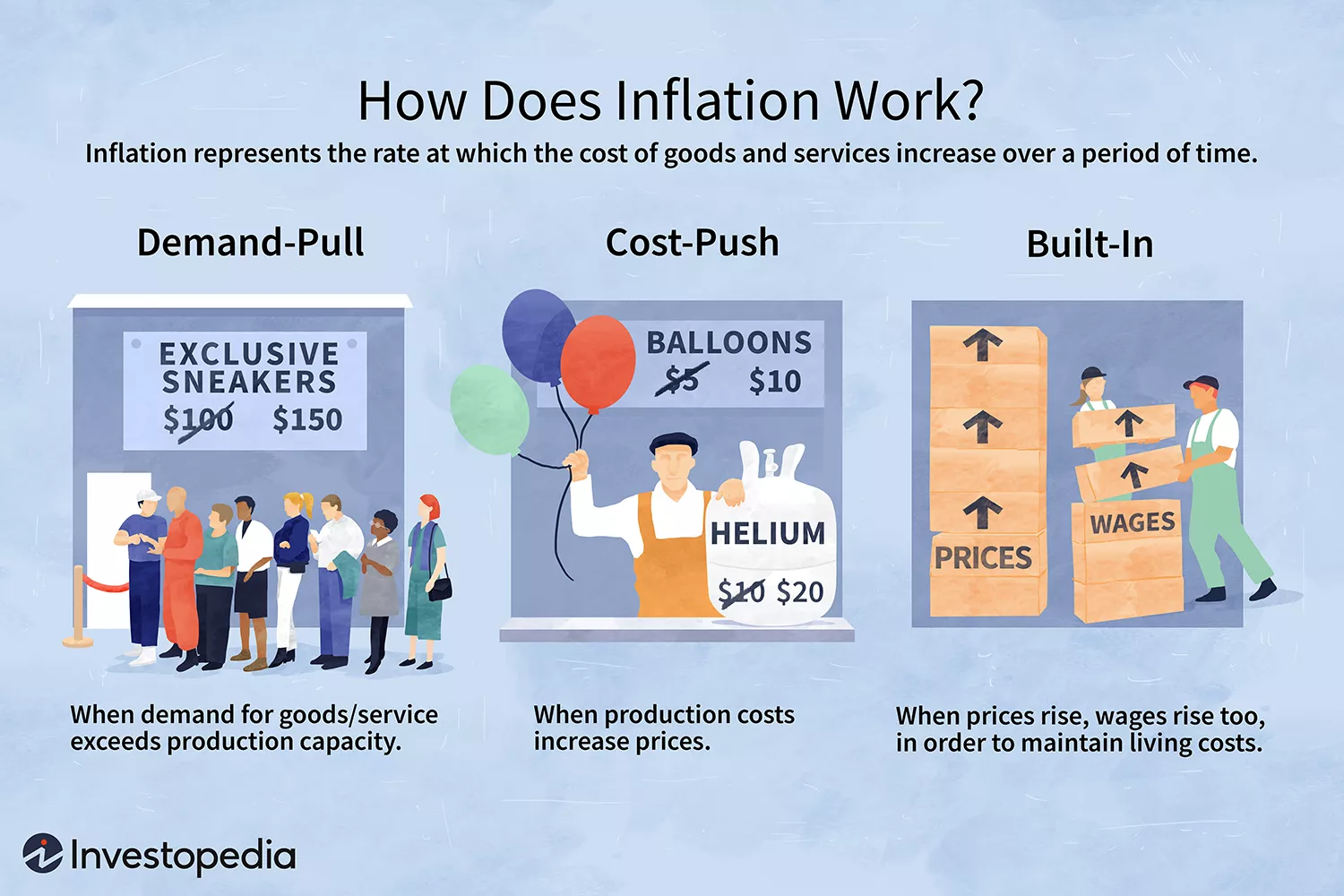

What Is Inflation And What Causes It Inflation is a widespread phenomenon that affects every citizen of the economy. inflation is caused by many factors depending upon the country’s internal factors and worldwide issues. some of the significant causes of inflation are 1.cost push inflation 2.demand pull inflation. Inflation in economics explained. inflation in economics is a rate or an indicator showing that the value of money depreciates with time. in simple words, expensive products and services today might become more expensive tomorrow. for example, the price of 10gram gold in 1990 was $40. however, the same quantity of gold today is available at $576.

Inflation Definition Measurement And Causes Economics Simplified Inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time. the inflation rate is calculated as the average price increase of a. Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. it is a key economic indicator that affects the purchasing power of money and can have significant implications for businesses, consumers, and governments. understanding inflation is crucial for making informed. What causes inflation? monetary policy is a critical driver of inflation over the long term. the current high rate of inflation is a result of increased money supply, high raw materials costs, labor mismatches, and supply disruptions—exacerbated by geopolitical conflict. in general, there are two primary types, or causes, of short term inflation:. The next year, the same basket costs $102. that means the average annual rate of inflation is 2 percent. at the bank, we target a 2 percent inflation rate, the middle of a 1 to 3 percent range. we have agreed with the federal government that this is the best way for us to promote the economic and financial well being of canadians.

Comments are closed.