Irs Form 1040 X Walkthrough Amended U S Individual Income Tax Return

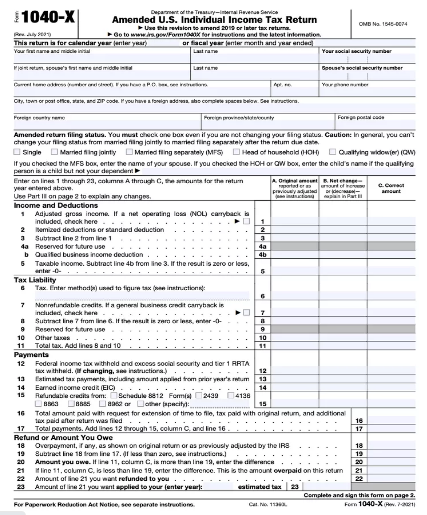

Irs Form 1040 X Amended U S Individual Income Tax Paper filing is still an option for form 1040 x. file form 1040 x to: correct form 1040, 1040 sr, or 1040 nr (or older filings of form 1040 a or 1040 ez). make certain elections after the deadline. change amounts previously adjusted by the irs. make a claim for a carryback due to a loss or unused credit. Subscribe to our channel: channel ucpqfix80n8 a3mc6gx9if2g?sub confirmation=1 please feel free to check out our article, whe.

Irs Form 1040 X Amended U S Individual Income Tax The above instructions apply to paper filing only. if you are electronically filing form 1040 x to amend form 1040 nr, you must complete the form 1040 x in its entirety. if you file form 1040 x claiming a refund or credit for more than the correct amount, you may be subject to a penalty of 20% of the disallowed amount. Any amended form 1040, 1040 sr, 1040 nr or 1040 ss pr returns older than the current or prior two tax periods cannot be amended electronically. amended returns for those earlier tax years must be filed by paper. if amending a prior year return originally filed on paper during the current processing year, then the amended return must also be. Step 2: get form 1040 x. irs.gov has a pdf version of form 1040 x that you can fill out online, then download, print and send. or you can amend your return electronically using tax software like. 2. gather the necessary documents. you’ll need the information from your original tax return for the given tax year, any new documentation or forms, and the reason for the amendment. 3. complete form 1040 x: add your personal information, details of what’s changed, and your explanation for the changes.

Comments are closed.