Investing Basics Fundamental Analysis

Investing Basics Fundamental Analysis Charles Schwab The bottom line. fundamental analysis is used to value a company and determine whether a stock is over or undervalued by the market. it considers the economic, market, sector specific, and. Investing basics: fundamental analysis. january 26, 2023 beginner. when deciding which stocks to buy, investors don't just guess. learn how to use financial statements to decide if a stock is a good investment.

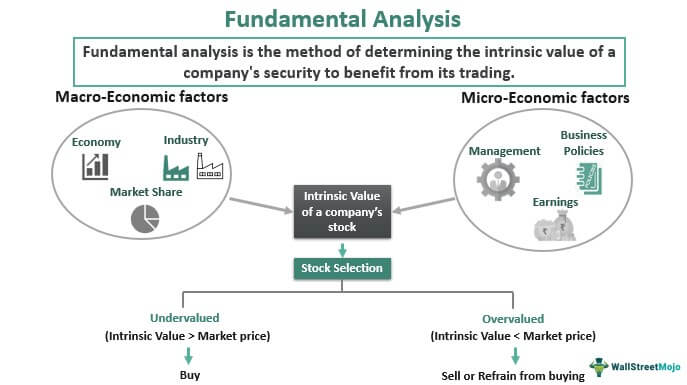

Fundamental Analysis Meaning Basics Types Examples Fundamental analysis. fundamental analysis is one of the cornerstones of investing, and gives you tools to help determine the value of different investments. from swot analysis to pe ratios, learn. A weekly illustration of trends and potential patterns to help analyze market developments. investing involves risk, including risk of loss. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. using fundamental analysis could help you decide whether a company may be a potential investment. Fundamental analysis of stocks involves evaluating and researching companies to determine if a company is healthy. remember this, there's no one right way to go about analyzing companies. consider the successes of two well known investors and their different approaches: warren buffett and peter lynch. What is fundamental analysis in trading? there are many different types of investing analysis. fundamental analysis is one method and can be understood as a process used to assess an instrument’s strength over a period of time and into the future. this could include examining related economic and financial factors such as a country’s.

How To Do Fundamental Analysis On Stocks Finance Investing Money Fundamental analysis of stocks involves evaluating and researching companies to determine if a company is healthy. remember this, there's no one right way to go about analyzing companies. consider the successes of two well known investors and their different approaches: warren buffett and peter lynch. What is fundamental analysis in trading? there are many different types of investing analysis. fundamental analysis is one method and can be understood as a process used to assess an instrument’s strength over a period of time and into the future. this could include examining related economic and financial factors such as a country’s. Fundamental analysis definition. fundamental analysis (fa) is a method that helps to determine whether an asset or a security is trading at a discount or its premium compared to its fair value. it is most often applied to stocks, and other markets, including bonds, currencies, commodities, or even cryptocurrency. Fa examines qualitative (management, competitive advantage) and quantitative (financial statements, ratios) aspects. fundamental analysis helps identify undervalued (buy) or overvalued (sell) securities. there are two fa approaches: top down (macro to micro), bottom up (micro to macro). fundamental analysis suits long term investing, requires.

Comments are closed.