Inflation Its Types Video 2 Class X Economic Application Icse

Inflation Its Types Video 2 Class X Economic Application Icse Inflation & its types video 2 | class x, economic application | icse board.this is the video on inflation & its types ,video 1,class x, economic application. These notes will be really helpful for the students giving the economics exam in icse class 10. our teachers have prepared these concept notes based on the latest icse syllabus and icse books issued for the current academic year. please refer to chapter wise notes for icse class 10 economics provided on our website. meaning of inflation.

Inflation And Its Types Question 1: choose the correct answers to the questions from the given options. (do not copy the question, write the correct answer only.) (i) which of these is the apex bank of the indian banking system? (a) state bank of india. (b) central bank of india. (c) reserve bank of india. (d) canara bank. Our cisce icse class 10 economic applications question paper 2023 serve as a catalyst to prepare for your economic applications board examination. previous year question paper for cisce icse class 10 economic applications 2023 is solved by experts. solved question papers gives you the chance to check yourself after your mock test. Our cisce icse class 10 economic applications question paper 2025 serve as a catalyst to prepare for your economic applications board examination. previous year question paper for cisce icse class 10 economic applications 2025 is solved by experts. solved question papers gives you the chance to check yourself after your mock test. Previous year question paper for cisce icse class 10 economic applications 2022 is solved by experts. solved question papers gives you the chance to check yourself after your mock test. by referring the question paper solutions for economic applications, you can scale your preparation level and work on your weak areas.

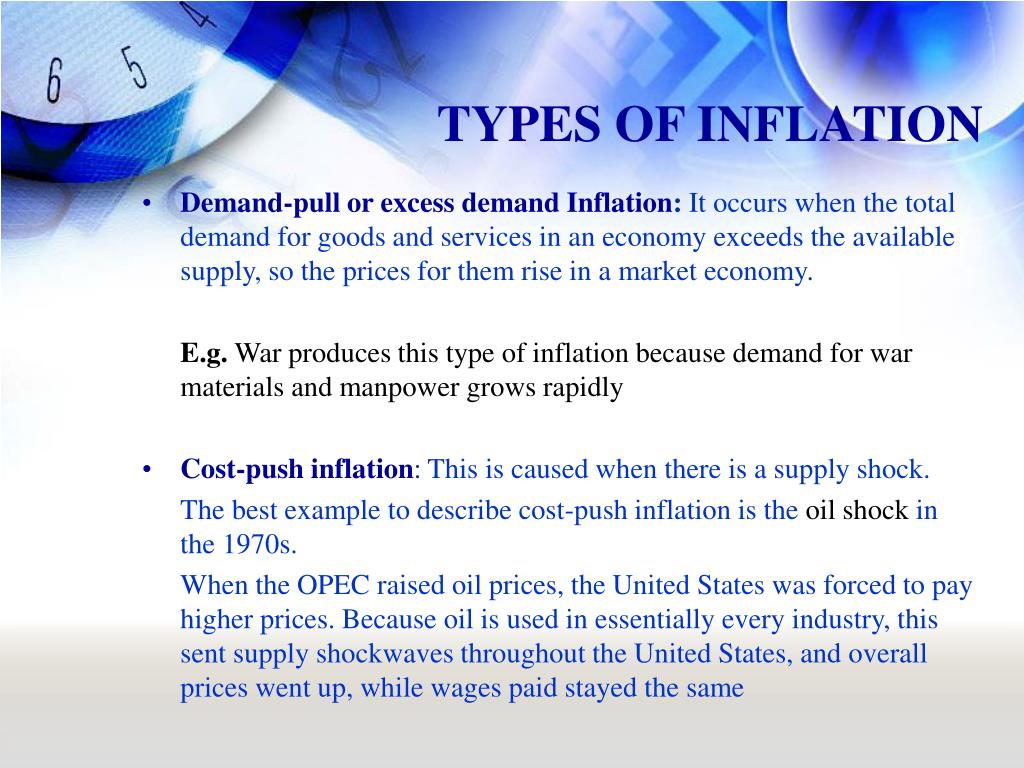

What Is Inflation Its Types Causes Effects Demand Pull Inflation Our cisce icse class 10 economic applications question paper 2025 serve as a catalyst to prepare for your economic applications board examination. previous year question paper for cisce icse class 10 economic applications 2025 is solved by experts. solved question papers gives you the chance to check yourself after your mock test. Previous year question paper for cisce icse class 10 economic applications 2022 is solved by experts. solved question papers gives you the chance to check yourself after your mock test. by referring the question paper solutions for economic applications, you can scale your preparation level and work on your weak areas. A basic understanding of the concepts of money, its functions. meaning and types of inflation to be discussed (creeping, walking, running and hyper inflation). the impact of inflation on various economic entities such as debtors and creditors, fixed income groups and producers are to be explained very briefly. (i) creeping inflation is inflation where the price level increases at a very slow rate of 2 to 2.5% per annum. running inflation is inflation where the price level increases a bit faster and is at the rate of 10% per month. (ii) the central bank provides financial assistance to commercial banks by rediscounting eligible bills of exchange.

Inflation And Its Types Ppt A basic understanding of the concepts of money, its functions. meaning and types of inflation to be discussed (creeping, walking, running and hyper inflation). the impact of inflation on various economic entities such as debtors and creditors, fixed income groups and producers are to be explained very briefly. (i) creeping inflation is inflation where the price level increases at a very slow rate of 2 to 2.5% per annum. running inflation is inflation where the price level increases a bit faster and is at the rate of 10% per month. (ii) the central bank provides financial assistance to commercial banks by rediscounting eligible bills of exchange.

Comments are closed.