Investment Analysis Definition Importance Types 2024

Investment Analysis Definition Importance Types 2024 Key takeaways. investment analysis involves researching and evaluating a security or an industry to predict its future performance and determine its suitability to a specific investor. investment. Investment analysis is a process of researching and evaluating investment opportunities to determine their potential risks and returns. it involves analyzing market trends, financial data, and economic indicators to assess the suitability of an investment opportunity for an investor's individual needs and goals.

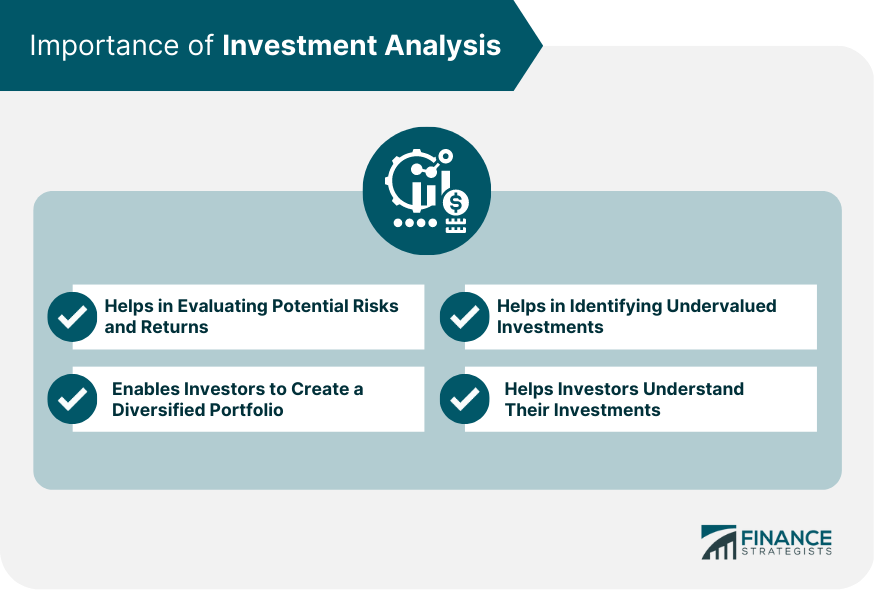

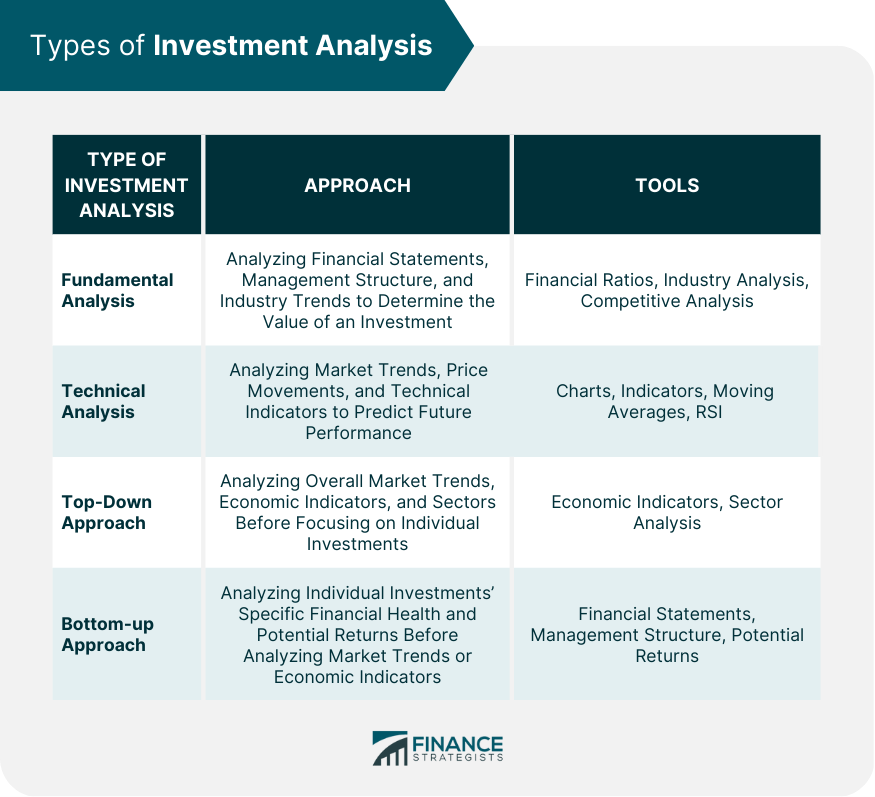

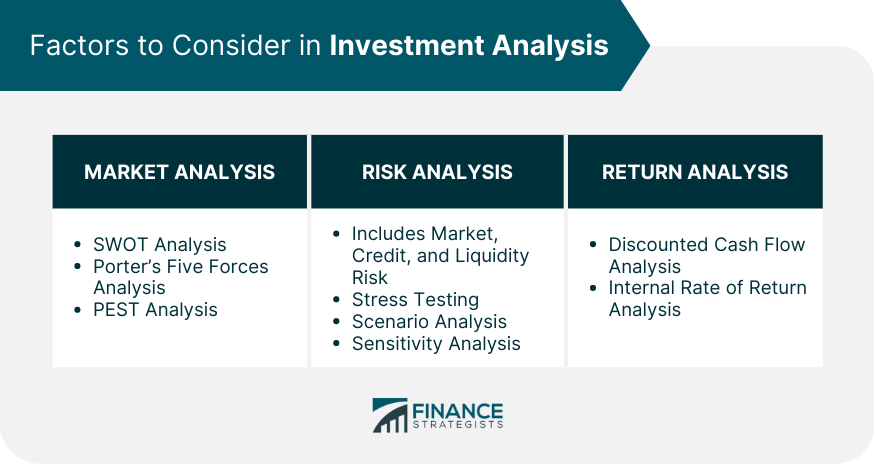

Investment Analysis Definition Importance Types 2024 The importance of investment analysis. investment analysis plays a crucial role in guiding individuals and institutions towards making sound investment decisions. here are some key reasons why investment analysis is of utmost importance: minimizing risk: through comprehensive analysis, investors can understand the risks associated with. Investment analysis plays a vital role in portfolio management by determining an investment’s potential performance and suitability for an investor. this article delves into the definition, types, and significance of investment analysis, exploring key concepts such as top down vs. bottom up approaches and fundamental vs. technical analysis. Financial analysis is used to evaluate economic trends, set financial policy, build long term plans for business activity, and identify projects or companies for investment. this is done through. The process of investment analysis involves multiple factors that help you make decisions in tune with your risk tolerance and financial goals. 1. cash flow analysis. understanding the cash flows generated by an investment is indispensable. examine both present and future cash flows to ascertain if the investment will offer adequate returns.

Investment Analysis Definition Importance Types 2024 Financial analysis is used to evaluate economic trends, set financial policy, build long term plans for business activity, and identify projects or companies for investment. this is done through. The process of investment analysis involves multiple factors that help you make decisions in tune with your risk tolerance and financial goals. 1. cash flow analysis. understanding the cash flows generated by an investment is indispensable. examine both present and future cash flows to ascertain if the investment will offer adequate returns. Top down analysis, investors are required to study the entire market. generally, big investors are interested in this type of strategy. the focus is entirely on the big markets and, not on the small companies. it is a comparatively broader approach than any other investment analysis. #3 fundamental. Investment analysis examples. investment analysis mostly consists of 6 types: fundamental analysis; technical analysis; top down analysis; bottom up analysis; portfolio analysis; security analysis. next up, you will learn how these types of analysis differ from each other.

Comments are closed.