Irs Here Are The New Income Tax Brackets For 2023

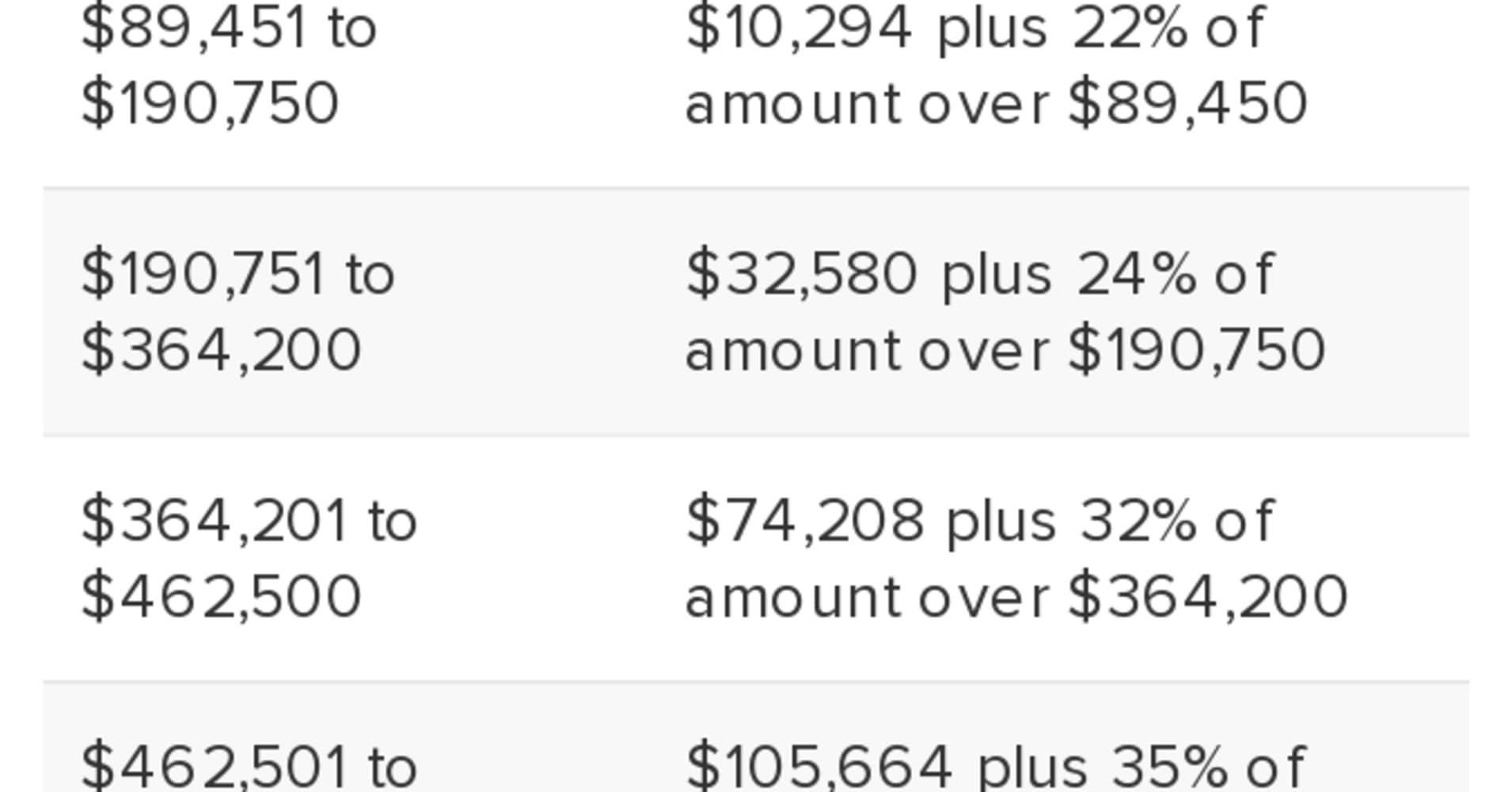

Understanding 2023 Tax Brackets What You Need To Know You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Marginal rates: for tax year 2023, the top tax rate remains 37% for individual single taxpayers with incomes greater than $578,125 ($693,750 for married couples filing jointly). the other rates are: 35% for incomes over $231,250 ($462,500 for married couples filing jointly); 32% for incomes over $182,100 ($364,200 for married couples filing.

Irs Here Are The New Income Tax Brackets For 2023 вђў Northeast Arkansas In 2023, she will take a standard deduction of $13,850, reducing her taxable income to $96,150. this year, she'll pay: 10% tax on her first $11,000 of income, or $1,100 in taxes. 12% tax on income. The income limits for every 2023 tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). there are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with taxable. This is up from a $10,275 cutoff in 2022. the top earning single filers will pay the highest rate of 37% on incomes over $578,125 in 2023. that threshold is increasing by more than $38,000 from this year's $539,900. here are the tax brackets for single filers in 2023: 10%: $0 to $11,000. 12%: $11,000 to $44,725. 22%: $44,725 to $95,375. The irs has released higher federal tax brackets for 2023 to adjust for inflation. the standard deduction is increasing to $27,700 for married couples filing together and $13,850 for single.

Irs Here Are The New Income Tax Brackets For 2023 This is up from a $10,275 cutoff in 2022. the top earning single filers will pay the highest rate of 37% on incomes over $578,125 in 2023. that threshold is increasing by more than $38,000 from this year's $539,900. here are the tax brackets for single filers in 2023: 10%: $0 to $11,000. 12%: $11,000 to $44,725. 22%: $44,725 to $95,375. The irs has released higher federal tax brackets for 2023 to adjust for inflation. the standard deduction is increasing to $27,700 for married couples filing together and $13,850 for single. Meanwhile, the individual tax brackets for ordinary income as well as those for capital gains will all be jumping in 2023 by 7%. so, for example, the lowest 10% ordinary income tax bracket will. The irs also increased the standard deduction for single filers by $900, for a total of $13,850 in 2023. for joint filers, the amount increases by $1,800, for a total standard deduction of $27,700.

New 2023 Irs Income Tax Brackets And Phaseouts Meanwhile, the individual tax brackets for ordinary income as well as those for capital gains will all be jumping in 2023 by 7%. so, for example, the lowest 10% ordinary income tax bracket will. The irs also increased the standard deduction for single filers by $900, for a total of $13,850 in 2023. for joint filers, the amount increases by $1,800, for a total standard deduction of $27,700.

Comments are closed.