Infographic Q1 2021 Mobile Market Monitor Counterpoint

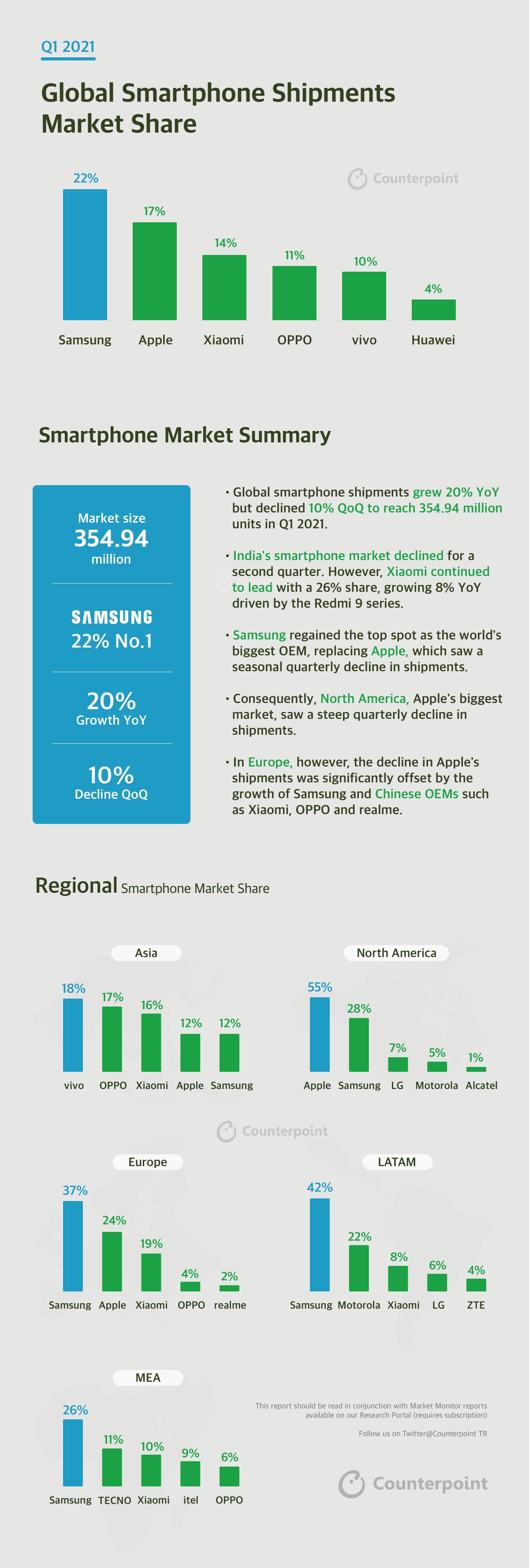

Infographic Q1 2021 Mobile Market Monitor Counterpoint Global smartphone shipments grew 20% yoy but declined 10% qoq to reach 354.94 million units in q1 2021. india’s smartphone market declined for a second quarter. however, xiaomi continued to lead with a 26% share, growing 8% yoy driven by the redmi 9 series. samsung regained the top spot as the world’s biggest oem, replacing apple, which saw. The global smartphone market declined 9% qoq but grew 17% yoy in q2 2021, clocking shipments of 323.1 million units, down from 354.9 million units in q1 2021. samsung retained the top spot as the world’s biggest oem despite a 25% qoq decline in its shipments to 57.6 million units in q2 2021. apple’s global shipments declined by about 18%.

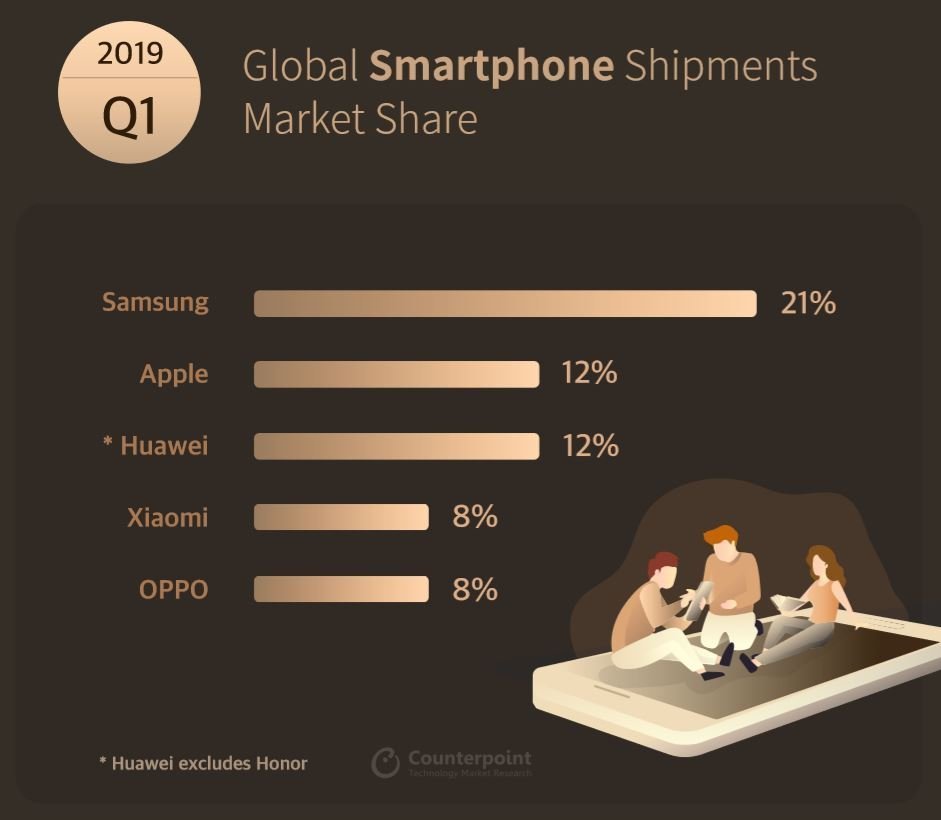

Infographic Q1 2019 Mobile Market Monitor Counterpoint Research Infographic: q4 2023 | smartphones | mobile market monitor. 2024.05.06 | infographic |. contact. info@counterpointresearch . 如果您有任何疑问,请向我们发送邮件,. 我们会尽快将相关回复发送到您填写的邮箱中。. 同意使用您的个人信息. 点击访问我们的隐私政策描述网站(英文版). 提交. The top five global brands — which also include chinese smartphone makers xiaomi, oppo, and vivo — made up a combined 64% of the global smartphone market in the third quarter of 2023, down from about 68% in 2022 and 2021, according to counterpoint’s data. the chinese companies recorded even steeper smartphone sales declines than samsung and apple as they “worked towards strengthening. Counterpoint has published its q1 2021 market monitor report. some of the key findings include the following: global smartphone shipments gre by 20% yoy but declined by 10% qoq. for a second quarter, india's smartphone market declines. it is led by xiaomi with a 26% market share, ineased by 8% yoy. samsung is again the world leader in. It declined 2% yoy from the peak q1 smartphone revenue of over $114 billion in 2021. in qoq terms, the revenue saw a cyclical decline of 17% from an all time high of over $134 billion in q4 2021.

Comments are closed.