Infographic Q3 2021 Semiconductors Counterpoint Research

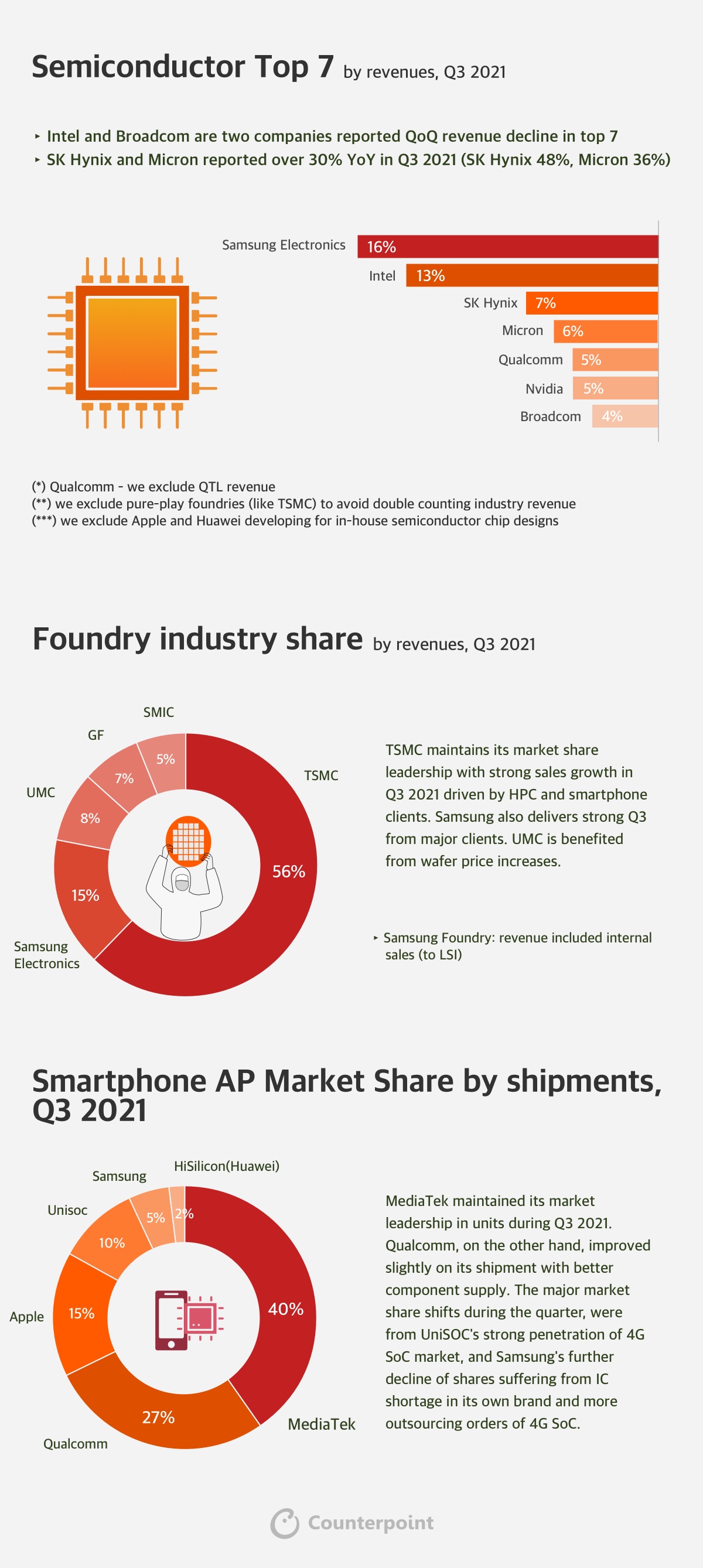

Infographic Q3 2021 Semiconductors Counterpoint Research Sk hynix and micron reported over 30% yoy in q3 2021 (sk hynix 48%, micron 36%) foundry industry share by revenues, q3 2021. tsmc maintains its market share leadership with strong sales growth in q3 2021 driven by hpc and smartphone clients. samsung also delivers strong q3 from major clients. umc is benefited from wafer price increases. We release one infographic each quarter to summarize the mobile handset market activities in a single page. some quick observations on the smartphone market: the global smartphone market grew 6% qoq but declined 6% yoy in q3 2021, clocking shipments of 342 million units, down from 365.6 million in q3 2020. samsung retained the number one spot.

Infographic Q3 2021 Semiconductors Counterpoint Research Infographic: q3 2021 | #semiconductors (by counterpoint technology market research 💡) #semiconductor top 7 by revenues, q3 2021: intel corporation and…. Infographic: q3 2021 | semiconductors. infographic: q3 2021 | semiconductors: lnkd.in esqazcer semiconductor top 7 by revenues, q3 2021: intel corporation and broadcom inc. are two. Counterpoint research expects semiconductor shortage to ease in 2h 2022 on higher component inventories, softening smartphone demand since late 2021, demand supply gaps have been shrinking. The decline in early stage deal share in the private markets. let’s dive in. equity funding to private semiconductor companies increased 68% quarter over quarter to $5.2b in q3’23, marking the highest quarterly funding level since q4’21, when it reached $7.8b. this is far beyond the growth seen in global venture funding, which increased.

Comments are closed.